As with India there s a good news with twist

#zerodha a bootstrapped indian #unicorn without external funding without external funding is launching for #FOSS

The twist [s]

- founder is allegedly trying to get close to the current #rightwing gov, for a banking license

- word is that its influenced by the opensource model of #Meta

https://floss.fund/blog/announcing-floss-fund/

#Zerodha

9 books recommended by Zerodha co-founders Nikhil Kamath and Nithin Kamath

Book recommendations by Kamath brothers Two brothers who took India by storm are Nikhil and Nithin Kamath. And this storm did not just brew with Zerodha, their brand, but also their podcasts, the interview with PM Modi, and much more. And here is a list of books the duo individually recommends. #books #recommended #Zerodha #cofounders #Nikhil #Kamath #Nithin #Kamath

#NikhilKamath #Zerodha

#India's #fitnessandwellness industry

Opportunity for #disruption

Rs. 8 lakh crore market

https://economictimes.indiatimes.com/magazines/panache/zerodhas-nikhil-kamath-spots-a-rs-8-lakh-crore-market-opportunity-in-india-that-you-should-know/articleshow/118606835.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

#MensGroomingMarket

857% growth in 5 years

This industry will blow up next : #NikhilKamath #Zerodha

https://www.businesstoday.in/latest/corporate/story/857-growth-in-5-years-the-industry-zerodhas-nikhil-kamath-says-will-blow-up-next-457361-2024-12-15

#NithinKamath #CEO #Zerodha

Advises users to tweak #WhatsApp #settings to protect themselves from #fraudsters.

https://www.businesstoday.in/technology/news/story/11000-crores-lost-in-9-months-rising-online-scams-prompt-warning-from-zerodhas-nithin-kamath-455596-2024-11-29?utm_source=rssfeed?utm_source=btwachannel&utm_medium=btwabroadcast&utm_campaign=btwachanneltracking

I think this is a good initiative.

Zerodha launches $1-million annual fund to support open source software projects.

Zerodha, une entreprise de courtage indienne, lance FLOSS/fund et va consacrer un million de dollars par an pour soutenir le libre et l'open-source.

Announcing FLOSS/fund: $1M per year for free and open source projects by Zerodha

📊 Leading Stock Brokers in India by active clients

➡️ Zerodha - 6.4 Million

➡️ Groww - 5.5 Million

➡️ Angle One - 4.3 Million

➡️ Upstox - 2.9 Million

➡️ ICICI direct - 2.3 Million

➡️ HDFC securities - 1.10 Million

➡️ Kotak Securities - 0.9 Million

➡️ Motilal Oswal - 0.8 Million

➡️ Sharekhan - 0.7 Million

➡️ 5 Paisa Capital - 0.7 Million

➡️ IIFL Securitie - 0.5 Million

#groww #zerodha #upstox #stockbrokersindia #stocks #stockmarket #sharemarket #goodluckcapital

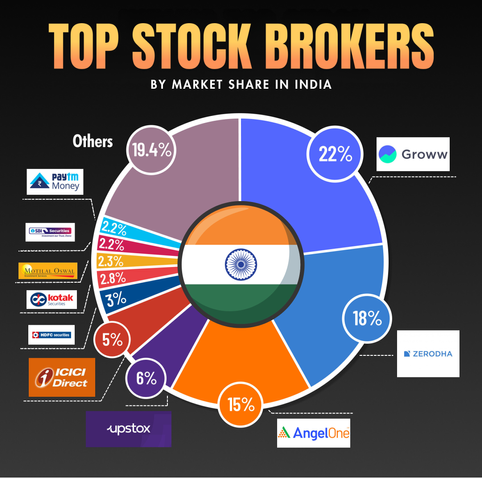

📊 Top Stock Brokers in India by market share

➡️ Groww - 22.6%

➡️ Zerodha - 18.8%

➡️ Angle One - 15.2%

➡️ Upstox - 6.4%

➡️ ICICI direct - 5.0%

➡️ Kotak Securities - 3.0%

➡️ HDFC securities - 2.8%

➡️ Motilal Oswal - 2.3%

➡️ SBI securities - 2.2%

➡️ Paytm Money - 2.2%

➡️ Others - 19.4%

✅ Join our Telegram channel for stock advice and analysis. Link is in the bio!

#groww #zerodha #upstox #stockbrokersindia #stocks #stockmarket #sharemarket #goodluckcapital

Groww vs Zerodha: Revenue, Funding and What’s New?

See here - https://techchilli.com/fintech/groww-vs-zerodha/

#Groww #Zerodha #BrokeragePlatforms #Investment #Finance #DiscountBrokers #StockMarket #Trading #Revenue #Funding #WhatsNew #Investing #FinancialNews #UserBase

Groww vs Zerodha: Revenue, Funding and What’s New?

See here - https://techchilli.com/fintech/groww-vs-zerodha/

#Groww #Zerodha #BrokeragePlatforms #Investment #Finance #DiscountBrokers #StockMarket #Trading #Revenue #Funding #WhatsNew #Investing #FinancialNews #UserBase

Low NAV is better than higher NAV? Until today, that is what I thought, since NAV is the unit price of a MF.

If NAV is low, you can buy more? Isn't that good? #till NAV is only one factor to consider.

Other part is expense ratio. Lower expense ratio is better than higher. If expense ratio is lower, then you pocket more returns.

Most MFs have two plans:

• regular

• direct

Regular plans are available via intermediaries like ICICI Direct. These intermediaries collect commission. So your returns are lower.

You buy direct plans from the MF houses bypassing the intermediaries. Expense ratio for these direct plans are lower and hence you gain more in returns.

Most MFs have the option to buy directly from them. But you can also buy these direct plans from portals like #zerodha . These new portals don't take commission and keep these MFs with depositories (CDSL/NDSL). So your investment is safe and earns higher returns.

Shoonya vs Zerodha: Which One is Best and How?

Know Here - https://techchilli.com/fintech/shoonya-vs-zerodha/

#NithinKamath of #Zerodha says he had mild stroke due to stress, poor sleep, excessive exercise. Can all these cause a stroke in a fit individual?

Nithin Kamath has been a fit individual. But doctors pointed out that even someone with a lifestyle as his could have a stroke.

🎉 I built a small #Rust crate - kiteticker-async! 🚀

An async implementation of Kite Connect’s WebSocket Streaming API -

https://docs.rs/kiteticker-async/0.1.0/kiteticker_async/

The official #rust library of Kite Connect APIs that include a ticker implementation is archived. #Zerodha is focussing on Go, Python, JS, and Java libraries of Kite Connect.

Moreover, the ticker implementation in the official #rust Kite Connect library (https://github.com/zerodha/kiteconnect-rs) is not designed for asynchronous clients.

The callback-based approach to handle new ticks resulted in spaghetti code in my client app.

I implemented the WebSocket streaming protocol described in the Kite Connect API documentation (https://kite.trade/docs/connect/v3/websocket/) within my async app. Once it worked well, I thought, why not open-source it?

And hence happened - kiteticker-async

Useful and technically detailed blog from #Zerodha on using #opensource #ClickHouse and #Vector for #logging analytics and #observability: