@justinwolfers.bsky.social @velshi.com @michaelsteele.bsky.social @kristenwelker.bsky.social @meetthepress.com @aliciamenendez.bsky.social @velshimsnbc.bsky.social @kylegriffin1.bsky.social

#TrumpRecession

#TrumpStagflation

RE: https://bsky.app/profile/did:plc:uo2fna47c4v6zcnklxfhcvjb/post/3lpfb7shfvv2i

#TrumpStagflation

@nicollewallace.bsky.social @stephruhle.bsky.social @timmiller.bsky.social @velshi.com @11thhourmsnbc.bsky.social @andrewrsorkin.bsky.social @michaelsteele.bsky.social @aliciamenendez.bsky.social

#Stagflation #TrumpStagflation #TrumpRecession

RE: https://bsky.app/profile/did:plc:4kshoaytrzhgsziro6ywozul/post/3lolyndoqko2x

Finally Friday Reads: “Historic Failure”

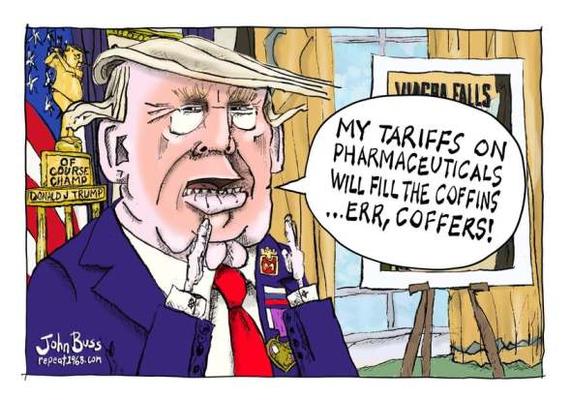

“Tariff Man doing Tariff Man stuff..” John Buss,@repeat1968

Good Day, Sky Dancers!

Last night, I dreamed I had been to an amusement park where everything spun oddly and fell apart. Guess who followed me around his theme park at one point shoving his hands down my shirt to grab my tits until a nice black lady in a black suit with sun glasses on said “Sir, you really shouldn’t do that.” I pressed an elevator at one point, and some skinny, red-headed white guy in a flannel shirt on the other side of what turned out to be a duo door elevator had the ground pulled out from under him. The ground below him started dropping. All I could do was watch from the other side. There were guys everywhere with stacks of boxes, trying to sell stuff they wouldn’t let you see. All the time #FARTUS just followed me, bragging about each ride that was more dangerous than the next.

I doubt I need a Jungian psychologist to decode all that. A lot of my time was spent trying to get children to get off and get out of here before they were hurt. Oddly enough, I was more fascinated during the dream than anything else. It was a bit like a Salvador Dali show. Maybe some of the celebratory herb wafting from the 4/20 Party at the bar on the corner got into my bedroom. Who knows? I woke up thinking, “What a Long Strange Trip It’s Been.” I heard a lot of Grateful Dead on Temple’s last walk of the day.

I might have foretold the White House Easter Egg Roll, where all those folks get to see 30,000 donated eggs from the American Egg Board, while your average kids get to eat and dye something altogether different. #FARTUS rejected the idea of using plastic. Don’t forget to watch for “The American Egg Board to Present 48th First Lady’s Commemorative Egg to Melania Trump at 2025 White House Easter Egg Roll.” It adds a “let them eat eggs” mode to the event. Yes, John, your dark muse is back. John Buss has a cartoon for everything. I don’t know what my posts would be without him up there with the Featured Funny.

Trump’s 100th day in office officially happens this month on the 30th. So far, not good. This headline in the Washington Post, attached to an op-ed analysis from Dana Milbank, grabbed me. And not by the you know what. “Trump is wrapping up 100 days of historic failure. America has seen ruinous periods, but never when the president was the one knowingly causing the ruin. It will be far worse if Trump tries to illegally remove Fed President Jerome Powell from his post. He’s trying to blame Powell for this mess. I’m not sure who will be dumb enough to take that bait, but I do know that Republicans won’t stand in his way of his lawlessness, as usual.

“By any reasonable measure, President Donald Trump’s first 100 days will be judged an epic failure.

He has been a legislative failure. He has signed only five bills into law, none of them major, making this the worst performance at the start of a new president’s term in more than a century.

He has been an economic failure. On his watch, growth has slowed, consumer and business confidence has cratered, and markets have plunged, along with Americans’ wealth. Federal Reserve Chair Jerome Powell said Wednesday that “growth has slowed in the first quarter of this year from last year’s solid pace” and that Trump’s tariffs will result in higher inflation and slower growth.

He has been a foreign-policy failure. He said he would end wars in Gaza and Ukraine. But fighting has resumed in Gaza after the demise of the ceasefire negotiated by his predecessor, and Russia continues to brutalize Ukraine, making a mockery of Trump’s naive overtures to Vladimir Putin.

He has been a failure in the eyes of friends, having launched a trade war against Canada, Mexico, Europe and Japan; enraged Canada with talk of annexation; threatened Greenland and Panama; and cleaved the NATO alliance.

He has been a failure in the eyes of foes, as an emboldened China menaces Taiwan, punches back hard in the trade war and spreads its global influence to fill the vacuum left by Trump’s retreat from the world.

