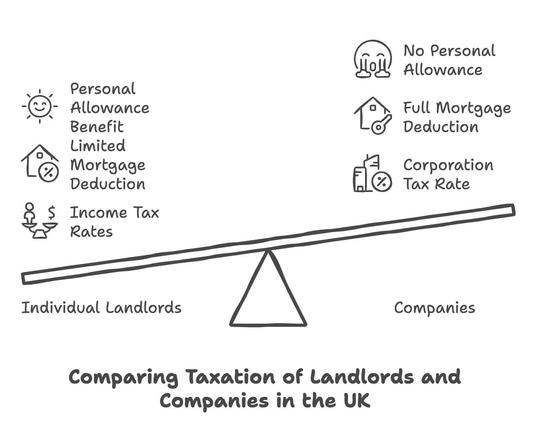

🏠💸 Hey UK landlords & property investors!

Sick of handing too much over to HMRC? 😩

Learn how to legally pay less tax, claim more expenses, and keep more 💷 in your pocket!

🎓 Free Property Tax Training Course

👉 https://zurl.co/M6rsJ

#LandlordLife #BuyToLet #UKProperty #HMRC #TaxHacks #PassiveIncome #PropertyTax #TaxTips