📅 GSTR-7 due date for May 2025 is 10th June 2025.

Applicable for entities deducting TDS under GST. Ensure timely compliance.

#GST #GSTR7 #TaxCompliance #IndirectTax #TDS #GSTUpdates #DueDateReminder #CharteredAccountants

#GSTUpdates

📅 GST Due Date Reminder

🔹 GSTR-6 due on 13th February 2025

📌 Applicable for Input Service Distributors (ISD)

📌 Report inward supplies & distributed ITC

Stay updated with compliance timelines!

🔹 GST Due Date Reminder 🔹

📅 GSTR-5 due on 13th February 2025

📌 Applicable for non-resident taxable persons

📌 Summary of outward taxable supplies & tax payable

Stay updated with compliance timelines!

Reminder: The due date for filing GSTR-1 for January 2025 is 11th February 2025. Applicable for businesses with turnover above ₹5 crore or those not under the QRMP scheme. Ensure timely compliance! #GST #GSTR1 #TaxCompliance #Finance #GSTUpdates

Reminder: The due date for filing GSTR-7 for January 2025 is 10th February 2025. Ensure timely compliance for tax deducted at source (TDS) under GST laws. Stay updated with important tax deadlines! #GST #GSTR7 #TaxCompliance #TDS #Finance #GSTUpdates

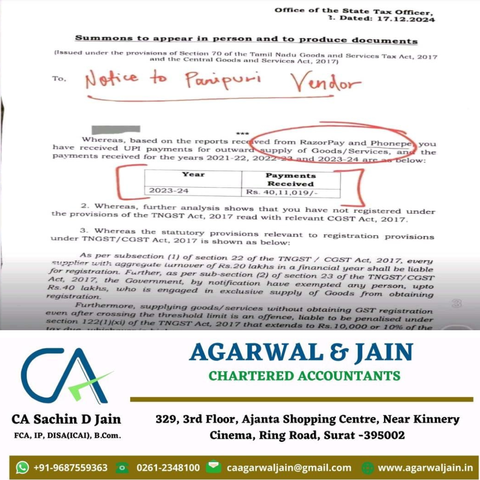

Every business shall track their gross receipts so as to avoid these kinds of GST Notices ⚖️ #GSTUpdates #Compliance #TaxLaw #DigitalEconomy

"📌 Reminder: GSTR-1 for December 2024 is due on 11th January 2025. File the summary of outward supplies if turnover exceeds ₹5 crore or QRMP scheme is not opted for Oct-Dec 2024 quarter. Stay compliant and file on time. 🕒✅ #GSTUpdates #GSTR1 #TaxFiling #ComplianceMatters

📢 GST Alert: GSTR-6 for Nov 2024 is due on 13th Dec 2024! Input Service Distributors (ISD) must file details of inward supplies and distributed Input Tax Credit (ITC). Ensure accurate reporting for compliance. #GSTR6 #GSTFiling #TaxCompliance #GSTUpdates #CharteredAccountants

📌 Reminder: IFF for Nov 2024 is due on 13th Dec 2024! This optional facility allows small registered persons filing quarterly GSTR-1 to furnish invoice details monthly. Stay updated on compliance. #GSTUpdates #IFF #TaxCompliance #GSTIndia #CharteredAccountants #StayInformed

📌 GST Due Date Reminder: 25th November 2024 is the deadline for filing PMT-06 for October 2024 under the QRMP scheme. This challan is used for tax, interest, late fees, and penalty payments by quarterly GSTR-3B filers. #GSTUpdates #Compliance #PMT06 #Taxation #QRMP

Unveiling the Latest Update in GST e-Invoicing: FAQs Answered | Webtel

The e-invoice system is designed for GST-registered individuals to upload all their B2B invoices to the Invoice Registration Portal (IRP). If you are eligible for e-invoicing, you may have several questions in mind. #gstindia #gstupdates #GoodsandServicesTax #goodsandservices #software #softwarecompany #softwaresolutions

👉 Watch the full video at>> https://youtu.be/rqp0x0mD1Nw

Accused who stole GST worth Rs 100 crore arrested

https://newswatchindia.com/accused-who-stole-gst-worth-rs-100-crore-arrested/

#gstupdates #GSTRegistration #gstindia #GSTEPChallenge #LatestNews #LatestUpdates #latesthindinews #HindiNews #HindiSamachar #BreakingNews #BREAKING #Ghaziabad #GhaziabadNews #ghaziabadlatestnews #gstthiefer #thiefofgst #Arrest #Businessman #businessmanagement #businessmanagementconsultant

A Deeper Dive into the Syllabus of GST Courses in 2023

Explore the dynamic GST syllabus, covering tax concepts, compliance, and latest updates. Our comprehensive program equips you with the knowledge and skills to navigate India's tax landscape effectively. Start your journey to GST proficiency now.

https://www.henryharvin.com/blog/all-about-gst-courses-role-syllabus-scope-jobs/

#GSTSyllabus #IndirectTax #GSTClasses #GSTUpdates #henryharvin

Invest in Your Future GST Courses in Kolkata

Discover the world of taxation with our GST Courses in Kolkata. Gain in-depth knowledge of Goods and Services Tax, advance your career, and ensure compliance. Enroll now for expert training and certification.

https://www.henryharvin.com/gst-course-kolkata

#GSTCourseKolkata #GSTTrainingKolkata #GSTCertification #GSTUpdates #henryharvin

#Breaking : வெளிநாட்டிலிருந்து இறக்குமதி செய்யப்படும் இலவச #COVID19 தொடர்பான பொருட்களில் #IGST வரி தள்ளுபடி செய்ய ஜிஎஸ்டி கவுன்சில் முடிவு செய்கிறது என்று நிதி அமைச்சர் திருமதி. சீதாராமன் கூறியுள்ளார்.

#GST #GSTUpdates #CovidRelief @nsitharaman@twitter.com @nsitharamanoffc@twitter.com @FinMinIndia@twitter.com

ஜிஎஸ்டி இழப்பீட்டை தர முடியாமல் போனதற்கு கடவுளின் செயல் என்று கூறிய நிர்மலா சீதாராமனுக்கு ப சிதம்பரம் கண்டனம்

https://www.patrikai.com/chidambaram-condemns-nirmala-sitharamans-remark-on-act-of-god/

#PChidambaram #GSTCouncilMeet #GSTUpdates #NirmalaSitharaman @PChidambaram_IN@twitter.com @nsitharaman@twitter.com @INCIndia@twitter.com @INCTamilNadu@twitter.com @TNCCMinority@twitter.com @TNCCITSMDept@twitter.com