"Oil prices slid more than 3% before paring losses on Thursday after President Trump hinted that the US is nearing a nuclear deal with Iran — a move that could increase global crude supply." finance.yahoo.com/news/oil-pri... #wallst #energy #politics #foreignpolicy

Oil tumbles 3% as Trump hints ...

#WallSt

"Frank Bisignano will rubber stamp Trump and Musk’s attack on Social Security. He’ll let them keep slashing services. He’ll let them keep threatening benefits. And that’s going to hurt people everywhere..." www.democracynow.org/2025/5/7/hea... #MAGA: DOGe #WallSt Doesn't care about your security.

RE: https://bsky.app/profile/did:plc:yw6wbtma6fynxiafh5v7j5sf/post/3lolw5sya4k2p

“I Am a DOGE Person”: Senate R...

"Wall Street billionaires are not used to being on the outside looking in. But that is where they find themselves after President Trump ignored their appeals to call off his tariff plans which they fear could endanger the economy." www.nytimes.com/2025/04/08/b... #coup #finance #frauds #WallSt

Wall Street Bursts With Anger ...

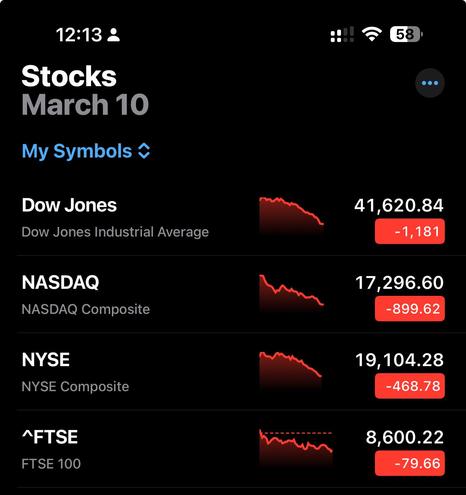

"Wall Street nosedived for a second straight day on Friday, confirming the Nasdaq Composite was in a bear market and the Dow Jones Industrial Average was in a correction, as an escalating global trade war spurred the biggest losses since the pandemic.

"The Dow Jones Industrial Average (.DJI), S&P 500 (.SPX), and the Nasdaq Composite (.IXIC) posted their largest two-day declines since the emerging coronavirus caused global panic during U.S. President Donald Trump's first term. For Thursday and Friday, the Dow was down 9.3%, the S&P 500 10.5% and the Nasdaq 11.4%.

"Fallout from Trump's sweeping tariffs stoked fears of a global recession, wiping trillions of dollars of value from U.S. companies.

"Since late on Wednesday, when Trump boosted tariff barriers to their highest level in more than a century, investors have dumped stocks, fearing both the new U.S. economic reality and also how U.S. trading partners might retaliate by steepening their own trade barriers.

"A record-breaking number of shares were traded on Friday, with volume on U.S. exchanges around 26.79 billion shares, beating the previous high of 24.48 billion shares traded on January 27, 2021."

https://www.reuters.com/markets/us/wall-street-futures-lose-ground-after-china-retaliates-against-us-tariffs-2025-04-04/

With China blocking CK Hutchison ports' sale to Backrock, is Adani wasting their time & money? www.inventiva.co.in/trends/adani... #Citadel #finance #investment scheme? #wallst #stock

Adani’s Last Shot? BlackRock &...

#DJT doubles planned #tariffs on #Canadian #steel and #aluminum to 50% as #tradewar intensifies in retaliation for #Canada raising #energy import costs for #power sent to #usa

#Kudlow (and others in #finance) quoted saying situation spiraling out of hand , and clearly hurting #Economic recovery that has #srly stalled in past 40 days since drastic #GOP market meddling has roiled #WallSt confidence game.

The #TrumpSlump accelerates into a full blown #MarketPanic.

5 weeks of non-stop losses with 7-8 trillion in lost market value: Time for his #WallSt #masters to grow a pair and tell him to either knock it off, #resign, or be #impeached

"GASLIGHTING a NATION"

CRIMINAL 🍄rump is all I hear 24/7!

Did #AlCapone ever get that much attention?

