Labour's #RachelReevesMP faces sack as backbench revolt brews over her £20bn "black hole" fib - speech sparked tax panic, but OBR reveals £4.2bn surplus!

-> PM #KeirStarmer's job also hangs by a thread!

=> Next 7 days will be crucial for both of 'em!

#UKLabour #Budget2025

#rachelReevesMp

Keir Starmer sets sights on welfare again as Rachel Reeves battles 'lies' claim

#RachelReevesMP

1. Had made up job details on LinkedIn account?

2. Said she hadn't been told she needed a license to rent her property out, yet husband had been given ALL the info?

3. Now, we learn she was told there was NO economic "black hole", but continued saying there was!?

Reeves hyped a productivity 'crisis' to ram through £26B tax hikes - turns out OBR's wage boost already fixed the books!

-> Smokescreen for Labour's stealth raid on wallets?

-> Time to demand transparency!?

It's been reported Labour's Chancellor #RachelReevesMP kicked Sir #SadiqKhan out of her office in a major bust up, earlier in the year, as he demanded extra funding for London.

-> Apparently she told him to 'get out of my office'!

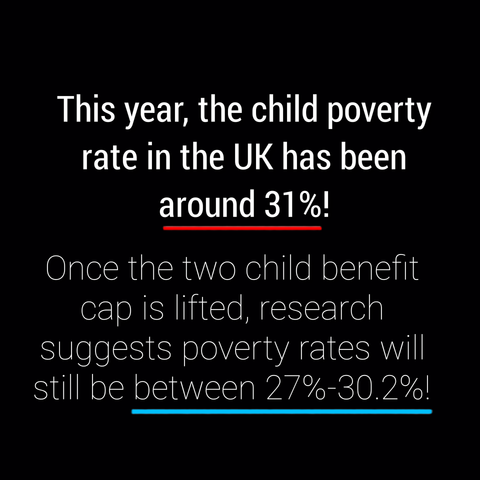

So, essentially between 3.8m & 4.5m British kids will STILL be living in poverty!

- Yet over paid MPs have been toasting themselves, patting each other's backs, in the subsidized world of Parliament, like they've solved #ChildPoverty!

Llanelli mining families win pension justice after decades of campaigning

Around 150 former mineworkers and their families in Llanelli are set to receive increased pension payments following changes to the British Coal Staff Superannuation Scheme (BCSSS) announced in the Budget.

The adjustment will see an average uplift of £100 a week for eligible members, with payments backdated and expected to begin before the end of the year.

Energy Secretary Ed Miliband said the change would deliver a 41% uplift to annual pensions for 40,000 former mineworkers across the UK, with payments backdated and expected to begin before the end of the year.

“A victory for relentless campaigning”

Dame Nia Griffith, MP for Llanelli, welcomed the announcement, saying:

“For far too long former miners in Llanelli have had to wait for the pension settlement they deserve. I am pleased to see a Labour Government taking decisive action to finally end this injustice and deliver what is rightfully owed back to mining families.”

Griffith has campaigned alongside ex-pit workers and other MPs representing coalfield communities to secure the change, which builds on previous action taken on the Mineworkers’ Pension Scheme.

Government and union response

Ed Miliband said the transfer of the investment reserve was a response to long-standing calls from campaigners:

“We owe the mining communities who powered this country a debt of gratitude. I pay tribute to those who have fought for a fair deal — without them this would not have happened.”

Chris Kitchen, General Secretary of the National Union of Mineworkers, said:

“The additional pensions this will provide will benefit not just the pensioners but our former mining communities.”

Welsh Liberal Democrats welcome move

David Chadwick, Welsh Liberal Democrat Westminster Spokesperson, also welcomed the announcement, saying:

“This is welcome news for the roughly 4,000 former miners who were denied full access to their pension pots in last year’s budget. I am proud to have been the only Welsh MP to consistently press the UK Government to right this historic injustice.”

He added that many former miners now suffer ill health as a result of their work, and said it was only right they receive the full pension support they’ve long been owed.

What happens next

The trustees of the BCSSS are expected to begin uplifted payments before the end of the year, with adjustments backdated to align with previous changes made to the Mineworkers’ Pension Scheme.

The announcement follows years of campaigning by former mineworkers and their representatives, and marks a significant change in how surplus investment reserves are handled within the scheme.

