ITR refund delayed? CBDT explains why and when you’ll finally get it https://english.mathrubhumi.com/news/money/itr-refund-delayed-cbdt-explains-why-and-when-youll-finally-get-it-vez6bfbj?utm_source=dlvr.it&utm_medium=mastodon #ITRRefund #IncomeTaxIndia #CBDT #TaxUpdates #FinanceNews

#IncomeTaxIndia

Facing delay in Income Tax refund? Know how to check refund status on the IT portal, reasons for delay, processing timeline, and interest on late refunds. https://english.mathrubhumi.com/news/money/income-tax-refund-status-delay-reason-how-to-check-online-gq5fmz3o?utm_source=dlvr.it&utm_medium=mastodon #IncomeTaxRefund #ITR2025 #RefundStatus #IncomeTaxIndia #TaxReturn

Understand when you need to pay advance tax in India, especially with new tax regime rules affecting bank interest and capital gains. https://english.mathrubhumi.com/news/money/advance-tax-capital-gains-new-tax-regime-tl9pbcm1?utm_source=dlvr.it&utm_medium=mastodon #AdvanceTax #CapitalGainsTax #IncomeTaxIndia #ShortTermGains #TaxTips

📩 Got an Income Tax Notice? Don’t worry — Legal Munshi is here to help!

Our experts provide accurate, compliant, and timely replies to keep you stress-free and penalty-free.

✅ Hassle-Free Process

💼 Expert Consultation

⏱️ On-Time Response

Stay compliant with ease — contact us today!

🌐 www.legalmunshi.in | 📞 +91 7566441515

#LegalMunshi #IncomeTax #TaxNotice #TaxFiling #IncomeTaxIndia #TaxConsultant #LegalServices #BusinessCompliance #TaxExperts #TaxHelp

🔔 ITR Due Date Alert 🔔

Filing Form 10BBB due date is too close.

Hurry Up!

File NOW to ensure compliance.

Stay informed!

Get Help @ https://zurl.co/7Gn4b

Join WhatsApp: https://zurl.co/UW6vP

#form10bbb #duedate #incometaxindia #taxcompliance #setindiabiz

Major win for taxpayers! 💼 Delhi HC orders ₹6.42L income tax refund with 53% interest. Court reinforces taxpayers' rights to refunds & interest on delays. Know your rights!

✅ Read more:

https://www.setindiabiz.com/blog/delhi-hc-orders-rs-6-42l-it-refund-with-53-persent-interest

#DelhiHighCourt #TaxRefund #IncometaxIndia #TaxpayerRights #Setindiabiz

A big win for all taxpayers — know your right to interest on delayed refunds https://english.mathrubhumi.com/news/money/delhi-high-court-tax-refund-interest-payment-bqkfwx2u?utm_source=dlvr.it&utm_medium=mastodon #DelhiHighCourt #TaxRefund #IncomeTaxIndia #TaxpayerRights

Paying high rent? Section 194I(a) of the Income Tax Act makes YOU responsible for deducting TDS.

Know about rate, due date 👉 https://zurl.co/d1K3y

Watch Now!

For Courses, visit: https://zurl.co/OU65T

🚨 ITR Due Date Alert 🚨

Submitting Form 9 Due Date is too close.

Don't be late!

File ASAP to ensure compliance.

Get Expert Help @ https://zurl.co/vVxV8

Join WhatsApp: https://zurl.co/rJ0D8

#incometax #duedate #incometaxindia #form9 #salariedindividuals #setindiabiz

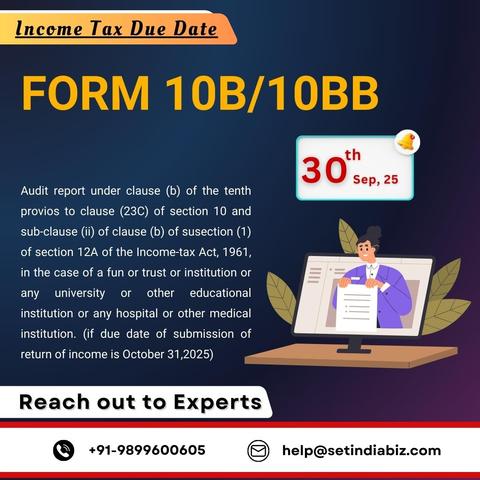

🚨 ITR Due Date Alert 🚨

Filing Form 10B/10BB Due Date is too close.

