#HDFC Bank is an approved implementing bank under PMMY; it originates #MUDRA loans to eligible micro/small entrepreneurs (Shishu/Kishore/Tarun categories) and disburses the loan to the beneficiary.

Source of funds: The bank uses its own lending resources (deposits/borrowing/capital) to finance the sanctioned loan.

#reliance participates in risk mitigation and credit #guarantee

Both #oligarchy and government scratch the backs of each other

Is it safe to rational to buy anything from tea to #gold to stocks in India?

But what can we do

#cryptocurrency is worse

It has more scam(mer)s than then the gov itself

#risk is not optional for any Indian its a necessity

#HDFC

🚨 Keep an eye on these stocks tomorrow: #Bosch, #HDFC AMC, #Dixon Technologies, #KEI Industries, and #Bajaj Auto – all showing strong momentum and potential breakout setups! 📈💥 Don’t miss the opportunity to ride the trend with expert guidance.

📞 Call & WhatsApp: +91 9522556802

🌐 Website: www.researchaim.com

चंदा कोचर ने दिया था HDFC और ICICI Bank के मर्जर का ऑफर, दीपक पारेख का खुलासा

#ChandaKochhar #DeepakParekh #HDFC #HDFCBank #ICICIBank #HDFCICICIBankMerger #HDFCLtd #Business #BusinessNews #Banking

No I don't want a credit card or to buy your overpriced apartment. Never deal with these guys. It took 2 weeks of spamming the unsubscribe button for hdfc to stop sending their garbage to my email.

#hdfc #chroma #india #rcs #e2ee

Are you an SBI customer? Here’s how new chairman C.S. Setty plans to improve your banking experience

Given that her mother was 80 years old and suffering from Parkinson’s disease, Srinivasan requested the branch manager to verify her identity over a video call. Unfortunately for mother and daughter, the manager was a stickler who insisted on doing things the 20th-century way—nothing less than the physical presence of the octogenarian would satisfy him.

“He refused despite all the background and insisted that my mother come to the branch,” said Srinivasan.

Submitting a life certificate is a yearly ritual for millions of pensioners. Srinivasan explained that it was impractical for her mother, who was in a retirement home in Neral, 80km from Mumbai, to visit the bank. Eventually, she managed to get the verification done online. But her ordeal did not end there. A few weeks later, her mother got a letter from the branch stating that she had to comply with the bank’s KYC (know-your-customer) requirements or the account would be frozen.

A frustrated Srinivasan took to X (the social media platform formerly known as Twitter) to detail her struggles with the bureaucratic mindset that bedevils India’s largest bank. There were numerous responses to her post by X-erati, many detailing their own struggles. That is when officials at SBI took note.

“I do not know where they got my number but I got a few calls to say that the KYC had been sorted. All I wanted was to sensitize them that branch managers need to be more receptive,” she said.

View Full Image

A screenshot of Kajol Srinivasan’s post.For any retail business in India, keeping customers happy is a constant endeavour. But SBI seems to have lots of room for improvement on that front—Srinivasan’s experience was not an isolated one, as evident from the responses to her X post.

Explaining how things have come to this pass, O.P. Bhatt, who helmed SBI between 2006 and 2011, said the nature of work at SBI’s branches has changed over the years. “There is outsourcing and branches have become more of a seller and cross-seller of products, leaving fewer staff to solve customers’ problems,” he said.

And that is perhaps why Challa Sreenivasulu Setty, SBI’s 27th chairperson, is looking at customer service as one of his primary areas of focus. Appointed in August, the new chairman wants to improve customer service across the board—a task easier said than done. The sheer number of branches and people involved—SBI is the banking lifeline for one in every three Indians—make it challenging for a bank of SBI’s size to keep every customer happy all of the time.

“We need to understand the reasons for the existence of friction points in customer service. The idea is to create a frictionless experience,” Setty told Mint during an interview at the bank’s Nariman Point headquarters. “Branches are a critical component in our customer service.”

View Full Image

SBI currently has about 78,000 customer service points.SBI adds 65,000 savings accounts every day, but while some are digital natives, there are many, especially senior citizens, who enjoy banking in person at their branch.