He has been a constitutional failure. His executive actions, brazen in their disregard for the law, have been slapped down more than 80 times already by judges, including those appointed by Republicans. He is flagrantly defying a unanimous Supreme Court, and his appointees are facing contempt proceedings for their abuse of the legal system.

He has been a failure in public opinion. This week’s Economist/YouGov poll finds 42 percent approving his performance and 52 percent disapproving — a 16-point swing for the worse since the start of his term. Majorities say the country is on the wrong track and out of control.

Even his few “successes” amount to less than meets the eye. Border crossings are down from already low levels, but despite all the administration’s bravado, there’s little evidence of an increase in deportations. Hopes for cost-cutting under the U.S. DOGE Service, which Elon Musk originally projected at $1 trillion this year, have been scaled back to just $150 billion — and much of that appears to be based on made-up numbers.

But Trump, whose 100th day in office is April 30, has achieved one thing that is truly remarkable: He has introduced a level of chaos and destruction so high that historians are hard-pressed to find its equal in our history.

And yet, he persists. There’s a long list that follows. Seeing it all in print is disturbing. Zachary Basu has another take posted on AXIOS. “Trump’s United States of Emergency. ”

In his first 100 days, President Trump has declared more national emergencies — more creatively and more aggressively — than any president in modern American history.

Why it matters: Powers originally crafted to give the president flexibility in rare moments of crisis now form the backbone of Trump’s agenda, enabling him to steamroll Congress and govern by unilateral decree through his first three months in office.

- So far, Trump has invoked national emergencies to impose the largest tariffs in a century, accelerate energy and mineral production, and militarize federal lands at the southern border.

- Paired with his assault on the judiciary, legal scholars fear Trump is exploiting loosely written statutes to try to upend the constitutional balance of power.

How it works: The president can declare a national emergency at any time, for almost any reason, without needing to prove a specific threat or get approval from Congress.

- The National Emergencies Act of 1976, which unlocks more than 120 special statutory powers, originally included a “legislative veto” that gave Congress the ability to terminate an emergency with a simple majority vote.

- But in 1983, the Supreme Court ruled that legislative vetoes are unconstitutional — effectively stripping Congress of its original check, and making it far harder to rein in a president’s emergency declarations.

The big picture: Since then, presidents have largely relied on “norms” and “self-restraint” to avoid abusing emergency powers for non-crises, says Elizabeth Goitein, senior director of the Brennan Center’s Liberty and National Security Program.

- That precedent was broken in 2019, Goitein argues, when Trump declared a national emergency in order to bypass Congress and access billions of dollars in funding for a border wall.

- President Biden stretched his authority as well, drawing criticism in 2022 for citing the COVID-19 national emergency to unilaterally forgive student loan debt.

- But Trump’s second-term actions have plunged the U.S. firmly into uncharted territory — redrawing the limits of executive power in real time, and fueling fears of a permanent emergency state.

Zoom in: Trump’s justification for his tariffs cites the International Emergency Economic Powers Act (IEEPA), which can be invoked only if the U.S. faces an “unusual and extraordinary threat” to its national security, foreign policy, or economy.

- According to the White House, America’s decades-old trading relationships — including with tiny countries and uninhabited islands — qualify as such threats.

As a result, a 1977 law originally designed to target hostile foreign powers — and never before used to impose tariffs — is now being deployed to rewrite the global economic order.

There’s much to look forward to as we lurch towards the midterms. Little Marco Rubio is sure fucking up the state department. All you need to do is see a cabinet meeting. His face is telling. He looks like the only one who knows he’s going to hell. This is from NPR as reported by Graham Smith. “The State Department is changing its mind about what it calls human rights.” What fresh hell is this lil Marco?

The Trump administration is substantially scaling back the State Department’s annual reports on international human rights to remove longstanding critiques of abuses such as harsh prison conditions, government corruption and restrictions on participation in the political process, NPR has learned.

Despite decades of precedent, the reports, which are meant to inform congressional decisions on foreign aid allocations and security assistance, will no longer call governments out for such things as denying freedom of movement and peaceful assembly. They won’t condemn retaining political prisoners without due process or restrictions on “free and fair elections.”

Forcibly returning a refugee or asylum-seeker to a home country where they may face torture or persecution will no longer be highlighted, nor will serious harassment of human rights organizations.

According to an editing memo and other documents obtained by NPR, State Department employees are directed to “streamline” the reports by stripping them down to only that which is legally required. The memo says the changes aim to align the reports with current U.S. policy and “recently issued Executive Orders.”

Officially called “Country Reports on Human Rights Practices,” the annual documents are required, by statute, to be a “full and complete report regarding the status of internationally recognized human rights.”

Human rights defenders say the cuts amount to an American retreat from its position as the world’s human rights watchdog.

“What this is, is a signal that the United States is no longer going to [pressure] other countries to uphold those rights that guarantee civic and political freedoms — the ability to speak, to express yourself, to gather, to protest, to organize,” said Paul O’Brien, executive director of Amnesty International, USA.

A spokesperson for the State Department declined to comment on the memo or the human rights reports. NPR confirmed the memo’s authenticity with two sources close to the process.

