I'm peeking in on Booker's filibuster, realizing I wish I'd listened all night. Quite inspiring.

He's speaking about who needs help in this nation. That seems to be a recurring theme.

One of the underlying themes of all these cuts is that people shouldn't be "charged" ("taxed") for services they don't use. It sounds good in isolation, but on closer inspection, it's utterly preposterous. What they're saying is...

... that the only people who pay for very expensive diseases are those who get them.

... that the only people who pay for disaster recovery are those hit by disasters.

... that the only people who pay for police protection are those who violated -- or perhaps the only people who can afford police patrols.

... that the only people who pay for fire departments are those whose houses burn down.

I could go on, but the point is that pay-per-service makes no sense for these. Instead...

... the only people who can afford to help people who are sick are those who can.

... the only people who can afford to help people who have lost everything in disasters are those who are not victims.

... the only time it makes sense to most of us to have the police patrol is BEFORE we are violated, robbed, or killed, and that we should not have to be rich to be protected.

... the only time it makes sense to have a fire department is BEFORE our homes burn, and our poor, who can barely afford to eat, should not have to shrug off protection of the fire department because they more needed food.

Most of us WANT COMMUNITY, where the strong help the weak so that we can all survive. It's easy for the mega-rich to pay focus groups to come up with tricky messaging, or to pay Facebook to use The Algorithm to evolve and promote messaging that seduces people into thinking community just sucks out of us, giving nothing back. You CAN spin it that way, but it won't make it true.

Even abroad, which is how this all started, where we were (and hopefully still are) helping others who could not help themselves, we are enriched by a world in which the overall standards of human existence are improved.

Even if we had no religious or moral reason to just be kind, and we were totally mercenary and sociopathic (as the co-presidents are), being kind to other people makes them less likely to attack us and more likely to trade fairly with us. Ending kindness, behaving belligerently, invites bullets instead. Where is the ECONOMY in that? The SAFETY? Kindness, even to a sociopath (if they had a brain in their head) should be seen as BUYING us something.

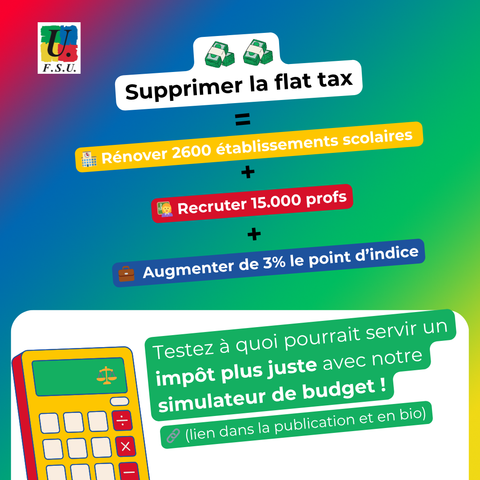

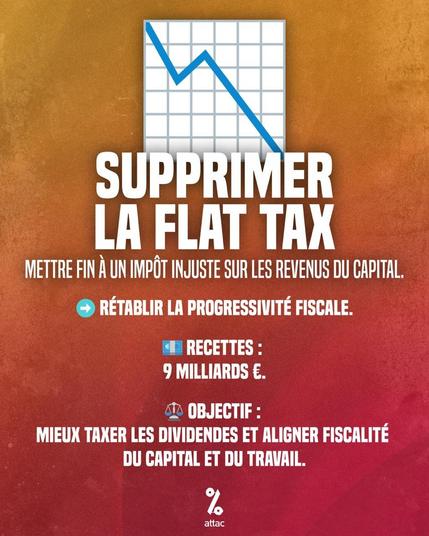

And our sociopathic oligarchic leaders, after gutting all of this stuff THEY feel the could buy off-the-shelf if they cared, will then turn to payment and suggest a flat tax because they hope poor people will demand a low tax hope that means they'll get one, too. There is NO justice in that, only regressive effect.

"But it's our money," the rich will say. "Taxes are a taking, a robbing. You're just robbing me," they'll say. Not so. These people did not make this money in a vacuum. They're in denial about how...

... they benefited from having a fire department and police department to have a customer base and even their own factories that were safe to visit or work at.

... they have benefited from working in a country where they, their employees, and their customers were not routinely seeing bombs flying overhead.

... they have benefited from having a country where customers were basically healthy.

... they have benefited from the availability of many well-educated candidates for employment.

... they have benefited from having a population of customers who were healthy and had enough surplus of cash to buy their products.

... they have benefited from people being able to count on a dignified retirement. SO MUCH could be said about that, and perhaps I will on another day, but let me here just say that the availability of a safety net lets employees and their families focus on work rather than their own and their family's retirement.

I could go on. but they have benefited from a society that was a COMMUNITY, where we pitched in together to make it a good place. And so to later say they did it on their own is, at minimum, the height of INGRATITUDE, and also really an outright, self-serving LIE.

Taxation is NOT robbery. It is INVESTMENT, and an acknowledgment of the obvious: That in order to have a society where all can aspire to a decent life, we need to acknowledge that some people will pay a little more because they can afford more AND because they have benefited more.

Here, if you're not already tired of reading my ramblings, I reference my 2011 essay "Enough", which I wrote in response to proposals at that time for a flat tax. It takes more about that.

https://netsettlement.blogspot.com/2011/08/enough.html

#BookerSolidarity #BookerFilibuster #SenatorBooker #SenatorCoryBooker #Booker #SocialSecurity #SS #Fascism #Oligarchy #GoodTrouble #USPolitics #politics #taxation #FlatTax