Here's a MOBSTER telling everybody how he's ripping us off & #WeTheSheeple r willing 2 take it⁉️ Up the ass, yet⁉️

#MSM #WallSt #CorpEnslavement #Mil_IndWelfareQueens

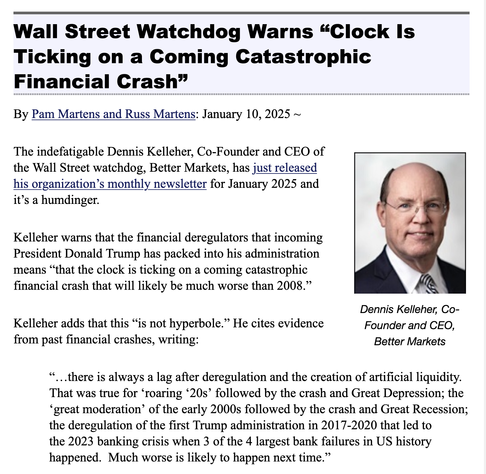

Dennis Kelleher knows what's up

#WallSt #markets #Stockmarket #Deregulation #Election2024 #2024Election #Trump #DonaldTrump #JDVance #uspol #uspolitics #politics #GOP #MAGA #MAGAts #Republicans #economics #banks #bank #finance

Geo. Washington warned, "Beware the Corporations!" (#WallSt).

Dems never get it, while Reps smell big $$ in crevices or under Black Robes.

🍄rump is an insane narcissist, but the billionaires r NOW at the helm & will go 4 total control of the diminished middle class❗️

25 yrs ago America's Corps FEARED "Y-2K" wld be "Y-1900":

a "failure" that wld have exposed 100 yrs of price gouging & profiteering.

Now they have an open NAZI umbrella & loudly tell #WeThePeople 2 lump it & 🖕🏼off❗️

#BigOil #BigPharma #WallSt #Mil_IndComplex #PrisonInd

Don't pay taxes?

Can't use The Infrastructure!

Until the tax-shy CORPORATIONS/Multi_Milionaires & EVEN #WallSt PAY UP TAXES DUE,

cut them off from using ANY part of The Infrastructure, incl air traffic control 4 pvt planes.

It's MORE than just State tax at the pump!

@PeteHegseth is SOOO full o' 💩!

"Ppl LOVE FREE markets!"

That's the BILLIONAIRES' line as prices rise!

Americans don't know free markets b/c #WallSt & the "regulars" shrouded the truth since Corps took over❗️

Put Pete on a Mattel trike at the top of a steep hill...

Curb brokers, Wall St., New York

"The Leighton & Valentine Co., N.Y. City." "L & V Co [in device] quality famous throughout the world"--printed on verso. New York, N. Y.

http://digitalcollections.nypl.org/items/0f949f90-c560-012f-c324-58d385a7bc34

#WallSt #NewYork #NYCity #NewYorkCity #NewYorkCitys #Stockexchanges #NewYork(NY)

#Nvidia #silicon #chipmaker soars in valuation as #AI boom sees earnings per share of $0.67, and a #WallSt stock price up 168% from #shareprice a year-ago

https://www.cnbc.com/2024/08/28/nvidia-nvda-earnings-report-q2-2025.html

#Nazi/@Heritage (Foundation) #Project25Manifesto gives anti-tax #Millionaires (& #WallSt) domininion over all Americans, visitors & tourists over their entire lives❗️

Do U really ant @JDVance 2 sleep on Ur couch❓

Vote 4 VP/@KamalaHarris as #POTUS_47 -- Vote 💙BLUE❗️

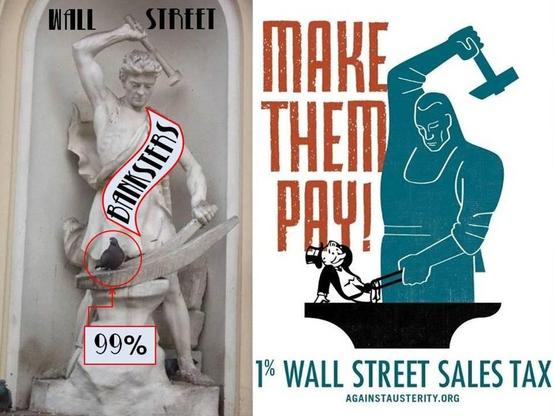

#WallSt is the "bankster" to greedy millionaire corp execs &

the enemy of employment, wages, ACA, & SS❗️

@WallStreetSilv

George Washington warned the Nation 2 b WARY of corporations!

VOTE BLUE💙

Curb brokers, Wall St., New York

"The Leighton & Valentine Co., N.Y. City." "L & V Co [in device] quality famous throughout the world"--printed on verso. New York, N. Y.

http://digitalcollections.nypl.org/items/0f949f90-c560-012f-c324-58d385a7bc34

#Wallst #Newyork #Nycity #Stockexchanges #Newyork(ny)