There is some good news on the front of Trump’s kidnapping and disappearing people to El Salvador. Chris Van Hollen (D-Md.) managed to get a meeting with Kilmar Abrego Garcia, as was his goal. Historian Heather Cox Richardson, writing at her Substack, gives us some perspective.

Today, Senator Chris Van Hollen (D-MD) posted a picture of himself with Kilmar Abrego Garcia, the Maryland man whom the Trump administration says it sent to the notorious CECOT prison in El Salvador through “administrative error” but can’t get back, and wrote: “I said my main goal of this trip was to meet with Kilmar. Tonight I had that chance. I have called his wife, Jennifer, to pass along his message of love. I look forward to providing a full update upon my return.”

While the president of El Salvador, Nayib Bukele, apparently tried to stage a photo that would make it look as if the two men were enjoying a cocktail together, it seems clear that backing down and giving Senator Van Hollen access to Abrego Garcia is a significant shift from Bukele’s previous scorn for those trying to address the crisis of a man legally in the U.S. having been sent to prison in El Salvador without due process.

Bukele might be reassessing the distribution of power in the U.S.

According to Robert Jimison of the New York Times, who traveled to El Salvador with Senator Van Hollen, when a reporter asked President Donald Trump if he would move to return Abrego Garcia to the United States, Trump answered: “Well, I’m not involved. You’ll have to speak to the lawyers, the [Department of Justice].”

Today a federal appeals court rejected the Trump administration’s attempt to stop Judge Paula Xinis’s order that it “take all available steps” to bring Abrego Garcia back to the U.S. “as soon as possible.” Conservative Judge J. Harvie Wilkinson, who was appointed by President Ronald Reagan, wrote the order. Notably, it began with a compliment to Judge Xinis. “[W]e shall not micromanage the efforts of a fine district judge attempting to implement the Supreme Court’s recent decision,” he wrote.

Then Wilkinson turned his focus on the Trump administration. “It is difficult in some cases to get to the very heart of the matter,” he wrote. “But in this case, it is not hard at all. The government is asserting a right to stash away residents of this country in foreign prisons without the semblance of due process that is the foundation of our constitutional order. Further, it claims in essence that because it has rid itself of custody that there is nothing that can be done. This should be shocking not only to judges, but to the intuitive sense of liberty that Americans far removed from courthouses still hold dear.”

“The government asserts that Abrego Garcia is a terrorist and a member of MS-13. Perhaps, but perhaps not. Regardless, he is still entitled to due process.” The court noted that if the government is so sure of its position, then it should be confident in presenting its facts to a court of law.

Echoing the liberal justices on the Supreme Court, Wilkinson wrote: “If today the Executive claims the right to deport without due process and in disregard of court orders, what assurance will there be tomorrow that it will not deport American citizens and then disclaim responsibility to bring them home?” He noted the reports that the administration is talking about doing just that.

“And what assurance shall there be that the Executive will not train its broad discretionary powers upon its political enemies? The threat, even if not the actuality, would always be present,” he wrote, “and the Executive’s obligation to ‘take Care that the Laws be faithfully executed’ would lose its meaning.”

h/t to JJ

NBC News reports on Senator Holland’s meeting with Garcia. It certainly was a relief to see proof of life.

Sen. Chris Van Hollen confirmed Thursday night that he has met with Kilmar Abrego Garcia, the man whom the Trump administration said it mistakenly deported to El Salvador in March.

“I said my main goal of this trip was to meet with Kilmar. Tonight I had that chance. I have called his wife, Jennifer, to pass along his message of love. I look forward to providing a full update upon my return,” Van Hollen, D-Md., wrote on X.

Images of Van Hollen’s meeting with Abrego Garcia were first posted online by Salvadoran President Nayib Bukele, who has rebuffed calls to return Abrego Garcia to the United States.

Bukele said on X after the meeting that Abrego Garcia will remain in El Salvador’s custody “now that he’s been confirmed healthy.”

President Donald Trump lashed out at Van Hollen Friday morning in a post on Truth Social, saying the Democratic senator “looked like a fool yesterday standing in El Salvador begging for attention.”

At an Oval Office meeting with Trump on Monday, Bukele argued that he didn’t “have the power to return him to the United States.”

Attorney General Pam Bondi said the same day that the United States would provide a plane for Abrego Garcia to travel back to the country should El Salvador allow his release, framing the decision as being solely in Bukele’s hands.

In a statement Thursday night, the White House called Van Hollen’s efforts in support of Abrego Garcia “disgusting” and said Trump will “continue to stand on the side of law-abiding Americans.”

Trump threats to Fed Chair Powell scare the shit out of me. I am totally with Senator Elizabeth Warren on this statement. “Markets will ‘crash’ if Trump can fire Fed’s Powell, Elizabeth Warren warns.” You can listen to her interview at this link. Nobel Prize-winning Economist Dr. Paul Krugman explains the dangers of a “Trumpified Fed” at his Substack today. “Why You Should Fear a Trumpified Fed. Don’t give an abuser power that’s easy to abuse. He even starts with the holy grail of economics charts from FRED. The Fed is a significant source of economic data. I spent hours as a new grad student in 1978 in the basement of the University of Nebraska at Omaha with a huge accounting pad and pencil in the Federal Documents area, writing down months of data to type onto punch cards with some code ordering up a graph that I had to wait hours for as I watched a huge printer spit out green bar paper. Now it’s just a few clicks of a mouse button to get the same data from FRED.

