Breaking News GST: GST on insurance premium zero, ITC discontinued

https://hindi.vaartha.com/gst-zero-gst-on-insurance-premium-itc-discontinued/business/62311/

#GSTUpdate #GSTZero #InsurancePremium #ITCDiscontinued #GSTNews #InsuranceGST #TaxUpdate #FinanceNews #BreakingNews #GST2025 #InputTaxCredit #InsurancePolicy #HealthInsurance #LifeInsurance #PremiumReduction #Policyholders #TaxExemption #EconomicUpdate #LatestNews #IndiaFinance

#GSTUpdate

Passenger vehicle sales fell 8.8% in August as buyers delayed purchases ahead of GST cuts, even as two-wheeler and three-wheeler demand grew strongly. https://english.mathrubhumi.com/auto/indias-auto-sales-show-mixed-trends-passenger-vehicles-dip-two-wheelers-surge-in-august-imegcg9m?utm_source=dlvr.it&utm_medium=mastodon #India #Automobile #GSTUpdate #PassengerVehicles #IndianEconomy

GST: Important alert for policyholders; pay premium before September 22

https://hindi.vaartha.com/gst-on-health-insurance/more/61157/

#GSTAlert #PremiumPayment #InsurancePremium #PayBeforeDeadline #September22 #Policyholders #InsuranceNews #GST2025 #TaxUpdate #InsurancePremiumAlert #FinancialNews #InsurancePolicy #GSTReform #GSTUpdate #InsurancePremiumDue #LifeInsurance #HealthInsurance #FinanceAlert #TaxSavings #PolicyRenewal

GST: Bullion traders disappointed with GST reform 2.0

https://hindi.vaartha.com/gst-bullion-traders-disappointed-with-gst-reform-2-0/business/59914/

#GSTReform #BullionTraders #GST20 #TradeDisappointment #BullionMarket #GSTUpdate #TaxReform #TradeNews #GSTImpact #BullionTrade #GSTReformUpdate #MarketReaction #GSTChanges #TradeConcerns #GSTPolicy #EconomicUpdate #BullionSector #GSTNews #TraderSentiment #GSTReformEffect

Food delivery just got costlier. The GST Council has imposed an 18% tax on delivery charges, affecting platforms like Zomato and Swiggy. https://english.mathrubhumi.com/news/money/gst-on-food-delivery-charges-swiggy-zomato-eepkl11m?utm_source=dlvr.it&utm_medium=mastodon #GSTUpdate #Zomato #Swiggy #FoodDelivery #ConsumerNews

GST Council Meeting परिषद की बैठक शुरू, अब सामान होगा सस्ता #महंगाईसेराहत #FestivalSeason #TaxRelief #GSTUpdate #GSTCouncil #GSTपरिषद #GSTपरिषद #GSTCouncil #TaxRelief #सस्ता_Samaan #Meva #Butter #घी #Fridge #TV #Electronics #GSTUpdate #BreakingNews #खुशखबरी #IndianEconomy #ConsumerRelief #GSTMeeting #सस्ता_फ्रिज #सस्ता_टीवी #FestivalSeason #महंगाई_से_राहत

https://www.vrnewslive.com/gst-council-meeting-started-two-days-service-ta/

NEW GST UPDATE 🚨GST council will scrapwith12% and 28% tax brackets. Of these, 99% of items currently in the 12% slab will be moved to the 5% rate and 90% of goods and services in the 28% bracket will move to 18%. There will be no cess of any kind over and above the GST rates.

.

.

Follow @wisebook.in For more update.

.

.

#gst #update #newupdate #gstupdate #india #Finance #Accounting #FinancialNews #FinancialUpdate #FinanceTips #Accountant #Bookkeeping #Tax #viral #trending #breakingnews

Big relief ahead? Govt may slash GST on insurance premiums to 0%.

.

.

.

.

#GST #InsuranceNews #TaxUpdate #FinanceIndia #InsurancePremium #GSTUpdate #GovernmentPolicy #TaxRelief #FinancialNews #IndiaEconomy

#sakshamagrawal

📢 GSTR-8 due date for June 2025 is 10th July 2025.

