📢 CBDT extends due date for filing ITRs (originally due 31st July 2025) to 15th September 2025.

Plan your filings accordingly.

#IncomeTax #ITR2025 #DueDateExtended #CBDT #TaxUpdate #Compliance #CharteredAccountants #TaxFiling

#CharteredAccountants

Auditors must ethically communicate with their predecessors before accepting a new role, as mandated by the Chartered Accountants Act of 1949. 📝📧✅ If the prior auditor doesn't respond within a reasonable time, the new one can proceed.

For more information 🔗https://www.setindiabiz.com/blog/noc-from-previous-auditor-icai-guidelines

#AuditorEthics #CharteredAccountants #NOC #AuditChange #Setindiabiz

Just went on Reddit and discovered senior managers at big chartered accounting firms are still treating young staff terribly. It seems that nothing has changed since I started as a graduate. For years they have been messing up with people's mental health, churning through employees who had to leave prematurely for their own well-being. Why don't senior people step up and start fixing this?

I am glad that I left after 18 months and found a wonderful mid-tier firm to work at. We were so much more productive and consequently gave our clients great service because we had such a harmonious workplace. A big feature was that we had the choice of when to work our hours. Some chose to start work at 7am and finish at 4pm. Others like me struggled in at 9:30 and worked to 7pm. This meant that our office could handle calls from our clients from 7am to 7pm no problems. The partners did not have to force us to keep the office open for extended hours. They created a great workplace and enabled us to do a great job.

It makes me so sad that big firms continue to be horrible workplaces and potentially mess up young people's lives.

No-Objection Certificate (NOC) in Auditing

A new auditor must communicate with the previous one before taking on an audit. This is an ethical requirement, not a formal legal mandate for an NOC. If the previous auditor doesn't respond within 15 days, the new auditor can proceed, as long as they can prove the communication was sent.

For more information 🔗https://www.setindiabiz.com/blog/noc-from-previous-auditor-icai-guidelines

#Auditing #Ethics #CharteredAccountants #Professionalism #Setindiabiz

🔔 Due date for TDS payment (Q1: Apr-Jun 2025) under sections 192, 194, 194D, or 194H (if AO permitted quarterly payment) is 7th July 2025.

#IncomeTax #TDSCompliance #CharteredAccountants #TaxUpdates #Finance #Accounting #TDSReminder

ICAI President Meets J&K LG: Boosts Revenue, Unveils Centre of Excellence Plans

#AsianTalks #ICAI #JammuAndKashmir #CharteredAccountants #ICAILeadership #CapacityBuilding #RevenueGrowth #CentreOfExcellence #SkillDevelopment #FinancialGovernance #ICAIResearch #MSMEDevelopment #InnovationInTheValley #SustainableDevelopment #ICAIForNationBuilding #CharanjotSinghNanda #ManojSinha #ICAIJKInitiative #EmpoweringYouth #TransparencyAndGovernance #CAProfession

Former President Ram Nath Kovind to Inaugurate National Conference of CA Students 2025 in Kolkata

#TycoonWorld #CAStudentsConference2025 #ICAI #EICASA #EIRC #ReskillResolveRejoice #RRRReturns #CAStudents #FutureCAs #YouthEmpowerment #CharteredAccountants #CACommunity #CAInspiration #NationalCAConference #KolkataEvents #ICAIEvents #CAEducation #FinanceProfessionals #StudentLeadership #WorldRecordAttempt #EthicsLecture #FinanceEducation #KhanSir #AnandRanganathan

📌 GSTR-1 for May 2025 is due on 11th June 2025. Applicable where turnover exceeds ₹5 crore or if QRMP scheme not opted for Apr–Jun 2025.

Ensure timely filing.

#GSTR1 #GSTReturns #GSTCompliance #TaxUpdate #IndirectTax #DueDate #CharteredAccountants

📅 GSTR-7 due date for May 2025 is 10th June 2025.

Applicable for entities deducting TDS under GST. Ensure timely compliance.

#GST #GSTR7 #TaxCompliance #IndirectTax #TDS #GSTUpdates #DueDateReminder #CharteredAccountants

📌 MCA Due Date Alert: Form PAS-6 (for Oct '24–Mar '25) must be filed by 30th May 2025. It is a half-yearly reconciliation of share capital audit report for unlisted public companies.

#Compliance #MCA #ROC #PAS6 #CorporateUpdates #CharteredAccountants

📅 PF & ESIC due date for April 2025 is 15th May 2025.

Ensure timely compliance for monthly remittances.

#PFCompliance #ESIC #TaxCalendar #StatutoryDueDates #AccountingUpdate #FinanceReminders #CharteredAccountants #GST #PayrollIndia

📌 GSTR-5 due date for March 2025 is 13th April 2025.

Applicable for non-resident taxable persons filing outward supplies & tax payable.

#GSTIndia #ComplianceReminder #TaxUpdate #CharteredAccountants #DueDate #GSTR5 #FinanceIndia

📢 GST Alert: GSTR-6 for Nov 2024 is due on 13th Dec 2024! Input Service Distributors (ISD) must file details of inward supplies and distributed Input Tax Credit (ITC). Ensure accurate reporting for compliance. #GSTR6 #GSTFiling #TaxCompliance #GSTUpdates #CharteredAccountants

📌 Reminder: IFF for Nov 2024 is due on 13th Dec 2024! This optional facility allows small registered persons filing quarterly GSTR-1 to furnish invoice details monthly. Stay updated on compliance. #GSTUpdates #IFF #TaxCompliance #GSTIndia #CharteredAccountants #StayInformed

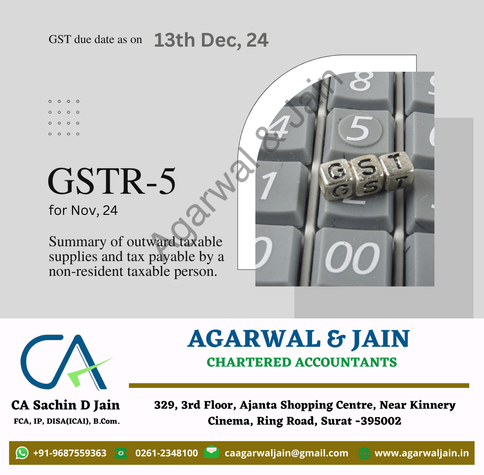

GST Reminder: GSTR-5 for Nov 2024 is due on 13th Dec 2024! It covers taxable supplies and tax payable by non-resident taxable persons under GST. Ensure accurate reporting to stay compliant. #GSTFiling #TaxUpdates #GSTR5 #GSTIndia #ComplianceMatters #CharteredAccountants

📌 GST Alert: GSTR-8 due on 10th Dec 2024! Ensure timely filing for Nov 2024. Stay compliant with TCS under GST laws. 💼 For e-commerce operators, accurate reporting is crucial. #GSTFiling #TaxCompliance #GSTR8 #GSTIndia #CharteredAccountants #StayUpdated

🔔 Reminder: GSTR-1 for Nov 2024 is due on 11th Dec 2024! Applicable for taxpayers with turnover > ₹5 crore or not under the QRMP scheme for Oct-Dec 2024. File timely to ensure compliance. #GSTFiling #TaxUpdates #GSTR1 #GSTIndia #StayCompliant #CharteredAccountants

📅 GST Alert: GSTR-3B QRMP 2 due date for July 2024 is on 24th October! This applies to states including Himachal Pradesh, Punjab, Haryana, and more, plus union territories like Jammu & Kashmir, Ladakh. #GSTUpdate #Compliance #DueDate #TaxFiling #CharteredAccountants