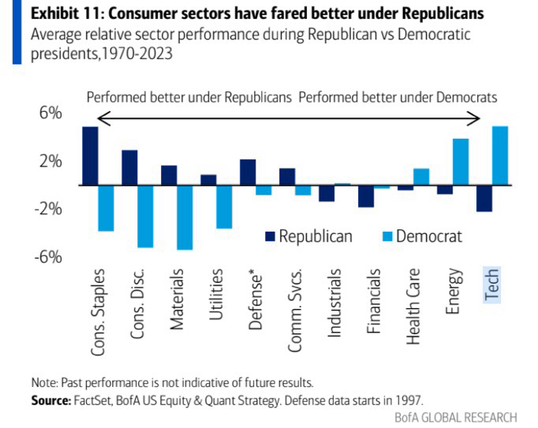

Average sector returns per party President

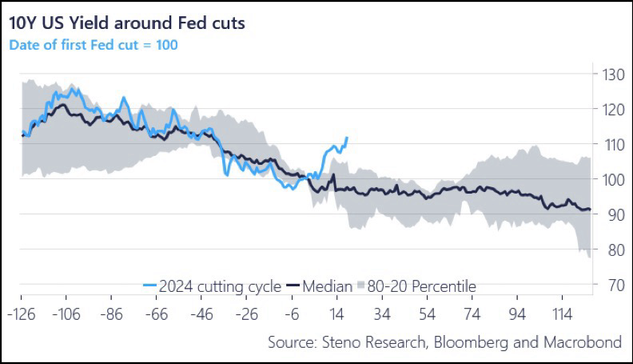

The move in bond yields after the 50bp cut is very out of the ordinary

Average annual working hours per country!

Gold to oil ratio highest in history (excluding covid shutdown when oil went negative)

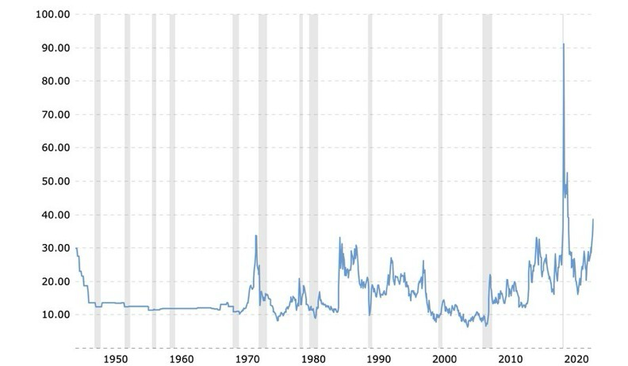

Implied volatility in Treasury yields has risen to the highest since December.

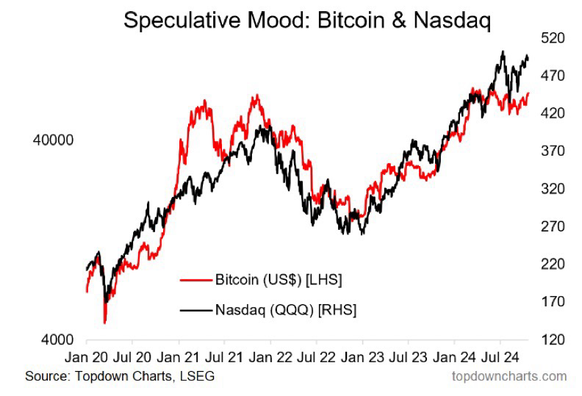

Interesting 4 year correlation between #bitcoin and the Nasdaq.

The ECB was way too slow to rise rates when inflation came and now seems like they are behind on the cutting cycle.

