🚨 ITR Due Date Alert 🚨

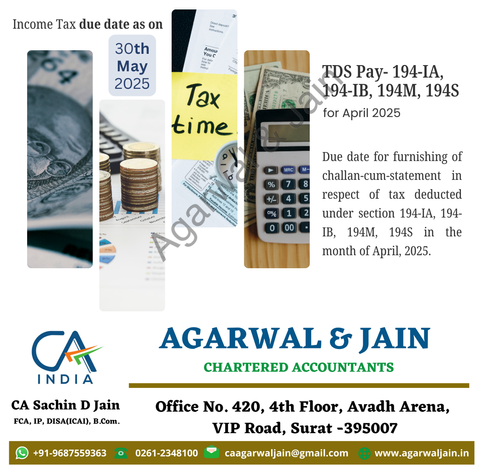

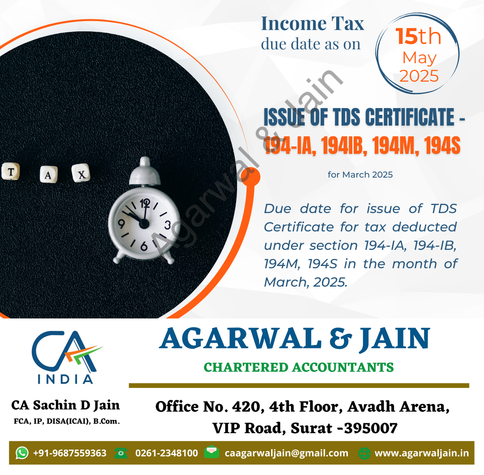

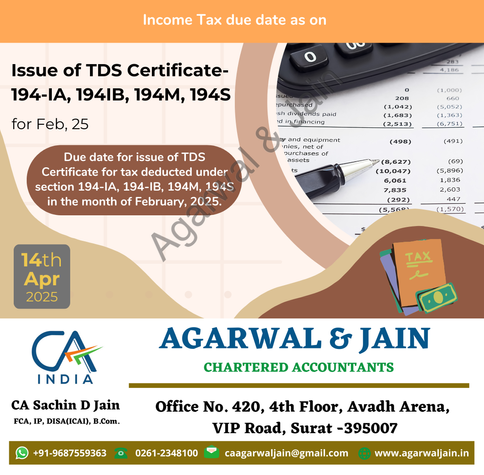

Furnishing TDS Pay challan is too close.

File ASAP to avoid penalties.

Stay informed!

Get Help @ https://zurl.co/Qknls

Join WhatsApp: https://zurl.co/GgFOt

#tds #tdspayment #duedate #tdscompliance #194ia #194ib #incometax #setindiabiz