University student depending on side hustles to manage ‘overwhelming’ financial pressures

A Swansea University student has said he depends on side hustles to manage the overwhelming financial pressures of attending university.

Joe Morgan, 19, is a first-year student studying journalism, media, and communications at Swansea University and due to the recent increase in tuition fees from £9,000 to £9,250, which are set to increase again this year, Joe has been forced into taking on a number of flexible jobs to survive.

In addition to the increase in fees, students have also been affected by inflation, a lack of job opportunities and flexible hours that can accommodate to their demanding academic schedules.

Joe is currently paying £680 a month for his accommodation in Swansea Uni’s student halls and says that next year his rent for privately rented accommodation will be £152 a week.

One of Joe’s part-time jobs is working at the university’s Students’ Union bar a couple of times per week, where he earns between £250 and £300 a month. However, to help with the cost of university Joe has resorted to taking on gigs from MyPocketSkills, a platform which gives young people the opportunity to take on paid work in sectors like photography, music coaching, tutoring and content creation.

Using the app, Joe said he often takes on social media management gigs via the platform and generally makes around £100 a month from them, but this can be more and is variable also taking on a few photography and research gigs.

But despite this, Joe explained he still needs assistance from his parents occasionally to help manage the cost of other necessities like groceries and transport, as the cost of university education can feel very overwhelming.

“I believe university should be free, because it’s essentially compulsory to attend if you want to access higher-paying jobs in the future.

“While I do get lots of value and support from my course, the price doesn’t seem quite proportionate to the hours of face-to-face learning I receive. Although the student finance package I have is a great help, I earn some extra money by taking on jobs which I can fit in around my studies.”

According to The i Paper, in an attempt to save money, Joe said he keeps a close eye on things like eating out and transport costs, limiting takeaways and trying to batch-cook meals when he can.

However, he noted: “I do prefer to save a little less in exchange for experiences, including a weekend trip to Aberystwyth with the university’s Welsh Society.”

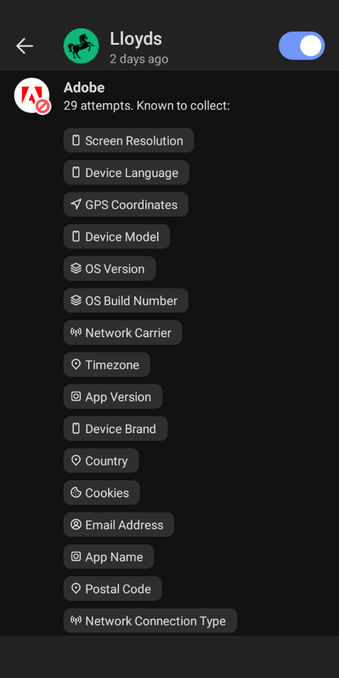

Since January 2025, MyPocketSkills has started a collaboration with Lloyds Bank to assist students from the UK in earning money and key skills. The initial phase of this partnership will take place at a number of universities in the UK, including University College London, University of West London, Cardiff University, and Swansea University.

Tamara van den Ban, propositions director at Lloyds Bank said:

“We’re all about helping students thrive in every aspect of their lives.

“By partnering with MyPocketSkill, we’re giving students the tools they need to earn extra cash while gaining relevant skills and financial education. If it’s successful, we’ll be looking at how we can help more of our students find opportunities to put more money in their pockets.”

Zara Ransley, the co-founder and co-CEO of MyPocketSkill, also spoke about the scheme, explaining:

“This partnership with Lloyds is a massive chance to support students who are feeling the financial squeeze more than ever.

“Our hands-on learning approach, which connects students with real-world, paid opportunities that fit around their uni commitments, makes a real difference in young people’s lives during tough times.

2Over 80 per cent of the young people using MyPocketSkill made progress towards a savings goal last year. We’re excited to team up with a trusted institution like Lloyds to roll out this initiative across selected campuses in the UK.”

[Lead image: Swansea University]

#LloydsBank #MyPocketSkills #SwanseaUniversity