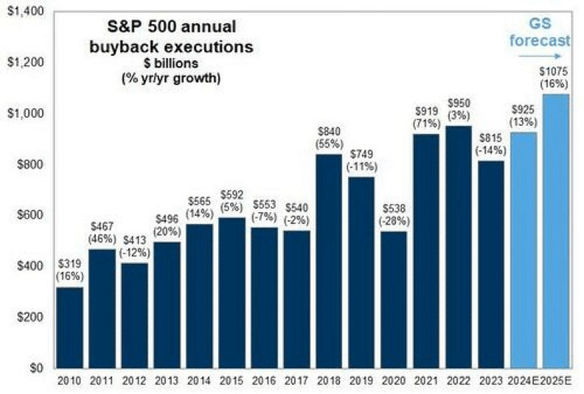

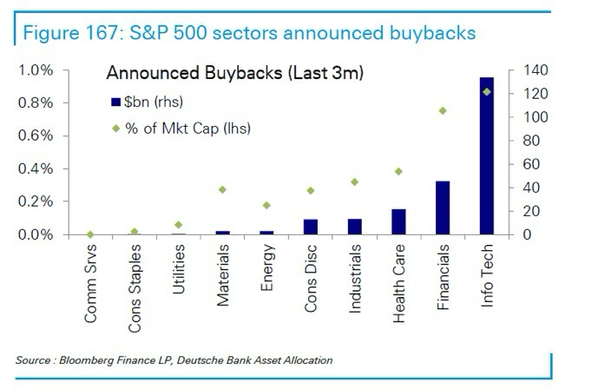

Companies have been pushing their own stock prices higher.

In 2024, equity issuance has been just $139B, while there has been a record $1.1T of buybacks.

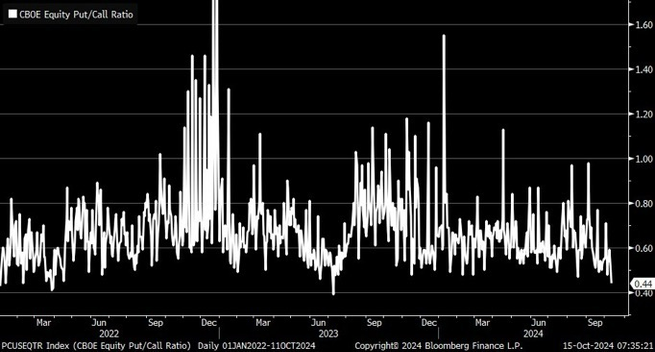

Open interest in VIX Volatility call options is very low.

Unusual given we have a federal election approaching! Investors seem under-hedged.

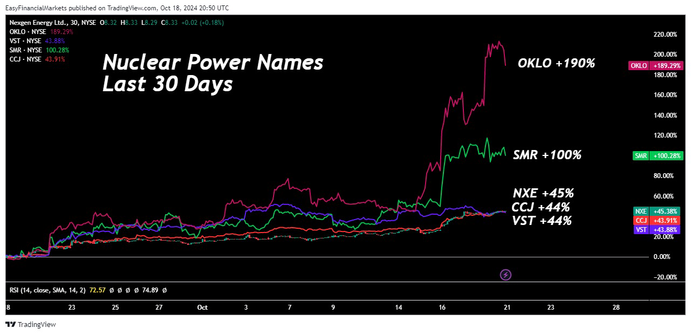

Nuclear Power stocks are surging higher!

Just 1 of our Top 5 Charts of the week.

Find the others here: https://open.substack.com/pub/easymarkets/p/top-5-charts-of-the-week?r=1vbilw&utm_medium=

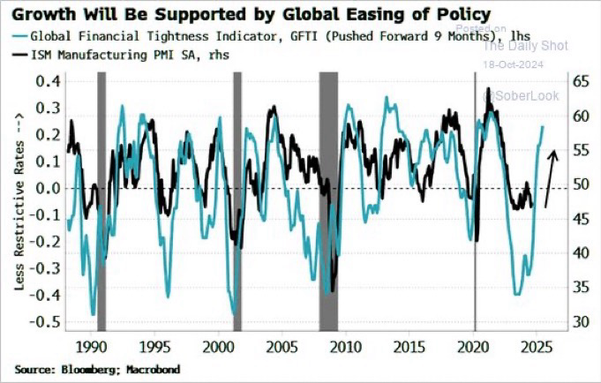

Global liquidity is on the rise, this points to an upswing in the real economy, not just financial assets.