“We have been continuously investing in technologies, and now we have the largest number of ATMs today at around 63,000, strong digital channels, (and) 78,000 customer service points, but we still have a large number of footfalls happening at branches,” said Setty. The challenge, the SBI chief added, is in getting some of these customers to begin using alternative channels.

One way that Setty wants to reduce the load on branches and improve service is by leveraging SBI’s Yono digital banking platform further. “(We have to see) whether we can increase the number of customers who can log in and obtain some basic services like balance inquiry, statement of account or mini statement, and in the process, declutter branches while empowering customers,” said Setty. “We are continuously creating awareness about alternative channels, and decluttering branches will help us in providing quality service to our customers.

What next?

Customer service is just one of many balls that Setty is juggling today. His biggest challenge is to figure out where to steer a bank that is already humongous in size. According to Setty, SBI is at an inflection point. It has a strong balance sheet and a strong digital platform, and is introspecting on how to use these to derive more business.

“Yes, we have a fairly large customer base, but we continue to attract customers, so growth in customers and business is not a challenge,” he said.

To be sure, nothing in the domestic banking sector matches SBI in scale. It has 22,640 branches, 234,000 employees, and a balance sheet of over ₹63 trillion. The closest competitor, HDFC Bank (the largest private sector lender), has a balance sheet of ₹37 trillion.

SBI had a total deposit base of ₹51.2 trillion and loans worth ₹39.2 trillion as on 30 September. It commands a deposit market share of 22.4% and loan market share of 19%, according to news reports of a recent speech by finance minister Nirmala Sitharaman. The bank could soon house one-fourth of all system deposits and one-fifth of all banking system loans.

While he has a sanguine outlook on growth, Setty has taken the reins at a time when the domestic economy is slowing on the back of tepid consumption demand. Given that India’s largest bank’s fortunes are closely intertwined with how the economy performs, Setty, who has called the gross domestic product (GDP) surprise in the September quarter a blip, might have to keep a close watch on toxic assets arising out of the slowdown.

There are already signs of stress among some of India’s smallest borrowers and those whose purchases are funded by credit cards. Although SBI has limited microfinance exposure, it does lend to non-banks that go on to lend to small customers. At the same time, its credit card arm has been reporting weak asset quality numbers for the last couple of quarters.

According to Ashvin Parekh, managing partner, Ashvin Parekh Advisory Services LLP, there are two sets of challenges that Setty will face: the first arises out of what SBI has done or failed to do in the last few years; and the second is around the current state of the banking sector.

“The environment during which Setty has taken the top job at SBI is quite different from when his predecessor Dinesh Khara took over,” said Parekh, adding that Khara was lucky to have come in at a time when the economy was going strong and the banking sector was in the pink of health. Setty, he said, faces a slowing economy and stress in some segments, such as small loans.

Parekh added that Setty must now take a hard look at the bank’s loan book to see if certain exposure needs to be trimmed to avoid being impacted by an economic downturn.

What analysts think

Most analysts are quite upbeat on SBI, although cautious about any surprises on the asset quality front. For instance, J.P. Morgan is overweight on SBI—overweight is a term used to define stocks that are expected to deliver a stronger performance in future. However, it sees a large corporate bad loan hit as something that could derail asset quality. Other risks to its rating and price target include weak loan growth and losses in market share.

Some are watching closely to see how unsecured loans at SBI perform, given how other lenders are seeing signs of stress in consumption loans not backed by collateral. At SBI, 95% of unsecured personal loans are to the salaried classes, where salaries are deposited in SBI accounts, Setty had said in November.

“While Xpress Credit (an SBI personal loan product) GNPAs (bad loans) have increased in the past two quarters to 100 basis points (bps), management expects this increase to be transient and normalize in the coming quarters. This remains a key monitorable given the commentary across peers,” Suresh Ganapathy, managing director and head of financial services research at Macquarie Capital, said on 11 November.