Sometimes the Federal Reserve has extraordinary power over the economy.

Consider what happened from 1982 to 1984. For most of 1982 the U.S. economy was in grim shape. Employment had plunged, especially in manufacturing. The unemployment rate hit 10.8 percent in December (it was 4.2 percent last month.) And economic pain helped Democrats make major gains in the 1982 midterms.

But everything was about to change, thanks to the Fed. In the summer of 1982 the Fed decided to ease monetary policy. Interest rates plunged, and about 6 months later the economy began a stunning rebound, growing 4.6 percent in 1983 and 7.2 percent in 1984. Ronald Reagan claimed credit for “Morning in America,” but actually it was the Fed that did it.

This episode illustrates the Fed’s power — power that must be insulated from abuse by politicians, especially politicians like Donald Trump.

Over the past few days Trump has been demanding that the Fed cut interest rates and calling for the Fed chairman’s “termination.” It’s worth looking at what he posted on Truth Social to get a sense of how, to use the technical term, batshit crazy he is on this subject:

And we really, really don’t want someone that crazy dictating monetary policy.

The reason we don’t want politicians in direct control of monetary policy is that it’s so easy to use. After all, what does it mean to “ease” monetary policy? It’s an incredibly frictionless process. Normally the Federal Open Market Committee tells the New York Fed to buy U.S. government debt from private banks, which it does with money conjured out of thin air. There’s no need to pass legislation, place bids with contractors, deal with any of the hassles usually associated with changes in government policy. Basically the Fed can create an economic boom with a phone call.

It’s obvious that this kind of power could be abused by an irresponsible leader who wants to preside over an economic boom and doesn’t want to hear about the risks. This isn’t a hypothetical scenario. Consider what happened in Turkey, whose Trump-like president, Recep Tayyip Erdoğan, recently arrested the leader of the opposition. When the global post-Covid inflation shock hit, Erdogan embraced crank economic theories. He forced Turkey’s central bank, its equivalent of the Fed, to cut interest rates in the belief, contrary to standard economics, that doing so would reduce, not increase inflation. You can see the results in the chart at the top of this post.

How can we guard against that kind of policy irresponsibility? After the stagflation of the 1970s many countries delegated monetary policy to technocrats at independent central banks. Can the technocrats get it wrong? Of course they can and often have. But they’re less likely to engage in wishful thinking and motivated reasoning than typical politicians, let alone politicians like Trump.

What makes Trump’s attempt to bully the Fed especially ominous is the fact that the Fed will soon have to cope with the stagflationary crisis Trump has created. Trump’s massive tariff increase will lead to a major inflationary shock:

I’ve been using that “s” word for a while now. If Krugman uses it, run for the hills.

So, this is running long, so I’ll quit with this. I hope your weekend is peaceful. We’re gearing up for Jazz Fest, so I have a few more weeks of Ugly American Tourists in the hood, and then it might get more normal since Trump is decimating the tourist industry.

U.S. tourism has dropped with visits from other countries down as much as 11% in March, while more Americans are moving outside of the country to places like Canada. NBC News’ Liz Kreutz talks to USC Hospitality and Tourism Professor Hicham Jaddoud on the drop.

Maybe those disruptive Airbnb’s will be used for the people who live here. I can only hope.

What’s on your reading and blogging list today?

#JohnbussBskySocialJohnBuss #BringKilmerHome_ #FARTUS #kakistocracy #TrumpHumanRightsViolations #TrumpMafiaState #TrumpStagflation

Some economists say that the Trump tariffs and labor shortages caused by ICE could cost us 2% of GDP growth in 2025. The GDP growth rates in 2023 and 2024 were 2.5%. So the new projection could be as low as 0.5%, which, combined with inflation equals #TrumpStagflation

Finally Friday Reads: The Chaos Kakistocracy

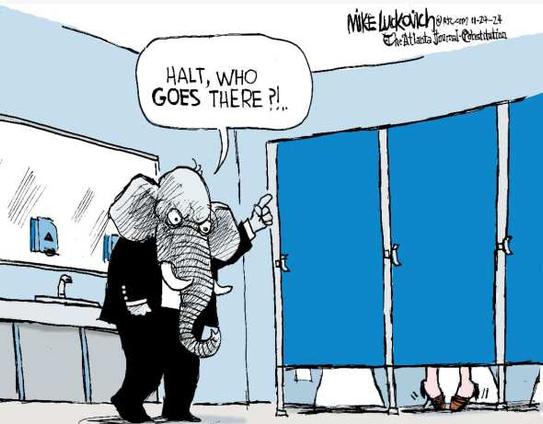

“Jobs, jobs, Jobs!” John Buss, @johnbuss.bsky.social

Good Day, Sky Dancers!

Regime changes haven’t happened yet, but businesses are already planning major layoffs, freezes, and price increases. That signals a type of economy we haven’t seen for a while. It’s called stagflation. For those of us who lived through that, you’ll remember the pain that went from the Nixon years to the Reagan years. It includes painful unemployment and rabid inflation. We just have to hope that the plans to take political control of the Fed don’t come to fruition. The current Fed Chair says he will not resign. That doesn’t even include the conversation about the massive removal of Federal workers and the deportation of the migrants that would have a devastating impact on the farm and most service industries.