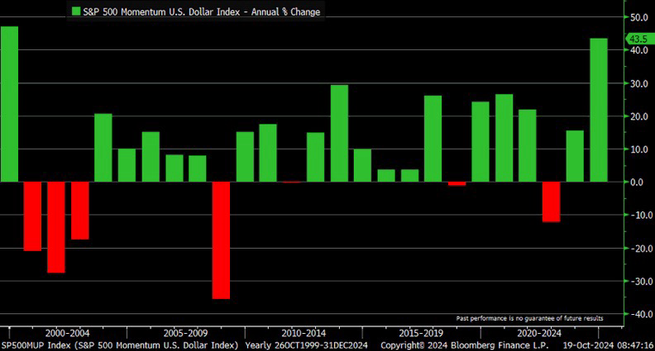

The S&P 500 Momentum Index is partying like its 1999

Silver surged this week to its highest level in 10 years! #inflation

Top 10 performers in the S&P 500 YTD:

Vistra (+230.4%)

NVIDIA (+176.5%)

Palantir (+144.6%)

Constellation Energy (+132%)

GE Vernova (+107.2%)

Howmet Aerospace (+96.3%)

General Electric (+89.4%)

Targa Resources (+86.4%)

Iron Mountain (+77.9%)

United Airlines (+77.7%)

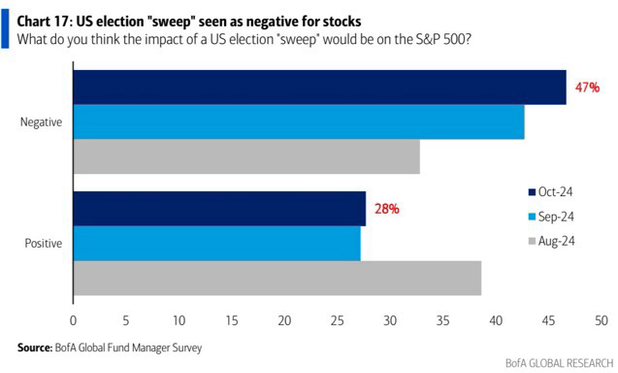

Most fund managers see an election sweep as bad for stocks.

Markets don’t like change.

Stock buybacks per sector #stocks

Big beats across the board for consumption

Retail Sales 0.4%, Exp. 0.3%

Retail Sales ex auto 0.5%, Exp. 0.1%

Retail Sales control group 0.7%, 0.3%

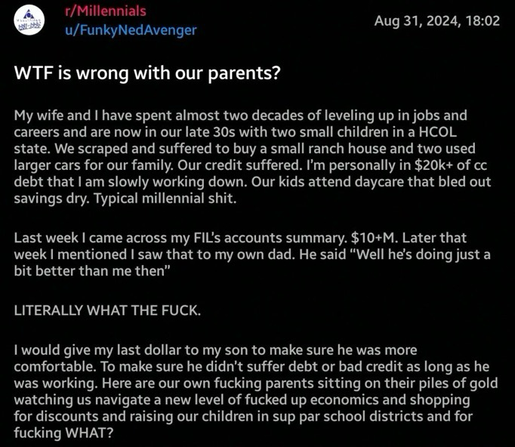

This Reddit rant has been going viral.

The transfer of wealth is likely to be a very hot topic in the coming years.

It is all due to generational inequality.

US consumers' #inflation expectations for the next 5-10 years skyrocketed to 7.1% in October, the highest in over 40 years.

(Even those of us who are actually in the industry have been scratching our heads on this one. Maybe it’s all the endless campaign promises coming from both sides of the aisle…)

Heading into today the market Put/Call ratio was the lowest in over a year.

Pretty normal to see a pullback from these extremes. #trading