The #EU Tax Observatory has published their "Global Tax Evasion Report 2024". It is available for download here -

https://www.taxobservatory.eu/

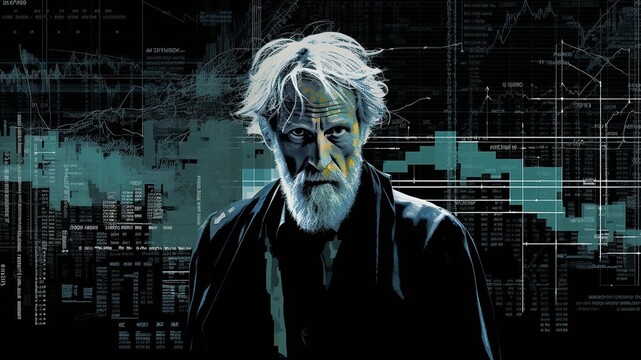

One highlight (lowlight) of their report is this - "Finding #2: A large amount of profit shifting to tax havens, with no discernable effect of policies so far - A persistently large amount of profits is shifted to tax havens: $1 trillion in 2022. This is the equivalent of 35% of all the profits booked by multinational companies outside of their headquarter country. The corporate tax revenue losses caused by this shifting are significant, the equivalent of nearly 10% of corporate tax revenues collected globally. U.S. multinationals are responsible for about 40% of global profit shifting, and Continental European countries appear to be the most affected by this evasion."

The attached graph also says a lot - in 1985 the average corporate tay rate in the EU was 50%. In 2020, it was 21%! For another thing, there is *no* difference between the corporate tax rate in the #US and in the #EU. Both 21%.

#Capitalism #Kapitalismus #Tax #Taxation #Taxes #TaxAvoidance #TaxHavens #Corporations #Multinationals #MultinationalCorporations