Yahoo Finance highlights that current HELOC rates remain stable, offering a strategic opportunity for homeowners with low primary mortgage rates. By considering a second mortgage or HELOC, individuals can tap into their home equity for various needs, maximizing favorable mortgage conditions. Explore how this option could work for you. Read more here: https://finance.yahoo.com/personal-finance/mortgages/article/heloc-rates-today-sunday-june-15-2025-100025377.html #HELOC #MortgageRates #HomeEquity #Finance #PersonalFinance

#heloc

Rising costs and tariffs got you stressed? A HELOC can help you take control of your finances and manage those unexpected expenses. 🏡💰

Call us today at 𝟒𝟏𝟔-𝟔𝟓𝟓-𝐂𝐀𝐒𝐇 (𝟐𝟐𝟕𝟒) to learn how we can help you secure the flexibility you need!

Struggling with rising costs and tariffs? A 𝗛𝗘𝗟𝗢𝗖 could be the solution you need to keep your finances in check. 📈💡

Reach out to us at 𝟰𝟭𝟲-𝟲𝟱𝟱-𝗖𝗔𝗦𝗛 (𝟮𝟮𝟳𝟰) to see how we can help you stay ahead!

#HELOC #FinancialSupport #CashinMortgages #TakeControl

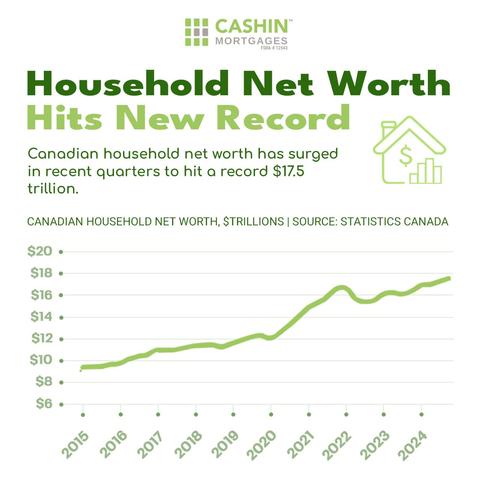

Canadian household net worth has hit an all-time high of $𝟏𝟕.𝟓 𝐭𝐫𝐢𝐥𝐥𝐢𝐨𝐧! 🚀 Thanks to rising real estate values, growing investments, and increased savings, homeowners have more financial security than ever. 🏡✨

Thinking about leveraging your home’s equity for investments or major purchases? A HELOC could be the key to unlocking new opportunities!🔑💸

#FinancialGrowth #HouseholdWealth #HELOC #SmartInvesting #RealEstate #CashinMortgages

Mortgage applications dropped last week as rates shot up

Tariff turbulence is beginning to show up in housing data.

#us #homebuyers #usa #mortgage #rates #mortgages #housing #homes #trump #tariffs #american #family #tax #spending #business #taxes #tariff #trade #mba #bankers #loans #lenders #originators #fha #heloc #families #shelter #americandream #refinancing #refinance #GSEs #treasury #yields #bonds #treasurybonds #interest #finance #financing #economy #economics #uspol #politics #usgov #gov #government

📢 𝐖𝐨𝐫𝐫𝐢𝐞𝐝 𝐀𝐛𝐨𝐮𝐭 𝐑𝐢𝐬𝐢𝐧𝐠 𝐓𝐚𝐫𝐢𝐟𝐟𝐬? 𝐓𝐚𝐤𝐞 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐰𝐢𝐭𝐡 𝐚 𝐇𝐄𝐋𝐎𝐂!

With costs on the rise, a 𝐇𝐨𝐦𝐞 𝐄𝐪𝐮𝐢𝐭𝐲 𝐋𝐢𝐧𝐞 𝐨𝐟 𝐂𝐫𝐞𝐝𝐢𝐭 (𝐇𝐄𝐋𝐎𝐂) gives you 𝐟𝐢𝐧𝐚𝐧𝐜𝐢𝐚𝐥 𝐟𝐥𝐞𝐱𝐢𝐛𝐢𝐥𝐢𝐭𝐲 when you need it most. 💰💡 Use your home’s equity to cover unexpected expenses, invest, or simply gain peace of mind.

📞 Call us today at 𝟒𝟏𝟔-𝟔𝟓𝟓-𝐂𝐀𝐒𝐇 (𝟐𝟐𝟕𝟒) to learn more! #HELOC #FinancialFreedom #SmartFinancing #CashinMortgages

Banks are pushing the HELOCS again because the economy is going down and this is a real easy way for them to get you to use your house as an ATM until you lose it.

Do not do this.

If you must do this you MUST make sure there’s no balloon payment at the end and you MUST understand that usually the payment amount they show you on the loan is just interest only. It looks great because they’re showing you the estimated interest you would pay if you maxed out the HELOC. That doesn’t cover the principal and then at the end of the term you owe a balloon payment.

My friend got into one of these back in 2007 and she had no idea she was only paying interest until she got about halfway through the term and realized she was going to have to figure out a way to refinance it at the end of the term because she wouldn’t be able to drop a lump sum to pay it off.

The problem is she was 10 years older and not working full-time anymore by the time 2017 rolled around, also she had cosigned for a car for one of her kids five years before that and he wasn’t paying on time so her credit had taken some hits. The bank wouldn’t let her refinance. She didn’t qualify to refinance.

The only way this worked out for her was because she had a son who could get a VA loan for a new home, so she sold the home she was in and used the proceeds to put down on a new home and he used his VA loan to finance the rest. But she was so sad this was the home she had grown up in, it was like losing everything to her even though she didn’t end up homeless. She never wanted to sell this house but she had to because of that #HELOC.

#CapitalismKills #HousingMarket #HousingBubble #mortgages #ARM #TeaserRate

Looking to unlock your home’s value? 🏡 Find out how to qualify for a Home Equity Line of Credit (HELOC) and make your home work for you! Explore now https://bit.ly/42dnatu

How bad does your financial situation have to be if you are being denied a #HELOC despite bringing in $7,000 a month?

Christ, it seems even worse when I type it out.

...And now that I've got it my credit score is up and my debt-to-income ratio is down, so much so I can now refinance into a new HELOC that's almost twice as big? Not that I mind — I'm going for it — but it is curious.

Painting is Laura Theresa Alma-Tadema's "At the Doorway".

#art #traditionalart #painting #oilpainting #beautifulwoman #beautifulgirl #realestate #housing #self #finance #credit #debt #HELOC

Went to my little local bank and it turns out I qualify for a home equity line of credit; enough to pay my credit cards off twice over, and at a third as much interest. I'm going to get it! 🙂

Painting is George Dunlop Leslie's "Sun and Moon Flowers".

#art #traditionalart #painting #oilpainting #beautifulwoman #beautifulgirl #flowers #realestate #housing #self #finance #credit #debt #HELOC