Covers TCS collected by e-commerce operators and deposited under GST laws for the month of June 2025.

#GSTR8 #TCS #GSTCompliance #ECommerce #GSTUpdate #TaxFiling #Finance #IndirectTax

Ask ChatGPT

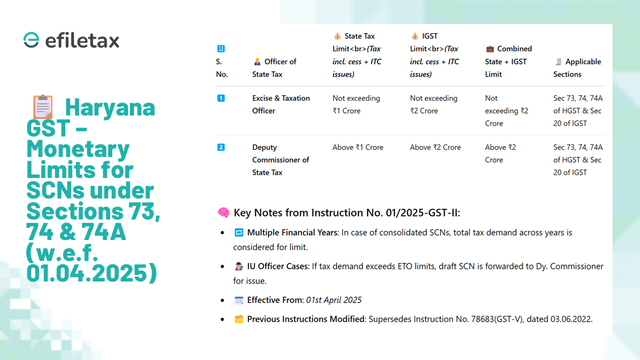

🚨 New Haryana GST Alert (w.e.f. 1st April 2025)

Which officer can issue a Show Cause Notice under GST?

Here’s a crisp table on new monetary limits for SCNs under Sections 73, 74 & 74A.👇

#GSTUpdate #HaryanaGST #Efiletax

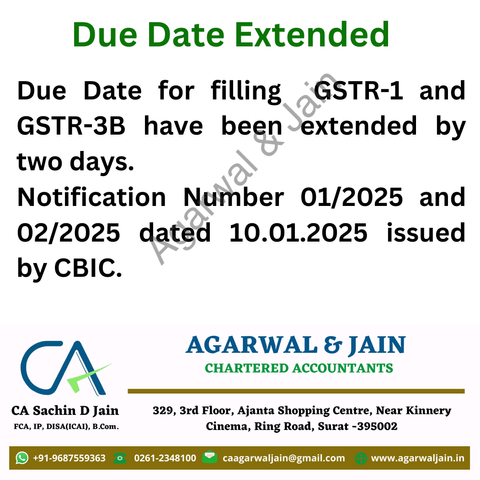

📢 Due Date Extended 📢

The due date for filing GSTR-1 & GSTR-3B has been extended by two days as per CBIC Notification No. 01/2025 & 02/2025 dated 10.01.2025. Stay updated & ensure timely compliance! 📝📊 #GSTUpdate #GSTR1 #GSTR3B #TaxCompliance #Finance #CBIC #BusinessUpdates

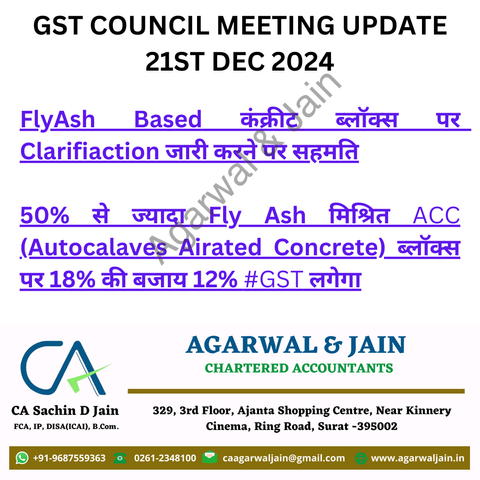

GST reduced! Fly ash-based ACC blocks with over 50% fly ash now attract 12% GST instead of 18%. A key update for the construction and real estate sectors. Stay updated on tax revisions! #GSTUpdate #TaxCompliance #ConstructionIndustry #FlyAsh #FinanceMatters

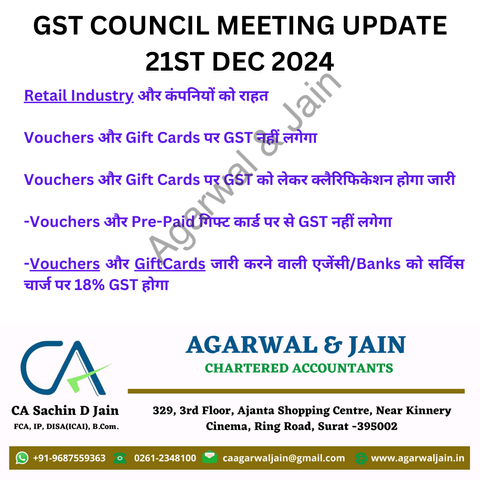

Good news! Vouchers and prepaid gift cards are not subject to GST. Stay informed about the latest updates in taxation and compliance. #GSTUpdate #TaxationSimplified #FinanceMatters #AccountingTips

