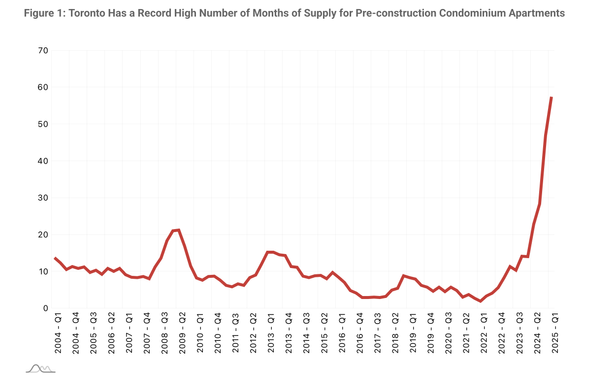

👀 🤔 https://www.cmhc-schl.gc.ca/blog/2025/condominium-apartment-market-risks-toronto-vancouver #toronto #vancouver #tore #vanre #cdnecon #econ #realestate

#Cdnecon

1 Desjardins: #Canadian #consumers continued to spend in April but appear to have pulled back meaningfully in May. Headline #retailsales rose 0.3% in April, one tick below expectations and also undershooting Statistics Canada’s flash estimate. 🧵 #cdnecon

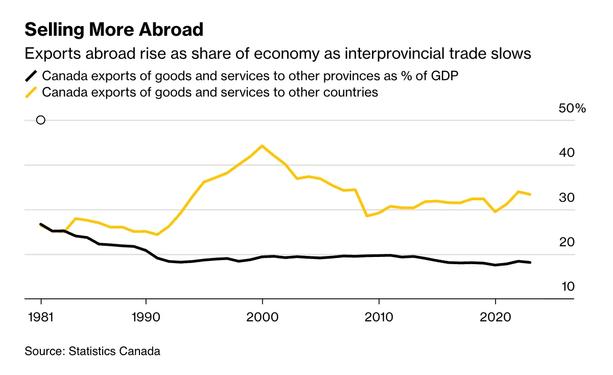

“Getting #Canadians to #trade with one another is harder than you might think!” adamtooze.substack.com/p/top-links-... #cdnecon

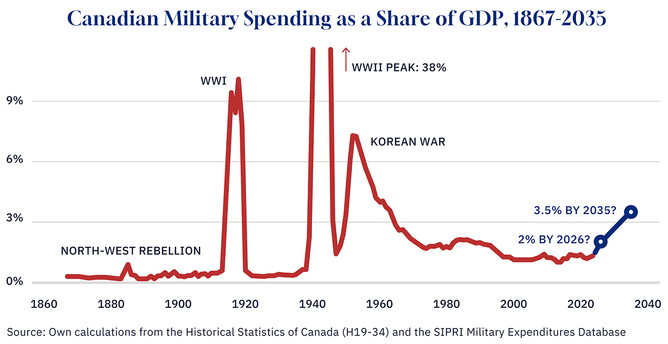

What a higher NATO military spending target means for Canada's finances. My latest for @TheHubCanada on the potential for a 3.5%+1.5% target for NATO members: https://thehub.ca/2025/06/12/trevor-tombe-what-a-higher-nato-military-spending-target-means-for-canada/ #cdnecon #cdnpoli

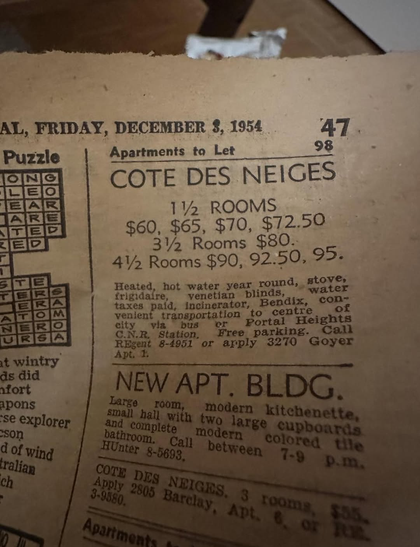

$90 in 1954 is the equivalent of almost $1,100 in 2025 w/ inflation... an increase of more than $1,000 over 70+ years... for a f*cking 4 1/2.

FYI there are 4 1/2s in my 'hood for almost 3K... but, there's no gouging, eh.

Once upon a time when I was a renter, a 4 1/2 in this 'hood was less than $750, i.e. 2004.

#housing #polMTL #MTLpoli #polQC #QCpoli #cdnpoli #cdnecon #affordablehousing #gougegougegouge

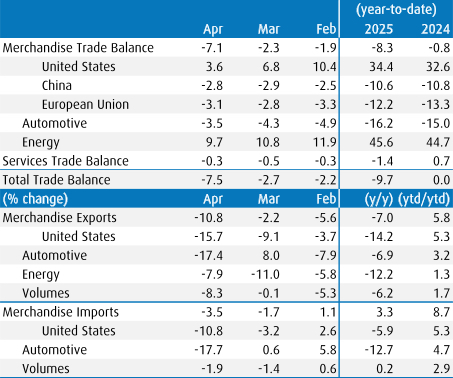

2 BMO: With #Canadian and #U.S. #officials engaged in talks, the #economy - especially #trade-sensitive sectors—are waiting for some certainty. #trade #tariffs #cdnecon

Liberalizing trade within Canada has long been a challenge. But recent moves by governments right across Canada are making big improvements, led by Atlantic Canada. My new report with PPF explores some the potential gains:

https://ppforum.ca/policy-speaking/free-atlantic-unlocking-regional-growth/ #cdnecon #cdnpoli

2 CIBC: Future cuts will rest on evidence of #growth remaining weak but also #inflationary pressures being contained, and we expect to see enough on both fronts to bring a 25bp rate cut in July. #BOC #BankofCanada #cdnecon #inflation

1 CIBC: The #BankofCanada chose not to provide fresh stimulus to the #Canadian #economy now, keeping the overnight rate steady at 2.75%, but did hint that #ratecuts are still possible in the future to help navigate the current period of #trade #uncertainty. 🧵 #BOC #cdnecon

🤔 To make housing more affordable, drop the tax hammer on real estate investors (🎁 link) https://www.theglobeandmail.com/gift/4ef08e3f17e3e79da7da921dff91e650ad61f5aae765a74cd327766b274581e6/APG4OJGABNGWRDVBABTGPBIIBM/ #tore #vanre #toronto #topoli #cdnecon #cdnpoli #speculation #realestate #econ #housing

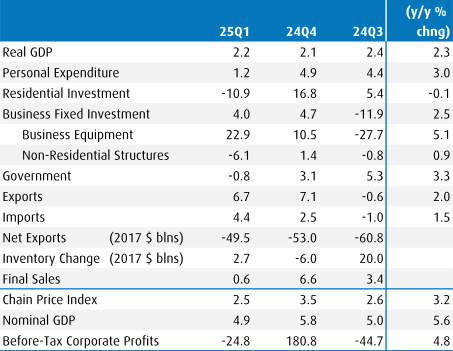

4 BMO: … and the flash for April was also a surprisingly—nay, amazingly—resilient +0.1%, in the very heart of the #trade and #election #uncertainty. #GDP #cdnecon

1 BMO: The #Canadianeconomy looks to have held up reasonably well in the opening months of the trade war, and even the most recent figure for April suggests growth is weathering the trade storm. Canadian real GDP rose at a 2.2% annual rate in Q1 … 🧵 #cdnecon

3 CIBC: However, #growth during Q1 was driven by #trade and #inventories, probably linked to efforts front-running #US #tariffs, and #finaldomesticdemand was only flat on the quarter. #cdnecon