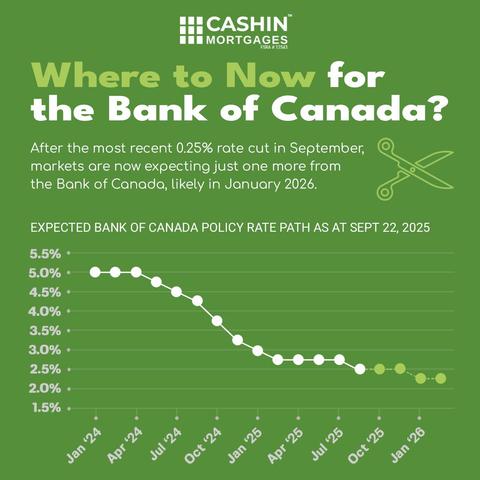

𝐃𝐢𝐝 𝐲𝐨𝐮 𝐤𝐧𝐨𝐰? After 𝐒𝐞𝐩𝐭𝐞𝐦𝐛𝐞𝐫’𝐬 𝟎.𝟐𝟓% 𝐫𝐚𝐭𝐞 𝐜𝐮𝐭, markets expect only one more cut likely in 𝐉𝐚𝐧𝐮𝐚𝐫𝐲 𝟐𝟎𝟐𝟔. Borrowing costs may stay relatively stable in the months ahead. Now is a great time to review your mortgage options!

#BankOfCanada #InterestRates #MortgageAdvice #BorrowSmart #CashinMortgages #MortgageStrategy #CanadianFinance #RateCut