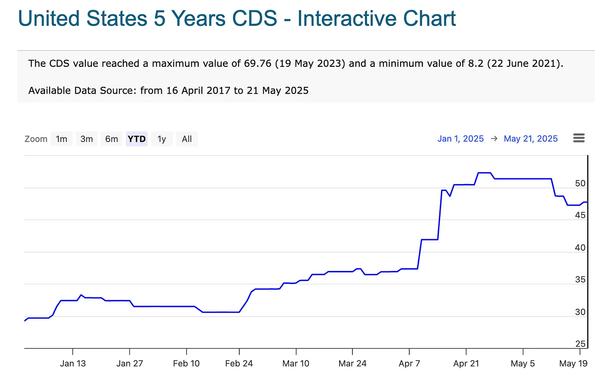

“The price of #US #creditdefaultswaps — which are supposed to protect #investors if #America fails to honor its #debt, and are an indicator of market pros’ sentiment — has surged” paulkrugman.substack.com/p/a-liz-trus...

#CreditDefaultSwaps

US credit default swaps surge to two-year peak, surpassing levels seen during tariff announcements, signaling heightened market concerns

#YonhapInfomax #USCDS #CreditDefaultSwaps #MarketConcerns #TariffAnnouncement #FinancialRisk #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=59686

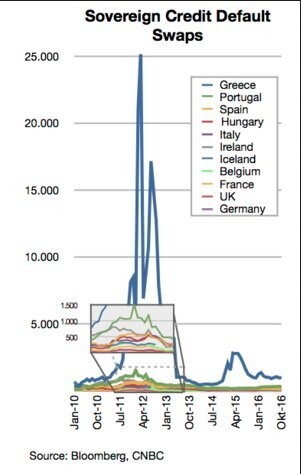

En el gráfico tienen udes. los famosos #CreditDefaultSwaps -CDS- q tanto dieron q hablar al final del segundo gobierno de RodríguezZapatero.

El gráfico es optimista,

en su día los vi peores

#Grecia estaba mal pero no era tanto dinero si es q alguien se lo quería prestar, el resto de #PIGS estaban mal pero lo malo es q se había puesto en marcha una caida de fichas de domino

El problema a finales de 2011 era la deuda de #Italia y q si caía, era el final de todo

from #TheBigShort (2015), regarding credit default swaps which were used to bet on the collapsing housing market / mortgage backed securities:

"let me put it this way: I'm standing in front of a burning house, and I'm offering you fire insurance on it."

It's not just #CreditSuisse stock is falling, but its bonds.

Primary market for bonds is its initial Public Offering and can be traded at par value or at discount or at premium

Bonds are speculated on secondary markets

Right now both #CreditSuisse bonds and its bond coupon are being traded at significant losses.

CDS -#CreditDefaultSwaps- are skyrocketing.

More on this topic soon

@laurend there is a reason why regulatory agencies try to protect customers from speculatory investment… unfortunately, every time a bubble pops (#SnakeOil, #CDO, #CreditDefaultSwaps, etc), conmen just invent another form of promising quick buck with “no risk”… and there is always people willing to give conmen their money… the big investors cut their losses, but the small investors suffer.

For #creditdefaultswaps, the 5-year contract sold at the most recent #IMM date is the on-the-run security; it thus has a remaining maturity of between 4 years, 9 months and 5 years.

For #creditdefaultswaps, the 5-year contract sold at the most recent #IMM date is the on-the-run security; it thus has a remaining maturity of between 4 years, 9 months and 5 years.