📢 GST Update (21st Dec 2024): Clarification issued for fly ash-based concrete blocks. GST on ACC blocks (with over 50% fly ash) reduced from 18% to 12%. Stay updated with key changes! #GSTUpdate #FlyAsh #TaxReforms #FinanceNews #IndiaBusiness

📢 GST Update (21st Dec 2024): Relief for the retail industry! No GST on vouchers, gift cards, and prepaid cards. Agencies issuing them to attract 18% GST on service charges. Stay informed with the latest updates! #GSTUpdate #FinanceNews #TaxUpdates #IndiaBusiness

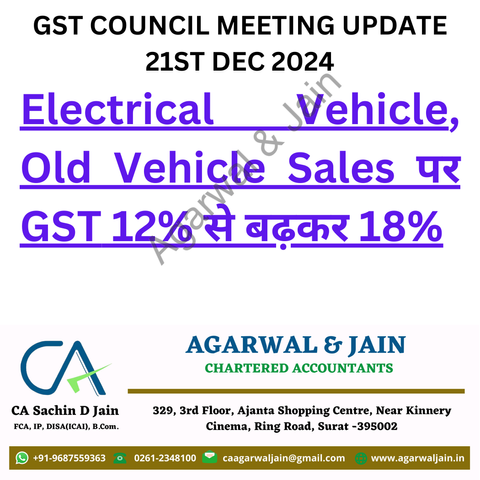

📢 GST Update (21st Dec 2024): GST rate on electric vehicles & old vehicle sales increased from 12% to 18%. Stay informed and plan ahead for these changes! #GSTUpdate #FinanceNews #TaxUpdates #ElectricVehicles #IndiaBusiness

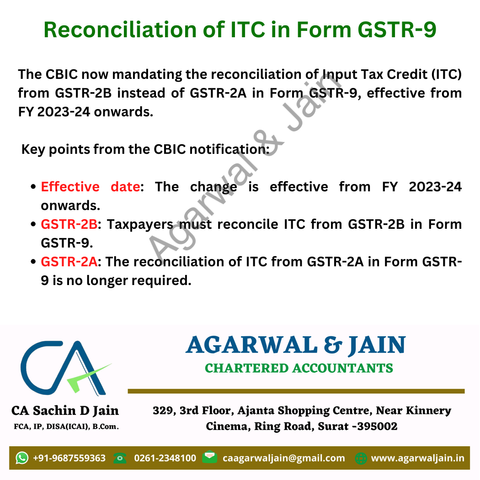

CBIC mandates ITC reconciliation in GSTR-9 from GSTR-2B instead of GSTR-2A, effective FY 2023-24 onwards. Ensure compliance with the updated guidelines. #GSTR9 #GSTUpdate #ITCReconciliation #TaxCompliance #GST2024 #CBIC #ITC #TaxUpdates

Update: From April 1, 2025, businesses with annual turnover ≥ ₹10 Cr must report invoices, credit & debit notes on the IRP portal within 30 days of invoice date as per GST advisory. #GSTUpdate #Compliance #IRP #EInvoicing #BusinessUpdates #GSTMandate #StayCompliant

💡 Did You Know? GST REG-21 is used to apply for the reversal of canceled GST registration. Taxpayers can use this form to request reinstatement if the cancellation was initiated by a tax officer. #GST #TaxCompliance #GSTUpdate #KnowYourForms

GSTR-1 due date alert: For taxpayers with turnover above ₹5 crore or those not under the QRMP scheme, the filing deadline for the October–December 2024 quarter is 11th November 2024. Timely submission helps maintain compliance. #GSTR1 #GSTUpdate #TaxFiling #Compliance