#autumnBudget2025 #budget #edMilibandMp #llanelli #mining #nationalUnionOfMineworkers #niaGriffithsMp #num #rachelReevesBudget #rachelReevesMp

Biggest winners and losers from Rachel Reeves' Budget - how it affects you

Budget 2025: Details you may have missed in the small print - fuel duty to ID cards

https://fed.brid.gy/r/https://www.mirror.co.uk/news/politics/budget-2025-details-you-missed-36311215

Budget 2025: New pension savings tax could cost workers more, experts warn

Workers could end up paying more to save for their retirement after the Chancellor confirmed a new pension savings tax in the Autumn Budget. From April 2029, anyone putting more than £2,000 a year into their pension through salary sacrifice will have to pay National Insurance contributions on the extra amount. National Insurance is the tax that funds state pensions and benefits, meaning workers will see less take‑home pay if they save above the cap.

The Treasury says the measure is designed to raise money as part of wider tax reforms. But pensions experts, consumer groups and campaigners warn it risks discouraging people from saving at a time when many households are already struggling with rising costs.

“Unpopular and disincentivising”

Salary sacrifice has been one of the simplest ways for workers to boost their pension pots, with both employees and employers saving on National Insurance.

Maike Currie, VP Personal Finance at PensionBee, said the change could undermine confidence in workplace pensions:

“Salary sacrifice is one of the most efficient ways for employees to save more for their future. Limiting the amount that can be contributed in this way is an unpopular move, disincentivising companies who provide workplace pensions and sending the wrong message to millions of basic rate taxpayers trying to save.”

Currie added that the government’s decision comes at a time when households are already under pressure, and that confidence in long‑term saving is vital to meeting retirement needs.

Industry and consumer concerns

Other industry figures echoed those concerns. Richard Knight, head of pensions at Burges Salmon, said the change “will hit employees who are trying to save responsibly” and adds complexity for employers, particularly smaller businesses.

Pensions UK, a national advocacy group, warned the cap could worsen Britain’s retirement savings gap. Executive Director Zoe Alexander said:

“Over half of savers are already on course to fall short of retirement income targets. Adding new costs to salary sacrifice risks widening that gap.”

Consumer campaigners pointed out that while the state pension will rise by 4.8% next April, frozen tax thresholds until 2031 mean more workers will be dragged into higher bands, reducing take‑home pay and pension affordability.

Treasury forecasts and government aims

The government argues the pension savings tax is necessary to protect revenues as more people use salary sacrifice to boost their pensions. The Office for Budget Responsibility (OBR) estimates the change will raise around £4.7 billion by 2031, money the Treasury says will help fund public services.

But analysts describe it as a “stealth tax,” warning that the measure will not only affect higher earners but also ordinary workers who try to save more than the £2,000 limit. Employers, too, will face higher National Insurance bills, reducing the incentive to offer generous workplace schemes. Critics say this risks undermining the very system designed to encourage long‑term saving.

What it means for savers

For employees, the change means salary sacrifice will remain in place, but its benefits will be capped. Anyone saving more than £2,000 a year through this route will see extra National Insurance taken from their pay packet, leaving them with less money each month.

Campaigners warn this could discourage workers from putting aside more for retirement, widening Britain’s savings gap. With Britain already facing a shortfall in pension provision, experts say stability and clear incentives are essential if the government wants people to keep saving for the future.

Related stories from Swansea Bay News

Autumn Budget 2025: Westminster leak, Welsh impact

Rachel Reeves’s Budget was overshadowed by an OBR leak and fierce Commons clashes — here’s what it means for Wales.

Autumn Budget 2025: Welsh parties clash over Reeves’s plans

Labour hails child poverty measures, Plaid warns Wales is shortchanged, Conservatives call it a “circus,” Reform and Lib Dems add criticism.

Autumn Budget 2025: What more than 100 possible tax changes could mean for South West Wales

From income tax rises to energy bill shifts, we break down how Budget reforms could affect households and businesses locally.

Tractors roll into Westminster as farmers protest Budget’s “family farm tax”

Farmers drove tractors into Westminster to protest inheritance tax reforms, warning of lasting damage to Welsh family farms.

#autumnBudget2025 #budget #money #nationalInsurance #ni #nic #obr #officeForBudgetResponsibility #pensionSaving #pensions #rachelReevesBudget #rachelReevesMp #salarySacrifice #savings #ukBudget2025

Budget 2025: EV pay-per-mile tax sparks backlash from motoring experts

Drivers face a new pay‑per‑mile tax on electric cars — a move critics say could stall Britain’s net zero journey and add fresh costs to motorists already struggling with rising bills.