However, analysts at Goldman Sachs are not too happy with SBI’s performance. The investment bank downgraded SBI to a sell rating from neutral earlier. It cited reasons such as lower loan growth in the coming quarters. Moreover, Goldman Sachs also expects an increase in SBI’s credit costs from rising slippages in small business, agriculture loans and unsecured portfolios.

“Further, given the gap in loan growth [16% year-on-year (y-o-y) in Q1 FY25] and deposit growth (8% y-o-y in Q1 FY25) and the bank continuing to lose market share in deposits over the last four quarters, we expect lending growth to moderate…” it said. As per the report, SBI’s market share in deposits has declined from 24% in Q2 of FY24 to 23.4% in Q1 of the current financial year.

Setty seemed unfazed, though. “It’s not about the market share loss; rather, we are focusing on market share gain,” he said. “Today, we have a deposit base of ₹52 trillion, which means that if we grow 10% every year, we will add ₹5.2 trillion, which is akin to adding two small banks to the deposit base.”

The way ahead

SBI traces its origins to the Bank of Calcutta, which was founded by the English East India Company in June 1806 and later renamed as the Bank of Bengal. There were other lenders, too, such as the Bank of Bombay and the Bank of Madras. All three merged in January 1921 to become the Imperial Bank of India, which eventually became State Bank of India after it was nationalized by the government in 1955.

View Full Image

Share of the Bank of Bengal, issued on 13 May 1876. (Public domain, Wikimedia Commons)SBI also had a clutch of subsidiary banks, namely, State Bank of Patiala, State Bank of Bikaner and Jaipur, State Bank of Mysore, State Bank of Hyderabad, and State Bank of Travancore, which were merged into the parent in April 2017 when Arundhati Bhattacharya, the only woman chair of the lender, was at its helm. Bhattacharya and other former SBI chiefs are now keenly watching to see how Setty charts a course forward.

“SBI’s cost-to-income ratio is relatively higher because of pension liability, a factor that impacts many efficiency ratios compared to other banks,” said Rajnish Kumar, a former chairman of the bank. Kumar, who headed SBI from 2017 to 2020, said that the lender has been investing heavily in technology to remain ahead of the curve and has superior risk management practices.

“Yono is the largest digital bank globally,” said Kumar, who is credited with launching the platform (in 2017).

The former chairman who might be the most invested in SBI’s immediate future is Khara, Setty’s predecessor. Pointing to how good the last few years have been for SBI, Khara said that the bank had earned more profits between FY21 and FY24 than it did in the preceding 65 years. He sees Setty continuing the work they started together in the last few years.

“When it comes to customer service, it has been part of my focus as well and he will be continuing that,” he told Mint.

On that front, Pratip Chaudhuri, who was SBI’s chairman from 2011 to 2013, said the new chief should try to empower frontline staff. “Passbook printing earlier required an officer-level employee. I changed the rule to allow clerks to do it as well, allowing us to deploy officers to other, more critical functions,” said Chaudhuri.

Setty wants to make SBI the best bank in India. The idea, he said, is that if somebody is opening an account with SBI, it should not be because of proximity or because their parents had an account. “It should be because the customer sees value in our services,” he declared.

The new SBI chief will certainly have his task cut out to make the lumbering behemoth achieve that ambitious goal. Perusing social media rants about SBI’s customer service could be a good starting point.

Share this:

#ArundhatiBhattacharya #ATM #badLoan #bankingSector #CSSetty #ChallaSreenivasuluSetty #corporateBadLoan #CSSetty #customerService #deposits #digitalBanking #GoldmanSachs #HDFC #NirmalaSitharaman #OPBhatt #pension #pensionLiability #personalLoan #PratipChaudhuri #RajnishKumar #sateBankOfIndia #SBI #SBIChairperson #Yono

HDBFin IPO: HDFC Bank board gives nod to initiate listing of HDBFS through IPO route

Catch all the Business News, Market News, Breaking News Events and Latest News Updates on Live Mint. Download The Mint News App to get Daily Market Updates.MoreLess HomeMarketsIPOHDBFin IPO: HDFC Bank board gives nod to initiate listing of HDBFS through IPO route #HDBFin #IPO #HDFC #Bank #board #nod #initiate #listing #HDBFS #IPO #route

