@metin

Good quote. Chomsky has some keen insights.

I'm not an accountant or a lawyer, but that won't keep me from offering some related opinions here. Sorry this will be slightly US-centric, though I won't be surprised if there are echoes elsewhere.

I assume he's talking about tax deductibility of advertising for business as an ordinary and necessary business expense.

There are those of us who think that corporations should not be "legal people", trying to get rights that were created for people, not corporations. The flip side of this that gets far less attention is that corporations have rights people do not.

The "ordinary and necessary business expense" means that there is an activity fundamental to the core of the existence of a company's interests. The scrutiny is MUCH higher for individuals, who may feel their own core identity needs some advertising, EVEN IF it is not a business.

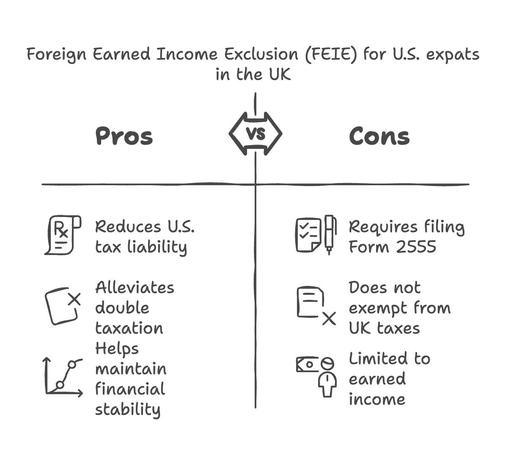

And so ordinary and necessary expenses of simply being alive are not deductible by human people, which seems an abomination. It's ridiculous. For example, interest on loans including high interest credit cards is not deductible by ordinary humans.

It used to be, but that right went away. It is a privilege of the rich now. You can deduct interest related to loans secured against your house. That sounds good, said that way, if you think it's intended to incentivize you to invest in your house. But an implication is that if I buy a pleasure yacht and secure the loan against my house, I can deduct the interest. But if I make ACTUAL upgrades to my home and pay for them on a credit card that is NOT secured against my home, I cannot deduct it.

So, back to the quote, we pay in other ways that are related but more subtle. We are told and eventually come to believe that the "ordinary and necessary expense" thing is a strong argument for justifying that OF COURSE such expenses cannot be seen as "profit". And yet we are routinely taxed in our ordinary lives in ways that are OBVIOUSLY not profit to ourselves, that are obviously taxes on our existence, and that is apparently not obviously something we should get as a reason not to be taxed.

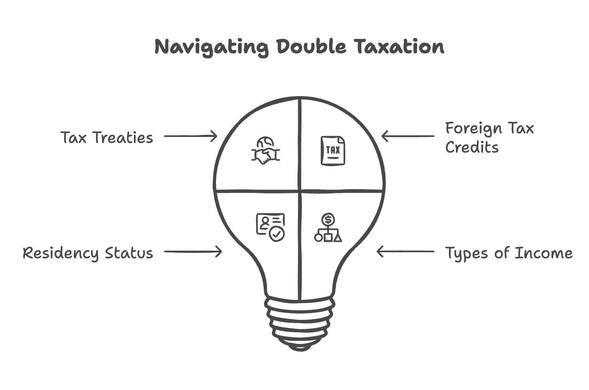

Related reading: My 2009 essay Credit Cards: A Tax on "Being Poor", where I argue that this kind of disparity creates "double taxation" on private individuals.

http://netsettlement.blogspot.com/2009/01/credit-cards-a-tax-on-being-poor.html

#CreditCards #deductible #deductibility #taxation #DoubleTaxation #LegalPerson #corporations