Aussie suburbs bucking the property trend—some areas see price drops up to $167K in the last five years.

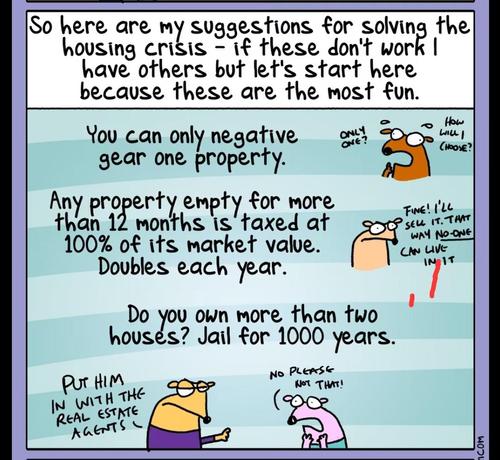

However, the article overlooks Victoria's proactive approach to housing supply. Since 2018, the state has implemented the Vacant Residential Land Tax (VRLT), targeting owners of vacant properties. From January 1, 2025, the VRLT expands statewide, aiming to encourage property owners to lease or sell unoccupied homes, thereby increasing housing availability.

Additionally, the Victorian Government has introduced a 7.5% levy on short-term accommodation platforms like Airbnb, effective from January 1, 2025. This measure aims to prioritise housing and long-term rentals, raising funds to support social and affordable housing initiatives.

These policies are part of a broader strategy to address housing affordability and availability in Victoria.

#property #realestate #victoria #housing #housingpolicy #australia #vacanthomes #investorproperty #shorttermrentals #auspol #airbnb #negativegearing