From April 2028, battery electric vehicles will be charged 3p per mile, while plug‑in hybrids will pay 1.5p per mile. The Treasury argues the measure is needed to replace lost fuel duty revenue as more drivers switch to electric.

The charge will be levied in addition to existing road taxes, including Vehicle Excise Duty (VED), which EVs will begin paying from 2025.

“Mixed messages” for motorists

John Wilmot, CEO of car lease comparison site LeaseLoco, said the new tax risks eliminating one of the biggest incentives for going electric — cheaper running costs.

“One of the massive benefits to driving an electric vehicle was that it was far cheaper to run than a petrol or diesel car, but a pay‑per‑mile tax risks eliminating that advantage, which could make drivers think twice about switching any time soon,” he said.

Wilmot warned that the change sends “mixed messages” to drivers, who are already facing rising insurance premiums, increased home charging costs and limited charging infrastructure.

“Understandably, drivers want clarity before committing to making the switch to electric — and it’s hard to have confidence when the rules and the costs keep changing.”

LeaseLoco said it has seen growing interest in electric options among lease customers, but cautioned that the new tax could cause many to hesitate.

FairFuelUK: “Thin end of the wedge”

FairFuelUK, the long‑running campaign group representing motorists and hauliers, welcomed the Chancellor’s decision to freeze fuel duty for a 15th consecutive year. Founder Howard Cox said this was a victory after years of lobbying, but warned that the new EV mileage levy could be the start of a wider shift to taxing all road users by distance.

“Rachel Reeves’s 3p pay‑per‑mile on EVs is, I fear, the thin end of the wedge to make all vehicles, whatever their type of fuel, pay tax as they drive,” said Cox.

He argued that fuel duty and VAT already deliver billions to the Exchequer, and that layering a mileage tax on top risks unfairly penalising drivers.

“Whilst fuel duty and VAT continue to deliver billions to the exchequer, both types of taxation cannot work alongside each other. It’s time government listens to and consults drivers on a long‑term road user tax plan that’s fair to the UK’s 37 million drivers and the economy.”

Cox also thanked MP Lewis Cocking for leading the campaign inside Parliament, noting that thousands of FairFuelUK supporters had contacted MPs to demand the freeze.

Industry concerns mount

The Office for Budget Responsibility forecasts the new levy will raise £1.1 billion in 2028–29, rising to £1.9 billion by 2030–31.

Yet across the motoring industry, concern is mounting that the policy could backfire. The Society of Motor Manufacturers and Traders warned the measure comes at the “wrong moment” in the UK’s EV transition, while the RAC said it risks undermining incentives for adoption just as electric cars are beginning to enter the mainstream. Octopus Electric Vehicles went further, predicting the tax could cut sales by more than 400,000 units in the coming years.

Leasing firms have also sounded the alarm. Select Car Leasing described the levy as a “significant shift” in government policy that will force drivers to reassess running costs. Consumer surveys echo that sentiment: research by What Car? found more than half of in‑market car buyers said the tax would deter them from choosing an EV.

Together, these warnings paint a picture of an industry worried that the government’s new approach could stall momentum at a critical point in the UK’s net zero journey.

A turning point for drivers

The warnings from both consumer finance experts and driver lobby groups underline how contentious the new mileage levy has become. LeaseLoco cautions that the tax risks stripping away the financial incentive to go electric, while FairFuelUK fears it could be the first step towards taxing all road users by distance.

Industry bodies add weight to those concerns, with manufacturers, leasing firms and motoring organisations all warning that the policy risks slowing adoption at a critical moment. Surveys suggest ordinary drivers are already questioning whether the benefits of going electric outweigh the costs.

Together, these voices paint a picture of a sector caught between ambition and reality: a government determined to secure revenue as fuel duty declines, and drivers who want clarity, consistency and confidence before committing to the switch.

With net zero targets looming, the debate over how Britain pays for its roads is no longer theoretical. For millions of motorists, the Budget’s pay‑per‑mile tax could mark a turning point in the journey to cleaner transport.

Related stories from Swansea Bay News

Autumn Budget 2025: Westminster leak, Welsh impact

Rachel Reeves’s Budget was overshadowed by an OBR leak and fierce Commons clashes — here’s what it means for Wales.

Autumn Budget 2025: Welsh parties clash over Reeves’s plans

Labour hails child poverty measures, Plaid warns Wales is shortchanged, Conservatives call it a “circus,” Reform and Lib Dems add criticism.

Autumn Budget 2025: What more than 100 possible tax changes could mean for South West Wales

From income tax rises to energy bill shifts, we break down how Budget reforms could affect households and businesses locally.

