US Treasury Secretary signals potential for increased stock buybacks, hinting at flexibility in financial policy amid market uncertainties

#YonhapInfomax #USTreasurySecretary #StockBuybacks #FinancialPolicy #MarketUncertainty #EconomicFlexibility #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=58654

#StockBuybacks

A fantastic comic series on how the wealthy have used #StockBuybacks to pilfer trillions from the working class. https://bindings.app/read/FgnoaYec

Trouble in RH land https://hntrbrk.com/rh/?fbclid=IwY2xjawICsA1leHRuA2FlbQIxMQABHQ1MTlbG4LxV44g_7lpvqU4hLwMBXPPcE0DGv_fk38cOPPtEO8PRDKREhA_aem_6GTfJHR5GbyanRCXj9IAEw #RestorationHardware

#FinancialTroubles

#LuxuryBrand

#CorporateSpending

#StockBuybacks

#DebtManagement

#RetailIndustry

#BankruptcyRisk

#InventoryChallenges

#EuropeanExpansion

#CEOLeadership

#FinancialAnalysis

#AltmanZScore

#CashFlowIssues

#LuxuryRetail

@JoeBeam

Dear Journalists —

The next time a CEO talks about labor costs, mention how much the CEO makes, how much the top 20 other corporate leaders make, and how much has been spent on stock buybacks.

The parent company of #Walgreens spent $69M on stock buybacks in Nov 2023.

As best as I can tell from this chart, #CVS buys back about $3bil every March (https://www.tipranks.com/stocks/cvs/buybacks)

So #CNN, when you write an article about how companies are downsizing, be sure to include #stockBuybacks.

These corporations are enriching their leadership and their stockholders because that is what #Capitalism says they should do. The could choose to be stewards of #healthcare. They don't

https://www.cnn.com/2024/10/16/business/walgreens-cvs-store-closures/index.html

#UAW Intensifies Fight for #US. Investments at #Stellantis as Company Spends Another $1.1 Billion on #StockBuybacks

#USA #CEOs #StockBuybacks #LowWages: "Why would CEOs prefer buybacks to dividends? Because CEOs sit on tons of shares. Even if only some of those shares have vested, a CEO who uses this ruse to increase share prices can cash those shares out, borrow against the rest, and count on a big stock grant from shareholders who are grateful for their windfall.

That means that the true cost of a CEO pay package isn't the value of the shares they're awarded – it's the cost of the stock buyback that leads to that award. And this is where the numbers get truly, obscenely, huge.

Take Lowe's: over the past five years, CEO Marvin Ellison spent $43 billion on stock buybacks, netting $18 million for himself in the process. Now, Lowe's has 285,000 employees, half of whom earn less than $33,000/year. Divide Ellison's $18m among those workers and each of them would net a paltry $126/year. But if you were to share out the $43 billion Ellison had to piss up against a wall on stock buybacks among those workers, you'd be able to give every worker a $30,000 bonus, every year:

(...)

Lowe's leads the "Low-Wage 100," IPS's index of the worst paying 100 companies out of the S&P 500. Over the past five years, the Low-Wage 100 has spent more than half a trillion dollars on stock buybacks. As with other companies, the CEOs of the Low-Wage 100 timed mass sell-offs of their shares to coincide with the buybacks:"

https://pluralistic.net/2024/09/09/low-wage-100/#executive-excess

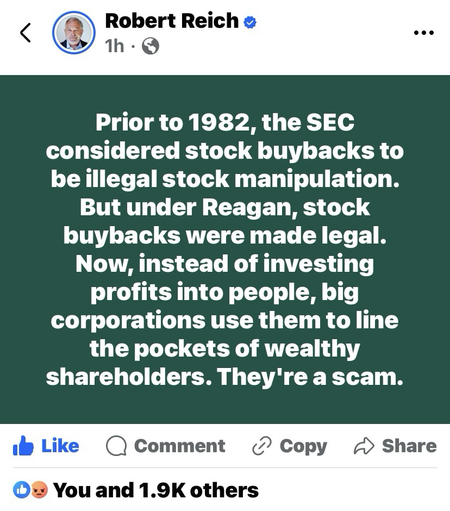

#Republicans did this.. #StockBuybacks 👇👇

🥥 Mastodon Engagement Tip Number 4:

To get double-digit response levels, write an impassioned reply criticizing the obscenely wealthy in a thread started by @rbreich.

Suddenly Eye have been noticed.

PS: Pleez sign up for my tumbril-building workshop, if you're into DIY. 🥥

#Fediverse, #Mastodon, #Engagement, #Traffic, #SocialMedia, #RobertReich, #Reagan, #StockBuybacks, #MarketManipulation, #TuckersBalls

#StockBuyBacks #InsiderTrading #CorporateTheft #GenerationalTheft

“Every dollar spent lining the pockets of CEOs and investors is a dollar less to upgrade equipment and protect workers and the public.

“Boeing failed to follow through with a promised $7 billion safety redesign of its 737 aircraft while it was spending roughly that much each year on stock buybacks.

“Norfolk Southern Railroad paid investors $18 billion in buybacks and dividends over the five years before its equipment malfunctioned in the disastrous derailment in East Palestine, Ohio, which released over 300,000 gallons of toxic and flammable chemicals into the air and soil…”

#USPol #SEC

Let's Be Blunt: Ninety Percent of American #CEO's making rapacious salaries have #Zero skills for globally competitive marketplaces. In the absence of #Mergers, #Monopolization, #StockBuybacks and finally #PrivateEquity they are frauds and chumps living in their parents basements

Maybe one last round of #stockBuybacks for old time's sake? #boeing #crapitalism

https://www.nbcnews.com/business/business-news/boeing-ceo-dave-calhoun-slew-executives-step-safety-crisis-rcna144882

@ariadne also thez could've just stopped eating #AvocadoToast all day aka. do #StockBuybacks and dish out ridiculous #ExecutiveBonuses...

As a Seattle area kid I grew up with so many Boeing connections, parents of friends, scout leaders, aunts and uncles. I even thought about going into aerospace engineering. But the decline of it's culture has been clear since the 90's

Jalopnik: John Oliver Explains How All Of Boeing's Problems Can Be Traced Back To Stock Buybacks And Incompetent Leadership

Once a paragon of quality, Boeing's focus on its stock price has caused hundreds to die.

https://jalopnik.com/john-oliver-explains-how-all-of-boeings-problems-can-be-1851315604

https://youtube.com/watch?v=Q8oCilY4szc

#Boeing #StockBuybacks #JohnOliver

Probably time to #tax the hell out of the rich. Increase #capitalgains put a tax on #stockbuybacks make a #weathtax real etc

👇

“The economy is cooling but the US is a frog in hot water

Government debt held by the public grows from 99 percent of GDP this year to 116 percent in 2034, more than twice its 50-year average...”

#economy #gdp #debt