Read the full article:

https://www.carbonbrief.org/analysis-chinas-co2-falls-1-in-q2-2024-in-first-quarterly-drop-since-covid-19/

Co-founder and lead analyst, Centre for Research on Energy and Clean Air: tracking & accelerating progress from polluting energy to clean air, with research and evidence.

China has committed to updating its climate targets for 2030 and releasing new targets for 2035 early next year. These targets will be key in cementing the emissions peak and specifying the targeted rate of emission reductions after the peak.

The surge in coal use for coal-to-chemicals is a demonstration that even as power sector emissions begin to fall, as long as China’s climate commitments allow emissions to increase, there is the potential for developments that increase emissions in other sectors.

A slew of recent policy developments hint at a renewed focus in Beijing on the country’s energy and climate targets. Yet the precise timing and height of China’s CO2 emissions peak, as well as the pace of subsequent reductions, remain key uncertainties for global climate action.

Manufacturing of solar panels, EVs and batteries is a part of energy-intensive industry, but media reports have exaggerated its role. These industries were only responsible for 1.6% of China’s electricity consumption and 2.9% of its emissions in the first half of 2024.

Compared with a year earlier, the increase in the number of electric vehicles (EVs) on China’s roads cut demand for transport fuels by approximately 4%.

China’s carbon intensity – its emissions per unit of GDP – improved by 5.5%, well short of the 7% needed to meet the country’s intensity target for 2025. This was despite a one-off boost from China’s hydropower output recovering from drought.

A major source of emissions growth in the second quarter was the coal-to-chemicals industry, which produces petrochemical products from coal instead of oil, supporting China's energy security goals at the expense of an even higher carbon footprint.

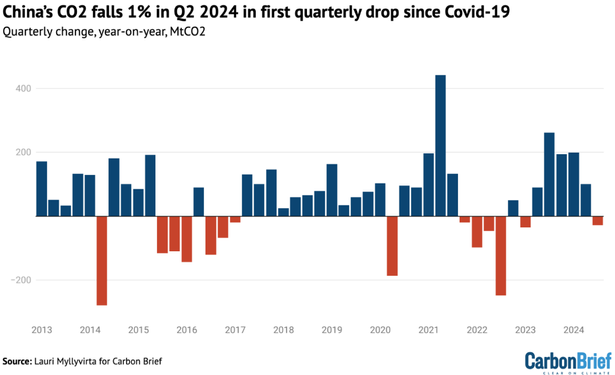

CO2 emissions from energy use and cement production fell by 1% in the second quarter. When combined with a sharp 6.5% increase in January-February and a monthly decline in March, there was a 1.3% rise in CO2 emissions across the first half of the year.

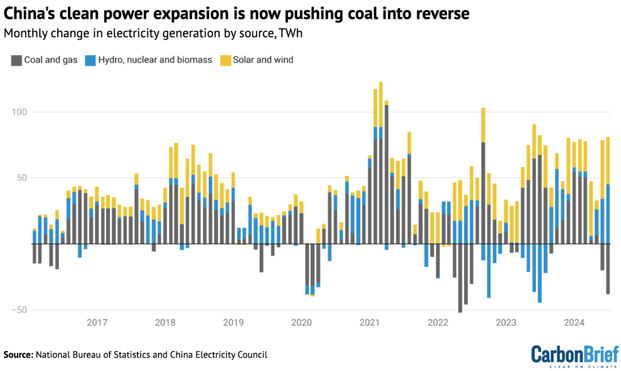

Power generation from wind&solar grew by 171 TWh in the first half of the year, more than the total power output of the UK in the same period, covering 71% of demand growth in the March to June period. Together with the rebound in hydropower, they more than covered demand growth.

The fall in CO2 was driven by power sector coal use and demand for oil products, as well as falling production of cement, reflecting ongoing contraction in the construction sector. Increases came from coal-to-chemical industry, district heating and industrial&residential gas use.

However, if the latest trends in energy demand and supply continue – in particular, if demand growth continues to exceed pre-Covid trends – then emissions would stay flat in 2024 overall.

Breaking: China’s CO2 emissions fell 1% in Q2 of 2024, the first quarterly fall since the end of zero-Covid, following five straight quarters of increases. Full-year emissions are on track to fall this year, but only if electricity demand growth eases as expected.

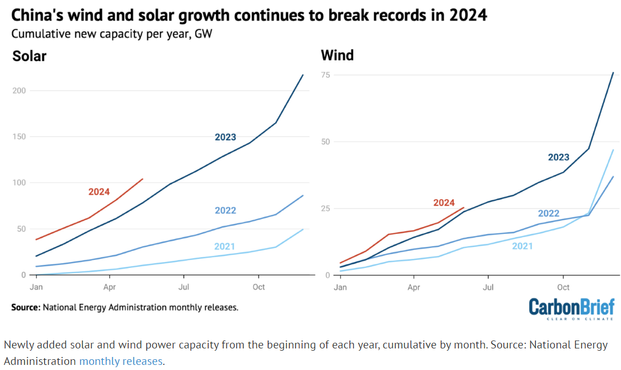

The record increase in power generation from solar and wind also shows that media speculation about the record renewable capacity additions running into grid constraints in May did not materialize.

https://x.com/laurimyllyvirta/status/1810213320370082181

My analysis highlights that the Monthly National Bureau of Statistics data on generation by technology is now severely limited for wind and solar, as it excludes smaller scale plants. I show how to work around these limitations to estimate power generation much more accurately.

As China continued to add coal and gas-fired power capacity, the utilization of this capacity fell sharply, 7% for coal and 24% for gas. This could help stem the wave of new investments in dirty power generation.

These reductions in electricity generation from fossil fuels point to a 3.6% drop in CO2 emissions from the power sector, which accounts for around two-fifths of China’s total greenhouse gas emissions and has been the dominant source of emissions growth in recent years.

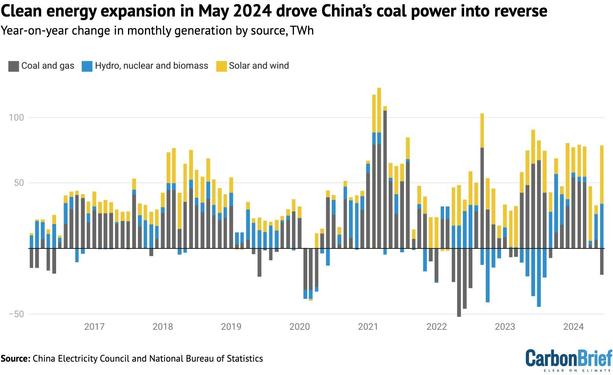

With clean energy generation expanding by more than the rise in electricity demand, fossil fuel saw the largest monthly drop since the Covid 19 pandemic. Gas generation fell by 4TWh (16%) and that from coal by 16TWh (4%).

China’s electricity demand in May 2024 grew by 49TWh (7.2%) from a year earlier.

Clean power generation grew by a record 78TWh, including 41TWh (78%) from solar, a recovery from earlier drought-driven lows for hydro of 34TWh (39%) and a modest rise for wind of 4TWh (5%).