Tractors roll into Westminster as farmers protest Budget’s “family farm tax”

Farmers drove tractors into Westminster to protest inheritance tax reforms, warning of lasting damage to Welsh family farms.

#autumnBudget2025 #budget #electricVehicles #ev #fairfueluk #motoring #netZero #payPerMileTaxUk #payPerMile #politics #rachelReevesBudget #rachelReevesMp #ukBudget2025

Tractors roll into Westminster as farmers protest Budget’s “family farm tax”

Farmers brought rush hour traffic to a standstill in Westminster on Wednesday, defying a police ban on agricultural vehicles to protest against the UK Government’s Autumn Budget and its proposed inheritance tax reforms.

Dozens of tractors entered central London from early morning, with signs reading “Starmer farmer harmer” and “rural communities betrayed by Labour.” The protest, organised under the banner Farmers to London: Budget Day, saw vehicles converge on Parliament Square and Whitehall as Chancellor Rachel Reeves delivered her statement in the Commons.

A protester’s tractor outside HM Treasury during the Budget Day demonstration, calling for the scrapping of inheritance tax reforms.(Image: Gareth Wyn Jones)A decorated protest tractor outside Parliament, calling for political change and backing British farmers.

(Image: Gareth Wyn Jones)Tractors gather outside Parliament with signs urging support for farmers and food producers.

The Metropolitan Police confirmed that several arrests were made after protesters breached conditions banning tractors from entering the area. At least 20 vehicles were stopped in Richmond and Westminster, but many reached the heart of government, where demonstrators called for the proposed “family farm tax” to be scrapped.

Journalist Toby Young described the protest as a “furious” response to Budget plans that would “force many to sell up.”

Ian Rickman, President of the Farmers’ Union of Wales, stands outside HM Treasury on Budget Day, calling for urgent reform of inheritance tax to protect Welsh family farms.(Image: FUW)

FUW: “Step in the right direction, but not enough”

The Farmers’ Union of Wales (FUW) said the Budget offered only a partial concession to Welsh family farms, with damaging inheritance tax reforms still set to come into force next April.

FUW President Ian Rickman welcomed the Chancellor’s decision to make the proposed relief for the first £1 million of agricultural and business assets transferable between spouses — a measure the Union had repeatedly called for.

“This is a step in the right direction, and one that will help ease the challenges of succession planning for many farming families,” said Rickman.

“It is also encouraging to note that the lifetime gifting rules remain unchanged — a mechanism the Union had urged the Treasury to preserve.”

However, Rickman warned that the wider reforms still represent an existential threat to Welsh family farms, risking unaffordable tax bills for those seeking to inherit and continue the family business.

“The Chancellor’s decision to press ahead with the government’s broader proposals for inheritance tax reform remains deeply disappointing, if unsurprising. These changes still risk causing lasting damage to rural communities.”

The FUW said it would continue lobbying MPs across all parties to support amendments to the Budget that would “ensure family farms can be passed on with confidence to the next generation.”

Gareth Wyn Jones: “We will not be silenced”

Welsh hill farmer and broadcaster Gareth Wyn Jones joined the protest in Westminster, sharing footage from Parliament Square and Trafalgar Square on social media.

In one video, he said:

“We’re here to stand up for our communities, our families, and our future. This Budget is a betrayal of everything rural Wales stands for.”

Jones also posted images of tractors lined up outside HM Treasury and called on MPs to “listen to the countryside before it’s too late.”

“We will not be silenced. Family farms are the backbone of Wales — and we’re not going anywhere.”

His posts were widely shared across farming networks and drew support from rural campaigners across the UK.

A protest tractor lists political figures on its “naughty list” during the Budget Day demonstration in Westminster.A protest tractor calls for fair treatment of British farmers, criticising import policies and Westminster decisions.Tractors enter central London in convoy during the Budget Day protest, escorted by police vehicles.For full coverage of the Autumn Budget 2025 and its impact on Wales, read our explainer here.

#autumnBudget2025 #budget #chancellor #farmers #farmersUnionOfWales #farming #fuw #hmTreasury #ianRickman #inheritanceTaxReforms #londonTractorProtest #rachelReevesBudget #rachelReevesMp #tractorProtest #ukBudget2025 #ukGovernment #ukParliament

Autumn Budget 2025: Welsh parties clash over Reeves’s plans

Labour claims progress, opposition cries foul

Welsh Labour were quick to claim victory on one of their long‑standing demands: the scrapping of the two‑child benefit cap. First Minister Eluned Morgan said the change would lift support for 69,000 children in Wales, describing it as “helping to tackle the scourge of child poverty.” Labour also pointed to nearly £1bn in additional funding for the Welsh Government, which ministers say will bolster public services and allow investment in steel transition at Port Talbot, AI Growth Zones, and nuclear energy at Wylfa.

