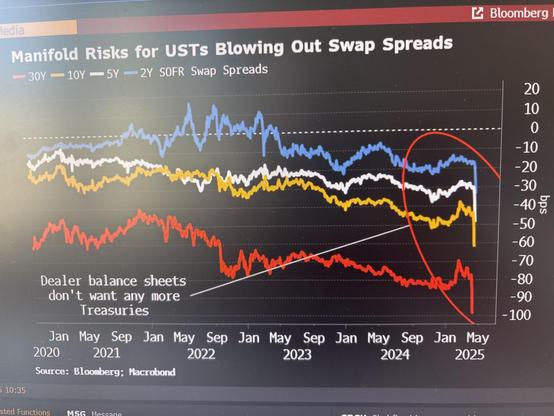

Die Händler können kein Risiko mehr aufs Buch nehmen, die Future-Cash Bond #basistrades kriegen Margin Calls und müssen liquidieren. Gleichzeitig wird gemunkelt, dass China als Retaliation auch USTs verkauft.

Sieht nach einem Perfect Storm für die US #Zinsmärkte aus.