Did I use enough citations for you? Let’s look at a few of them but I’ll get to the bottom line. Pay off all your debt as much as possible. Don’t take on anything that requires financing. Interest rates will go up as inflation returns. The entire thing is a vicious circle we learned much about in the 1970s. The 1980s taught us that tax cuts for the rich only drive up the deficit. Get ready for a repeat of that on steroids.

Traditional Republicans have always been migrant-friendly. However, that’s back when they were more focused on getting the business donors enriched and less worried about things like “poisoning the blood” and blaming them for statistically nonexistent problems, like crime and eating pets. However, that was before the rise of the Christofascists and the NAZIs ushered in MAGA.

The Brookings Institute reviewed recent peer-reviewed research in economics in September that shows exactly how devastating the cost of these deportations will be. That does not even cover the psychological and emotional trauma to communities forced to witness the round-up of their neighbors to massive concentration camps. This is a must-read. Chloe East is the researcher.

Increased deportation is associated with poorer economic outcomes for US-born workers

Across multiple studies, economists have found that once SC is implemented, the number of foreign-born workers in that county declines and the employment rate among U.S.-born workers also declines. My research with Annie Hines, Philip Luck, Hani Mansour, and Andrea Velásquez finds that when half a million immigrants are removed from the labor market because of enforcement (due to deportations and indirectly due to chilling effects), this reduces the number of U.S.-born people working by 44,000.

Why do deportations hurt the economic outcomes of U.S.-born workers? The prevailing view used to be that foreign-born and U.S.-born workers are substitutes, meaning that when one foreign-born worker takes a job, there is one less job for a U.S.-born worker. But economists have now shown several reasons why the economy is not a zero-sum game: because unauthorized immigrants work in different occupations from the U.S.-born, because they create demand for goods and services, and because they contribute to the long-run fiscal health of the country.

First, unauthorized immigrant workers and U.S.-born workers work in different types of jobs. Figure 1 shows the percentage of unauthorized immigrant workers, authorized immigrant workers, and U.S.-born workers that are in each of the 15 most common occupations among unauthorized immigrants.

It is clear that unauthorized immigrants take low-paying, dangerous and otherwise less attractive jobs more frequently than both U.S.-born workers and authorized immigrant workers. For example, almost 6% of unauthorized immigrants work as housekeepers, construction laborers, or cooks, compared to about 2% of authorized immigrant workers and 1% of U.S.-born workers (See Figure 1).

Occupations common among unauthorized workers, such as construction laborers and cooks, are essential to keep businesses operating. Deporting workers in these jobs affects U.S.-born workers too. For example, when construction companies have a sudden reduction in available laborers, they must reduce the number of construction site managers they hire. Similarly, local restaurants need cooks to stay open and hire for other positions like waiters, which are more likely to be filled by U.S.-born workers.

Caregiving and household service jobs are also common among unauthorized immigrants. The availability and cost of these services in the private market greatly impacts whether people can work outside the home. My research with Andrea Velásquez and new research by Umair Ali, Jessica Brown and Chris Herbst find that Secure Communities impacted the childcare market—the supply of childcare workers fell. This led to a reduction in the number of college-educated mothers with young children working in the formal labor market.

You’ll notice women bear the brunt of this policy, but it goes nicely into the plan to get women back into the kitchen. Please read about the impact of the deportation in 2008 that happened in South Carolina, called the SC Act or Secure Communities Act. The details are gruesome but here’s the bottom line in a move to deport 400,000 people in a limited area.

While only people who were arrested had their immigration status checked under SC, the policy nonetheless impacted a large portion of immigrants. There were broad “chilling effects” of the policy that meant even people not targeted for deportation became fearful of leaving their house to do routine things like go to work. This is partly because the program did not only target serious criminals—the most serious criminal conviction for 79% of those deported was non-violent, including traffic violations and immigration offenses, and another 17% were not convicted of any crime.

An article that appeared in Mother Jones, also last September, details the devastation that will come if mass deportation happens. Isabela Diaz provides the analysis. “How Trump’s “Mass Deportation” Plan Would Ruin America. It would be brutal, costly, and likely illegal.”

This time around, they plan to invoke an infamous 18th-century wartime law, deploy the National Guard, and build massive detention camps—and intend on reshaping the federal bureaucracy to ensure it happens, drafting executive orders and filling the administration with loyalists who will quickly implement the policies. “No one’s off the table,” said Tom Homan, the former acting director of US Immigration and Customs Enforcement (ICE) under Trump. “If you’re in the country illegally, you are a target.”

If Trump and his allies have it their way, armed troops and out-of-state law enforcement would likely blitz into communities—knocking on doors, searching workplaces and homes, and arbitrarily interrogating and arresting suspected undocumented immigrants. The dragnet would almost certainly ensnare US citizens, too.

The nation’s undocumented immigrants grow and harvest the food we eat, construct our homes, and care for our young and elderly. They pay billions in taxes, start businesses that employ Americans, and help rebuild in the wake of climate disasters.