Plaid Cymru, however, accused Westminster of once again failing to deliver fair funding. Treasury spokesperson Ben Lake MP said the Budget “proves that when Westminster does the counting, Wales always loses out,” highlighting the absence of Barnett consequentials from major rail projects and warning that employer National Insurance increases would hit Welsh services hard. Plaid also criticised the First Minister’s response, claiming she had “no influence” over the UK Government’s decisions.

Conservative leader Kemi Badenoch responds to the Autumn Budget 2025 in the House of Commons, accusing the Chancellor of breaking promises and delivering a “circus.”(Image: UK Parliament)

Conservatives, Reform and Lib Dems sharpen attacks

The Conservatives seized on the Budget’s chaotic delivery and its tax implications. UK leader Kemi Badenoch told MPs there was “no growth and no plan,” branding the episode a “circus” and accusing Reeves of breaking promises by extending the freeze on tax thresholds. Welsh Conservatives echoed the criticism, calling for a review of Wales’s fiscal framework and warning that inheritance tax changes and higher employer National Insurance would damage family farms and businesses.

Reform UK Wales went further, describing the Budget as proof that “having Labour Governments at both ends of the M4 has been a disaster.” The party said Reeves’s measures would take taxes to “post‑WW2 highs,” framing the upcoming elections as a choice between Plaid Cymru, whom they accused of backing Labour’s tax rises, and Reform as “a new hope for left behind communities.”

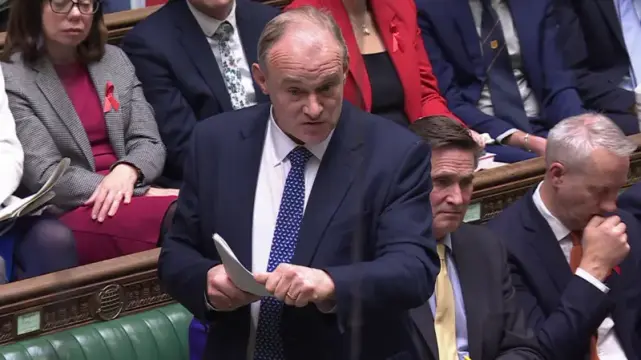

Liberal Democrat leader Ed Davey addresses the House of Commons during the Autumn Budget 2025, criticising the Chancellor’s approach to growth and taxation.(Image: UK Parliament)

The Liberal Democrats also joined the chorus of criticism. Party leader Ed Davey said Reeves “has diagnosed the disease but not administered the cure,” arguing that “you can’t tax your way to growth” and calling for a new trade deal with Europe. Former pensions minister Steve Webb added that the extended tax threshold freeze would drag hundreds of thousands more pensioners into paying income tax, warning of a growing burden on older households.

Together, the reactions underline how Reeves’s Budget has become a political battleground in Wales: Labour presenting it as a progressive step for families and public services, while opposition parties line up to portray it as chaotic, unfair, and economically damaging.

For a full breakdown of the Budget measures and their impact in Wales, read our explainer here.

#autumnBudget2025 #benLakeMp #budget #edDavey #kemiBadenoch #plaidCymru #rachelReeves #rachelReevesBudget #rachelReevesMp #reformUk #ukBudget2025 #ukParliament #welshConservatives #welshLabour #welshLiberalDemocrats

Autumn Budget 2025: Westminster leak, Welsh impact

A Budget delivered in chaos

Rachel Reeves rose to deliver her Autumn Budget in the Commons — but the drama had already begun. The Office for Budget Responsibility (OBR) had accidentally published its forecasts online 40 minutes before she spoke, leaving MPs scrolling through graphs on their phones as the Chancellor tried to set out her plans. Treasury minister Torsten Bell, the newly‑elected MP for Swansea West, was seen passing his mobile to Reeves as she scribbled notes onto her speech.

BBC economics editor Faisal Islam called the leak “wild,” describing it as “history of the wrong sort” and noting that all the market‑critical fiscal numbers were out in the open before Reeves even stood up.

The deputy speaker, Nusrat Ghani, had already admonished ministers for the sheer volume of leaks and pre‑announcements surrounding the Budget, suggesting the government may have breached the ministerial code even before the OBR error.

