How do you know if your trading system actually works? You backtest it.

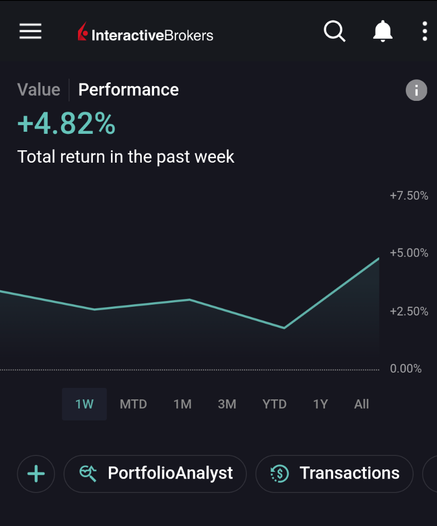

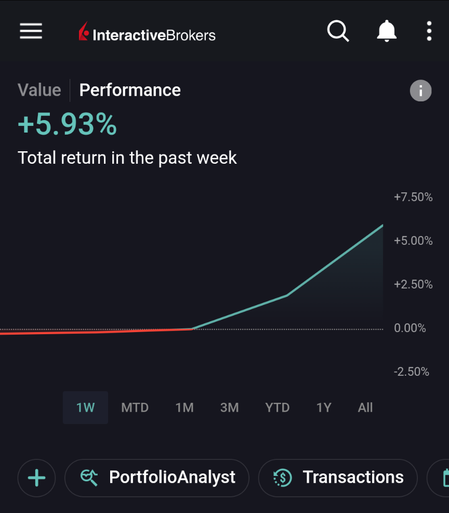

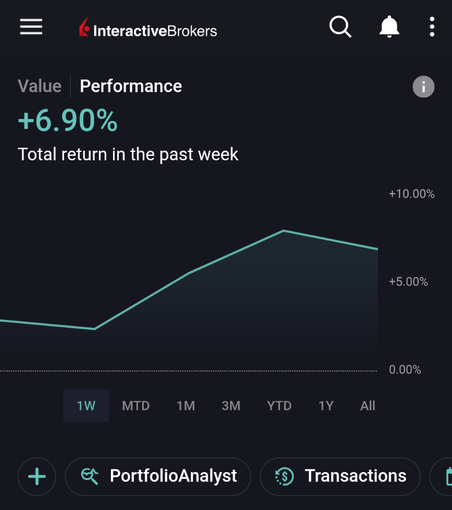

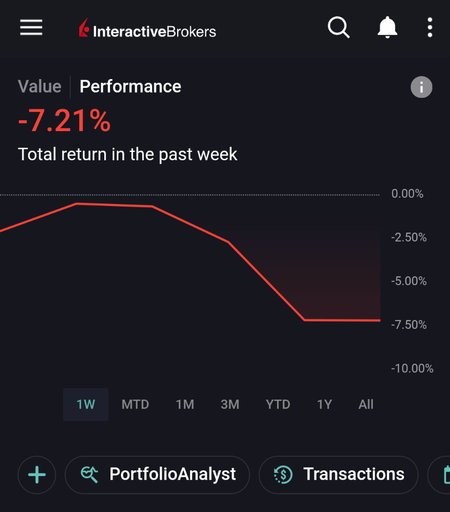

Track 100+ trades across bull, bear, and choppy markets.

Measure win rate, risk-reward, and drawdowns. Build confidence through data, not hope. Here's the complete guide to backtesting the right way:

#SystematicTrading #TradingStrategy #DataDriven #TradingDiscipline #EdgeValidation (1/1)