Not only would Trump’s plan rip families and communities apart, but it also would have devastating effects for years to come, including on US citizens who perhaps have overlooked how integral undocumented immigrants are to their everyday life. Trump frames immigration as an existential threat to the United States. He has said immigrants are “taking our jobs,” are “not people,” and are “poisoning the blood of our country.” The reality is that if his plan were implemented, American life as we know it would be ruined—even for those cheering for mass deportation.

This will be in the hands of many of the folks who say they’re Christians but miss a major cultural value in both the Old and New Testaments. I was raised Presbyterian, attended my best friend’s Lutheran Church, baptized my girls in the Methodist church, and taught a large number of Sunday School classes. I’m not unfamiliar with the Bible. Matthew was my favorite of all. Whenever you ask me about my favorite verses, I’ll quote the Beatitudes and anything from Matthew or James. Trump is an actor, and his piety display is just an act.

Matthew 25:31-40 Jesus says, “I was a stranger, and you welcomed me,” and “Truly, I say to you, as you did it to one of the least of these my brothers, you did it to me.”

Numbers 15:16 The Bible says, “I am the Lord, and I consider all people the same, whether they are Israelites or foreigners living among you”.

Here’s a study cited in the Mother Jones article.

According to a 2016 report by the Center for American Progress, deporting 7 million workers would “reduce national employment by an amount similar to that experienced during the Great Recession.” GDP would immediately contract by 1.4 percent, and, eventually, by 2.6 percent. In 20 years, the US economy would shrink nearly 6 percent—or $1.6 trillion. Trump’s plan would lead to a dire shortage of low-wage workers, which would “bring on a recession while reigniting inflation,” predicts Robert J. Shapiro, a former undersecretary of commerce in the Clinton administration.

The costs of mass deportation will be devastating. Here is another study on the costs from The American Immigration Council.

“Using data from the American Community Survey (ACS) along with publicly-available data about the current costs of immigration enforcement, this report aims to provide an estimation of what the fiscal and economic cost to the United States would be should the government deport a population of roughly 11 million people who as of 2022 lacked permanent legal status and faced the possibility of removal. We consider this both in terms of the direct budgetary costs—the expenses associated with arrest, detention, legal processing, and removal—that the federal government would have to pay, and in terms of the impact on the United States economy and tax base should these people be removed from the labor force and consumer market.

In terms of fiscal costs, we also include an estimate of the impact of deporting an additional 2.3 million people who have crossed the U.S. southern border without legal immigration status and were released by the Department of Homeland Security (DHS) from January 2023 through April 2024. We consider these fiscal costs separately because we don’t have more recent ACS data necessary to estimate the total net changes in the undocumented population past 2022, or the larger impact on the economy and tax base of removing those people, an impact that is therefore not reflected in this report.

In total, we find that the cost of a one-time mass deportation operation aimed at both those populations—an estimated total of is at least $315 billion. We wish to emphasize that this figure is a highly conservative estimate. It does not take into account the long-term costs of a sustained mass deportation operation or the incalculable additional costs necessary to acquire the institutional capacity to remove over 13 million people in a short period of time—incalculable because there is simply no reality in which such a singular operation is possible. For one thing, there would be no way to accomplish this mission without mass detention as an interim step. To put the scale of detaining over 13 million undocumented immigrants into context, the entire U.S. prison and jail population in 2022, comprising every person held in local, county, state, and federal prisons and jails, was 1.9 million people.

In order to estimate the costs of a longer-term mass deportation operation, we calculated the cost of a program aiming to arrest, detain, process, and deport one million people per year—paralleling the more conservative proposals made by mass-deportation proponents. Even assuming that 20 percent of the undocumented population would “self-deport” under a yearslong mass-deportation regime, we estimate the ultimate cost of such a longer operation would average out to $88 billion annually, for a total cost of $967.9 billion over the course of more than a decade. This is a much higher sum than the one-time estimate, given the long-term costs of establishing and maintaining detention facilities and temporary camps to eventually be able to detain one million people at a time—costs that could not be modeled in a short-term analysis. This would require the United States to build and maintain 24 times more ICE detention capacity than currently exists. The government would also be required to establish and maintain over 1,000 new immigration courtrooms to process people at such a rate.”

How’s that for dismantling the state and getting rid of Federal Workers? It sounds like a bit of hypocrisy to me.

There’s that stagflation prognosis again. That was the time of the economy in 1980 when I got my first house fixed rate loan at 16.7%, which was only one of three mortgage loans made that month at the largest Savings Loan in the heartland. I worked there so they gave me a discount down to 12%. Let’s see all those young people trying to buy their houses in that environment. My loan now is fixed at 3%. Thank you, Obama!

One of the worst possible things that could happen is allowing politics back into Fed Policy. This was a problem that was fixed by law because obvious presidential interference generally led to low interest rates that brought more inflation. I have purposefully used a conservative-bent economist for this analysis. “The Economic Consequences of Political Pressure on the Federal Reserve.” Elonia is hot for this pogrom. Tell me again, who thinks that Nepobaby is brainy? Again, if you lived through the dread of Nixon’s years, you’ll remember the inflation he brought trying to get the Fed to loosen interest rates during a period of inflation. It wasn’t pretty.

The data on personal interactions by themselves are at best a noisy measure of political interference with the Fed. For example, in a recession the president might be more likely to contact the Fed chair and ask them about their view on the economy. In this instance, personal interactions would increase, but not because they reflect political pressure.