File timely to stay compliant.

Stay informed!

Get Help @ https://zurl.co/Dzyem

Join WhatsApp: https://zurl.co/A6zSY

#10b10bb #form10b #form10bb #incometaxindia #taxsaving #taxcompliance #setindiabiz

New era for partnership tax: Section 194T of the Income Tax Act, effective April 1, 2025, mandates a 10% TDS for all Partnership Firms and LLPs on specified partner payments (salary, interest, bonus, commission, remuneration) exceeding ₹20,000 annually 💼💰. This is India's first TDS on such payments, closing a compliance gap 🇮🇳✅.

For more information 🔗 https://www.setindiabiz.com/blog/section-194t-tds-partner-payments

#Section194T #TDS #PartnershipTax #IncomeTaxIndia #Setindiabiz

🚨 ITR Due Date Alert 🚨

Submitting Form 9 Due Date is too close.

Don't be late!

File ASAP to ensure compliance.

Get Expert Help @ https://zurl.co/Zm9K9

Join WhatsApp: https://zurl.co/j4RJ7

#incometax #duedate #incometaxindia #form9 #salariedindividuals #setindiabiz

🚨 ITR Due Date Alert 🚨

Filing Form 10B/10BB Due Date is too close.

File timely to stay compliant.

Stay informed!

Get Help @ https://zurl.co/l6O7o

Join WhatsApp: https://zurl.co/h4Frq

#10b10bb #form10b #form10bb #incometaxindia #taxsaving #taxcompliance #setindiabiz

Why should we, as professionals, should ask for extension. The businesses shall know the implications of delayed filing of Tax Audit Reports viz. Penalty upto Rs 1.5 lacs, and they shall pursue for TAR due date extension. Now is the time to make them aware of this. #Extend_Due_Date_Immediately #extend_TAR_duedates #TaxAudit #IncomeTaxIndia #itrduedateextension #DueDate #TaxUpdate #CAcommunity

How to Report Tax-Deferred ESOPs in ITR-2

Learn step-by-step how to file ITR-2 with ESOP income, track deferred tax, and stay compliant with Income Tax rules. Simplify your ESOP tax planning today!

Master your salary tax in India!

Learn how to calculate income chargeable under salaries, claim exemptions, handle allowances & perquisites, and file ITR without mistakes.

Explore the social impacts of high taxation on salaried Indians—from financial stress and lifestyle shifts to changing perceptions of equity and government trust. A deep dive into how tax burdens shape middle-class aspirations and societal dynamics.

#IncomeTaxIndia #TaxBurden #SalariedStruggles #TaxReformIndia

https://www.scitechsociety.com/what-are-the-social-impacts-of-high-taxation-on-salaried-indians/

📢 टीडीएस भुगतान की तिथि 7 जुलाई 2025 है (अप्रैल 2024 से जून 2025 तिमाही हेतु), यदि AO द्वारा त्रैमासिक भुगतान की अनुमति धारा 192, 194, 194D या 194H के तहत दी गई है।

#TDS #IncomeTaxIndia #Compliance #TaxUpdate #Finance #HindiPost

Ask ChatGPT

ITR refund delayed? It could be a type of account error. Learn how to fix this common issue, validate your bank details, and get your income tax refund without the wait.

#ITR2025 #BankValidation #AccountTypeError #PANLinking #IncomeTaxIndia

New ITR rules impose a 200% fine on False Tax Deduction claims.

#IncomeTaxIndia #ITR2025 #TaxPenalty #FalseClaims #Sakshamagarwal