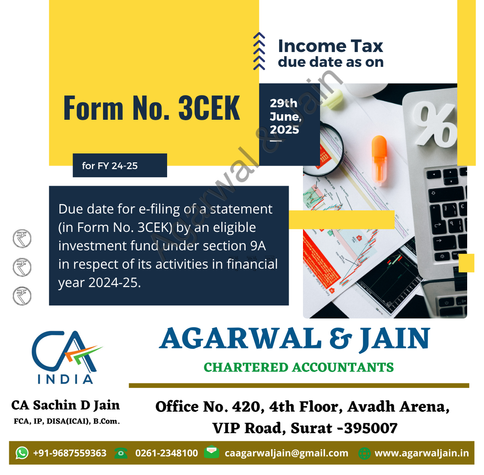

“Reminder: Form 3CEK e‑filing (Section 9A) for FY 24‑25 & related foreign‑share transfer info is due 29 June 2025. Stay compliant & on schedule. #TaxCalendar #FinanceCompliance #IncomeTax #FY25 #Section9A”

#TaxCalendar

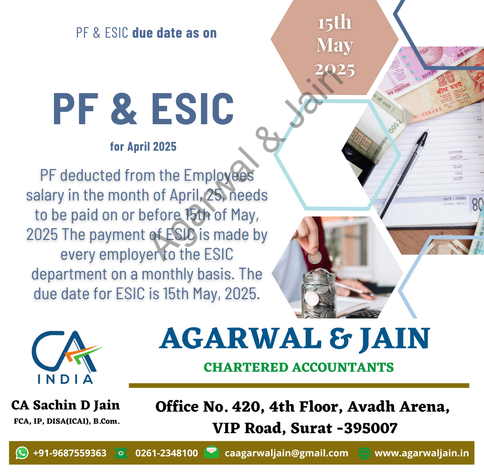

📅 PF & ESIC due date for April 2025 is 15th May 2025.

Ensure timely compliance for monthly remittances.

#PFCompliance #ESIC #TaxCalendar #StatutoryDueDates #AccountingUpdate #FinanceReminders #CharteredAccountants #GST #PayrollIndia

📌 GSTR-1 for April 2025 is due by 11th May 2025.

Applicable for taxpayers with turnover above ₹5 crore or those not opted for QRMP scheme for Q1 FY 2025-26.

#GSTR1 #GSTCompliance #OutwardSupplies #TaxCalendar #IndirectTax #CAUpdates #GSTIndia

📌 GSTR-8 due date for April 2025 is 10th May 2025.

Applicable for e-commerce operators depositing TCS under GST. Ensure timely compliance as per Rule 67.

#GSTR8 #TCSunderGST #GSTCompliance #TaxCalendar #CAUpdates #ECommerceCompliance #GSTIndia

🔔 GSTR-7 due date for April 2025 is 10th May 2025.

Ensure timely filing of TDS under GST as per Rule 66.

#GSTR7 #GSTCompliance #TDSunderGST #IndirectTax #CAUpdates #TaxCalendar #GSTIndia #AccountingCompliance #StatutoryDueDates

Mark your (tax) calendars. We've got all the important dates you'll need to know for 2024 laid out here.