To overcome this identification challenge, I exploit an increase in president–Fed interactions that plausibly took place purely for the purpose of influencing Fed policy and arguably had an impact on the stance of monetary policy. In his desire to be re-elected in 1972, Richard Nixon pressured Arthur Burns to ease monetary policy in 1971. Burns, a Republican and friend to Nixon, reportedly gave in to Nixon’s pressure.

A variety of external evidence corroborates this interpretation of the Nixon–Burns clash, including recordings from the “Nixon tapes” and entries in Arthur Burns’ personal diary. For example, Burns writes in his diary that Nixon urged him “start expanding the money supply and predicting disaster if this didn’t happen.” To support the interpretation that Burns eased policy in response to Nixon’s pressure, I show that Romer and Romer (2004) uncover easing shocks to monetary policy prior to Nixon’s re-election. I also present supporting evidence from the voting behavior of the FOMC.

I exploit the narrative around Nixon’s pressure in a structural vector autoregression (SVAR) that contains the president–Fed interactions as well as standard macro data. I identify a shock to political pressure on the Fed based on narrative sign restrictions. Specifically, I define a political pressure shock as an increase in president-Fed interactions that eases policy in an inflationary way and constitutes the main contributor to the spike in president–Fed interactions in late 1971.

Yes. This is the kind of thing I do for my research. Just go look at the graphs. They speak volumes.

The number of president–Fed interactions displays persistence after the political pressure shock hits, with the IRF reversing to closes 0 after around two years. The shock induces a monetary easing, with a roughly 100 basis points lower interest rate after a few quarters. The price level response to the shock builds up gradually and persistently and reaches a 5% higher price level after four years. These estimates imply that exerting political pressure 50% as much as Nixon did, over a period of six months, permanently increases the US price level by more than 8%.

The responses of real GDP and fiscal variables are not distinguishable from zero. This finding indicates that political pressure primarily induces a price level effect. It turns out that in some subsamples (not shown here), it is possible to detect a significant response of real GDP, but this response is actually negative.

This cartoon is actually from the American Enterprise Institute. This shows you have far Republican Politicians have actually gotten from actual Economics.

That’s a dismal scientist telling you that all hell breaks loose whenever an American President tries to influence the Fed. Nixon wanted to win the reelection and pressured the Fed to drop interest rates, which caused massive inflation. eventually, we got unemployment, and that’s stagflation. That’s what poor Jimmy Carter inherited. The Tax Cuts for the Rich narrative through the Reagan years was even worse. I was studying economics at the time and became an economic analyst for that Savings and Loan that went bankrupt because of that policy. (I surprised them with that data, the first of many times I was the brains of a clueless CEO.) When the Reagan administration pulled off the usury laws, we got a financial crisis in 1984, which later looked mild compared to the one Dubya brought on in 2008, also known as the SubPrime Crisis.

NPR unravels the plan that Trump has to control the Fed. “How Trump’s wish for more Federal Reserve control could impact economy if he’s reelected.”

Geoff Bennett:

So, first, let’s start with a bit of a reality check. How feasible is it for Donald Trump to fundamentally change the autonomy of the Fed and change the relationship between the Federal Reserve and the president if he is reelected?

Krishna Guha:

Well, it’s complicated.

So, first off, for President Trump, if reelected, could certainly let his views on monetary policy be known loudly and including through social media and other nonconventional channels. He could try to do what’s called jawboning, leaning on the Fed in public to take certain actions on interest rates.

Actually changing the institutional independence of the Fed, that’s more challenging. The Fed’s independence is enshrined in the act of Congress the Federal Reserve Act, and that makes the chairman, for instance, removable as generally understood, only for a cause, which would mean something pretty extreme to make him unfit for office.

The president can’t simply appoint additional members to the Federal Reserve Board. He’d have to wait until vacancies became available and those only become available very slowly. So it would be tough. Now, there is one complication, and that is that it is somewhat unsettled as to what the exact legal status of the Fed chair is and whether the president might have some legal grounds for being able to dismiss a Fed chair.

That’s not something that I think any mainstream lawyer or central banker believes is right, but it hasn’t been fully tested in the courts. And so there’s some outside possibility that the president could attempt to assert an authority over the Fed chair that has not been understood to be there.

Geoff Bennett:

If we look to other countries or look back in this country’s own history, what does it tell us? Does a Central Bank that remains independent from political influence, does that yield better monetary policy and better macroeconomic decision-making?

Krishna Guha:

There’s just very, very strong evidence from the U.S. itself and from countries around the world that independent central banks tend to achieve better economic outcomes.

And that ultimately doesn’t just benefit society, doesn’t just benefit the economy. It, in the end, tends to benefit the president as well. And so I think there’s actually a lot of good reason why it would be not to try to assault the independence of the Central Bank.

Geoff Bennett:

Critics have blasted the Fed for being too slow to respond to inflation. And there will certainly be folks who say, why is it such a bad thing to have the Fed accountable to someone, accountable to the executive branch?

Krishna Guha:

So, you raise a really important issue there, Fed accountability.

Now, Fed officials past and present will say, absolutely, the Fed must be accountable. But under our system of government, the Fed is accountable to Congress, not the executive branch. The Fed is a creature of Congress. The Fed chair goes to Congress to testify. He’s grilled by members of the Senate. He’s grilled by members of the House.

