The range of high-quality analysis presented at this conference, covering the full breadth of these issues, left me encouraged about the future of Australian housing policy. It’s great to see housing put front and centre of Australian economic policy research.

(He/him) Posting about public policy, housing and economics. Associate at the Grattan Institute. https://grattan.edu.au/expert/matthew-bowes/

Finally, the challenge of housing policy is that it covers topics that are often seen in isolation: from tax, to welfare policy, urban planning, tenancy law, and finance & building regulation.

Improving the productivity of the construction sector is a worthwhile goal. But how we plan our cities matters just as much for housing affordability, for people’s ability to find productive work, and for our broader business innovation ecosystem.

This is why updating planning rules to allow new apartments and townhouses to be built in well-located suburbs is essential to boosting Australia’s housing supply. Importantly, this will not necessarily increase productivity, even thought it helps reduce house prices.

In many areas of Australian cities, the price of a new home is well above what it costs to build it. This reflects the cost of buying scarce land in well-located areas, and in a well-functioning market would lead to more homebuilding - and higher densities - in valued locations.

A key takeaway from this discussion was that, while improving construction productivity is desirable, we may not need big changes to construction productivity in order to reduce housing costs, because these are in large part determined by land prices and land use policies.

There are several theories as to why dwelling construction seems to see such poor productivity growth. But while the cyclicality of the industry, the small size of its firms, and the way it’s regulated all clearly matter, there is little agreement on what policies might help.

Unsurprisingly, a conference led by economists was also very interested in productivity - in this instance the productivity of our housing construction sector, which has historically been woeful, as it has been in many peer economies.

This creates a self-reinforcing cycle. It’s hard to imagine housing wealth being taxed more equally with other kinds of wealth, or housing security without owning your own home. This leads many to defend our current system, despite its impacts for tax efficiency and inequality.

These concessions clearly distort housing decisions. But they are also informed by a culture of homeownership. When Australians think of wealth creation, they think first of homeownership. When they think of stable housing, their only thought is also of homeownership.

On tax, it is well established that Australia’s current tax and transfer arrangements put a finger on the scale in favour of housing over other kinds of investments. Notably, owner occupier homes go largely un-taxed and mostly aren’t included in the pension assets test.

Earlier this week I presented to an ABS/RBA conference on data insights in housing. While my presentation was on Grattan’s February report, ‘Renting in retirement’, the conversation in the room left me with a range of important takeaways on housing tax and productivity. 🧵

I’ve often enjoyed Annie Lowery’s work, but as an Australian, it was painful to read this nonsensical article about preferential voting. PV isn’t more ‘chaotic’ because candidates recommend preferences instead of choosing whether to drop out entirely.

https://www.theatlantic.com/ideas/archive/2025/06/new-york-mayoral-race-cuomo-mamdani/683146/

Regardless of your opinions on the policy merits, the purpose of reforming the planning system isn’t to encourage any more or less regulation, it’s to allow for people to buy - and builders to build - well-located homes if they want to. Why abstract from this underlying purpose?

Planning reform discourse is confusing because it often revolves around abstract terminology such as ‘red tape’ and ‘deregulation’, rather than the underlying policy reality that for decades we’ve effectively outlawed new townhouses and flats in large parts of Australian cities.

You can find the full paper at this link here: https://www.journals.uchicago.edu/doi/full/10.1086/733977#

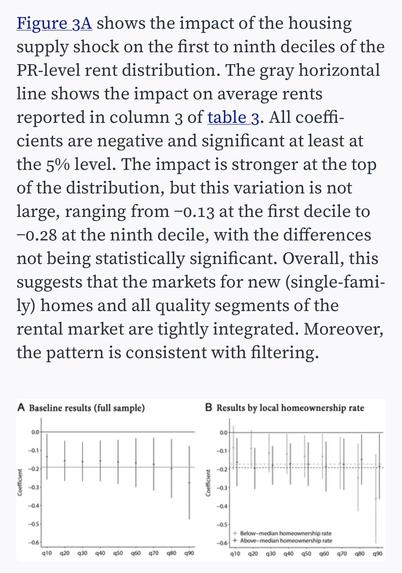

Importantly, this suggests that the quality of newly built homes doesn’t tell you much about the impact that its construction will have on lower-rent units. People purchasing ‘luxury’ new units are often moving from cheaper units, which unlocks more affordable housing options. 8/

While the details of the model are beyond me, the key result is intuitive: because moving house is costly, new homebuyers are often moving several ‘rungs’ up the housing ladder. As such, the homes they vacate are often those most affordable to middle-income renters. 7/

The second half of the paper then expands on these results by building a structural model of the housing market that captures the dynamics which occur as new homebuyers move out of existing rental housing, freeing up homes for other people to move into. 6/

Importantly, while the effect of new market-rate housing construction on rents is (at least initially) stronger among higher-rent sub-markets, the new supply significantly reduces rents across the rental distribution. 5/