Conservative leader Kemi Badenoch seized on the chaos, branding the whole episode a “circus” and accusing Reeves of becoming “the first chancellor to release the whole Budget ahead of time.”

The OBR has promised to explain how the mistake happened at a press conference later in the afternoon, where officials are expected to face tough questions about why their report was published before the Budget was even public.

Tax thresholds frozen until 2031

After the drama over leaks, Reeves confirmed one of the most contentious measures: income tax and National Insurance thresholds will remain frozen until 2031. “I know that maintaining these thresholds is a decision that will affect working people,” she told MPs. The OBR estimates 780,000 more people will be pulled into paying income tax by 2029–30. Badenoch accused her of breaking promises, saying Reeves had “sworn last year it was a one‑off.”

Families see benefit cap scrapped

In contrast, Reeves announced the scrapping of the two‑child benefit cap from April 2026, saying every child “deserves an equal chance.” Welsh Labour highlighted that 69,000 children in Wales will benefit, with First Minister Eluned Morgan welcoming the change as a step to tackle child poverty.

Pensions and savings face new limits

Turning to pensions, Reeves said she would cap salary sacrifice contributions at £2,000 from 2029, describing it as a “pragmatic step.” PensionBee warned the change “punishes hard‑working savers” and risks discouraging employers from supporting workplace schemes.

Savings products were also reshaped. From 2027, under‑65s will only be able to put £12,000 into cash ISAs, with the rest reserved for investments. Over‑65s will retain the full £20,000 cash allowance. Industry experts criticised the move as “needless complexity” that could penalise groups who rely more heavily on cash savings.

Motoring and property charges

Drivers will face new costs too. Electric vehicles will be subject to a mileage‑based excise duty from 2028 — 3p per mile for battery cars and 1.5p for plug‑in hybrids. Disabled drivers using the Motability scheme will find luxury models removed, with Reeves saying the scheme must return “to its original purpose.”

Property owners at the top end of the market will also pay more. From 2028, homes worth over £2m will face an annual charge of £2,500, rising to £7,500 for those above £5m. Reeves said the measure would raise £400m by 2031 and affect fewer than 1% of properties.

Energy bills, gambling and devolved funding

Household energy bills will fall by around £150 from April as green levies are scrapped. Gambling taxes will rise sharply, with remote gaming duty increasing from 21% to 40% and online betting duty from 15% to 25%. Bingo duty will be abolished from 2026.

Wales will receive an additional £505m in Barnett consequentials and £425m in fiscal flexibilities, giving the Welsh Government almost £1bn in extra spending power. Ministers in Cardiff will decide how to allocate this funding across health, education and infrastructure.

What happens next

The immediate changes — higher minimum wages, pension uprating, and the end of the two‑child cap — will be felt from April 2026. ISA reforms and energy bill savings arrive in 2027, while the mansion tax and EV mileage duty begin in 2028. The salary sacrifice cap takes effect in 2029, and tax thresholds remain frozen until 2031.

For households in South West Wales, the Budget brings both near‑term changes to pay packets and benefits, and longer‑term reforms to pensions, savings and motoring costs. England‑only measures such as rail fare and prescription freezes will not apply, with the Welsh Government deciding how to spend its share of the additional funding.

#autumnBudget2025 #budget #hmTreasury #houseOfCommons #money #obr #officeOfBudgetResponsibility #rachelReeves #rachelReevesBudget #rachelReevesMp #ukGovernment #ukParliament

Aldi confirms 8p sale coming to all stores in December

Budget 2025 predictions as Rachel Reeves makes changes to tax, benefits and savings

Chancellor, #RachelReevesMP set to abolish the two child benefits cap.

-> But many people are saying, "Keep the cap, but increase the amount of support for families with one or two children?"

-> Public split: 59% want to keep the cap vs. just 26% backing full abolition!

#RachelReevesMP -> Budget bombshell: Rail fare freeze saves commuters £350/year for the first time in 30 years - but it ONLY kicks in March 2026, while a sneaky 5.8% hike on regulated fares looms b4 hand!

-> Media mute on the fine print? :)

Labour's Chancellor, #RachelReevesMP, has apparently, decided to drop the two-child benefits cap in her forthcoming budget!

-> So that'll be a £58,000,000 cost to working taxpayers!

#UKBudget #ChildPoverty #LabourFail #TwoChildCap #Budget2025

Voters support Budget tax hikes if burden falls on wealthiest, poll shows