Agri exporters are the bridge between India’s fields and the world’s markets

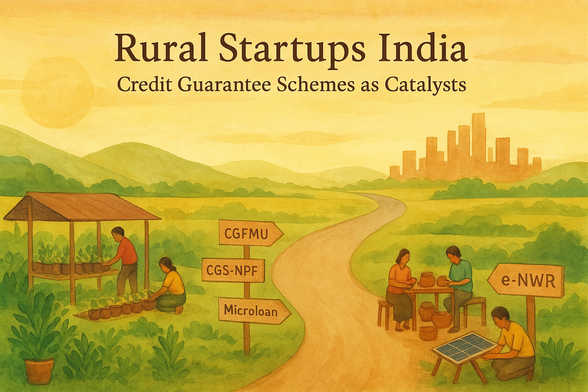

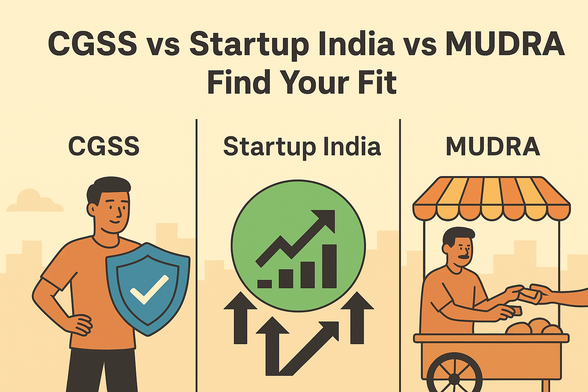

With credit guarantee schemes like CGSSI and CGS-NPF, small exporters can access financing without heavy collateral — turning harvest into global opportunity.

Read more: https://www.ncgtc.in/en/product-details/CGFSI/Credit-Guarantee-Scheme-for-Stand-Up-India-(CGSSI)

#AgriExports #CreditSchemes #RuralFinance #GlobalTrade #IndiaAgriculture