Mitsubishi UFJ Financial Group’s negotiations for a minority stake in HDFC Bank’s consumer lending unit are stalling due to differences over how much say it will have in company strategy, sources say. https://www.japantimes.co.jp/business/2024/07/03/mufg-india-lender-hdfc/ #business #mufg #hdfc #india

नए साल में निवेशकों के लिए उपहार, दुनिया में पहली बार इंडिया में शुरू होगी यह सुविधा

https://newswatchindia.com/gift-for-investors-in-the-new-year-this-facility-will-be-started-in-india-for-the-first-time-in-the-world/

#‘UPIfor secondary market’ launches on Monday #BSE #hdfc #ICICI #IPO, NationalPaymentsCorporationofIndia #new era – in digitalpayments #npci aadharlink #npcicustomercare#NPCI is going to start #npciLinkBank Account#npcilinknpcicomplaint #NPCISecondaryMarket #NPCIsettoLaunchUPI

HDFC Bank Reports Slowdown in Low-Cost Deposits.

#HDFC #HDFCBank #Deposits #LowCostDeposit #SlowDown

https://www.ganganews.com/business/hdfc-bank-reports-slowdown-in-low-cost-deposits/

HDFC Bank Revamps Top Management to Boost Business.

#HDFC #HDFCBank #Business #BusinessNews

https://www.ganganews.com/business/hdfc-bank-revamps-top-management-to-boost-business/

Send in TEENAGE!!!

After this game nobody’s going to be sleeping on the Dynamo.

#houstondynamofc #hdfc #houstondynamo #usopencup #mastodonfc #ForTheH #contratodos

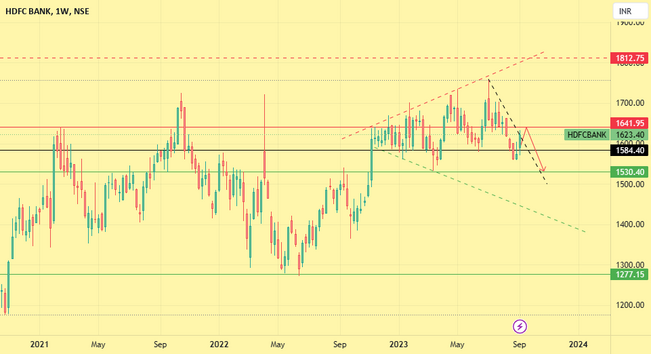

#HDFCBANK #HDFC #Rangebound: #HDFCBANK #HDFC showing weakness, its been range bound and it will be good short 1640 is the area of invalidation if flipped into support http://dlvr.it/SvsbhB 📊 Full Chart 👉 #MarketWatch #stockalerts #stockpicks #wallstreet #StockScreener

After several years of suffering as a fan, it’s surreal to be supporting two teams undergoing a stunning revival simultaneously. #spurs #THFC #coys #HDFC #houstondynamo

Some days it’s hard to be a Dynamo fan. I’m just thankful that the lowest amount of points you can earn per game is zero. #MastodonFC #HDFC

Stock Market: Indices shrug off RBI monetary policy action fear

By S Jha for @theraisinahills

Read: https://theraisinahills.com/stock-market-indices-shrug-off-rbi-monetary-policy-action-fear/

#stockmarket #nifty #banknifty #Larsen #HDFC #equity #investment

📢 A subsidiary of India's largest private bank, #HDFC, is the latest to suffer a massive data breach by the same hacker who was behind the #Acer breach a couple of days ago.

Details: https://www.hackread.com/hackers-india-hdfc-bank-data-leak/

https://www.hdfcergo.com/locators/cashless-hospitals-networks

This is about #HDFCErgo. They updated their list of supported hospitals and sent this link.

The problem is that this link seems to be blocking access to multiple ISPs. #HDFC support conveniently said that they can access this link at their end. So, I imagine that their networking guy managed to keep access enabled only for their own IPs or something.

It wouldn't be a big deal if they would just send me a PDF file but nope. They 'can't' do that! Gotta use the link!