That is the way that our system of accountability is set up. And it’s the way that it’s worked very well in recent decades. That doesn’t mean that the Fed is always going to get everything right. Of course not. The issue is simply, would you have more confidence that the Fed would get things about right most of the time if it was more insulated from short-term political pressures, or do you think that political pressures are going to make them do a better job?

I think most people have a pretty intuitive grasp of what the answer to that question would be.

Again, Powell says he will not resign. That gives us about another year where monetary policy can offset this craziness. This is from CBS. “Fed Chair Jerome Powell says he won’t resign if Donald Trump asks him to step down.”

Federal Reserve Chair Jerome Powell said he won’t step down if President-elect Donald Trump, who has previously criticized Powell’s performance, asks him to resign.

Speaking at a press conference Thursday to discuss the Fed’s move today to cut its benchmark interest rate by 0.25 percentage points, Powell added that it is not permitted under the law for presidents to fire or demote the Fed chair.

When asked if he’d step down if Trump requested it, Powell responded with a one-word answer: “No.”

Powell’s insistence that he’ll remain in his role comes after Trump aired grievances about the Fed’s decision-making during his first presidency and, more recently, on the campaign trial. Trump, who has accused Powell of being “political,” also told Bloomberg Businessweek this summer he would let the economist serve out his term, “especially if I thought he was doing the right thing.”

Yet Trump has also said he thinks the U.S. president should have more influence on Fed decisions.

Are you asleep yet or is your hair on fire like mine? And again, here are the massive layoffs and hiring freezes now planned for 2025. “A running list of companies preparing to raise prices if Trump’s trade plan is enacted.” This is from Business Insider. The analysis is provided by Ayelet Sheffey. It’s from a few days ago.

President-elect Donald Trump proposed broad tariffs on imports, including up to 60% on goods from China.

Economists say his proposals could spike inflation as companies tend to pass costs on to shoppers.

Some companies have already said increased tariffs would lead them to raise prices.

Some executives have warned that price hikes are on the way if President-elect Donald Trump’s trade plans go into effect.

On the campaign trail, Trump proposed a 60% tariff on goods imported from China coupled with a 10% to 20% tariff on goods imported from other countries. While the president-elect could choose not to enact tariffs at that scale once he assumes office, economists and the market have predicted that his proposals would spike inflation and cause the Federal Reserve to raise interest rates.

Several companies have already begun responding to Trump’s election victory and the implications his tariff proposals would have on the costs of their goods. Executives have told analysts on earnings calls that it would be difficult to maintain current prices under Trump’s broad tariffs.

Other companies are still waiting for more information from the president-elect. Tarang Amin, the CEO of ELF Beauty, told Business Insider that the company must first see the policy Trump enacts before making any changes to its pricing and that a new policy wouldn’t affect the business until after its 2025 fiscal year.

“We don’t like tariffs because they are a tax on the American people,” Amin said, adding that the company had been subject to a 25% tariff since 2019 because of policies from Trump’s first term. “And at that time,” he said, “we pulled all the levers available to us to minimize the effects to our company and our community.”

Karoline Leavitt, a Trump-Vance transition spokeswoman, told BI: “In his first term, President Trump instituted tariffs against China that created jobs, spurred investment, and resulted in no inflation.” She added that Trump will “work quickly” to lower taxes and create more American jobs.

Below are the companies that are warning of price increases if Trump’s tariff proposals are implemented.

Before I went completely into economics, I was a history major. We’ve done this before. The Smoot-Hawley Tariff Act of 1930 raised import duties on more than 20,000 goods and agricultural imports to protect U.S. businesses and farmers. Hoover signed it into law. It made the Great Depression worse. Don’t these whackadoodle schools teach History and Civics anymore?

Before every major recession we’ve had since 1984, I’ve always found myself running around going what are these idiots smoking? I’ve fled to safety and minimized my losses. Ronald Reagan’s folly basically wiped out my first IRA and my Dad’s retirement portfolio. But, I always did better than everyone else because if you’re just an economics teacher living a normal life and not privy to all the insider muckety muck, you do that. I remember the manager for my Louisiana 403B was amazed I held my losses to a lower percentage than anyone else at the USL. I was not amused. A loss is a loss, and I’m definitely paying for those years now as I was then.

Just buckle up. This is going to be a very chaotic ride. Prepare for the worst. Again, the best thing you can do is pay the debt off and not add any more, if possible. I am also expanding my small food garden and orchard. I’m not sure if Congress is up to the test of its checks and balances, so this is not looking good. Also, remember how long it took to get out of Nixon’s mess. We really didn’t recover completely until the Clinton years.

The two pieces of news we also have today is that Matt Gaetz quit the AG cabinet appointment. He says he’s not going back to Congress. Speculation is that he will still have a political appointment in the administration, just one that doesn’t take Senate approval. Pam Bondi, who he once bribed to stop her from filing a suit against his phony university and who is basically one of his personal attorneys is now the nominee.

What’s on your reading and blogging list today?

#JohnbussBskySocial #chaos #ConvictedFelon #DonnyDotardAndTheChaosCult #TheEconomicImpactsOfDeportationAndTariffs #Trump #TrumpEconomyWrecker #TrumpStagflation