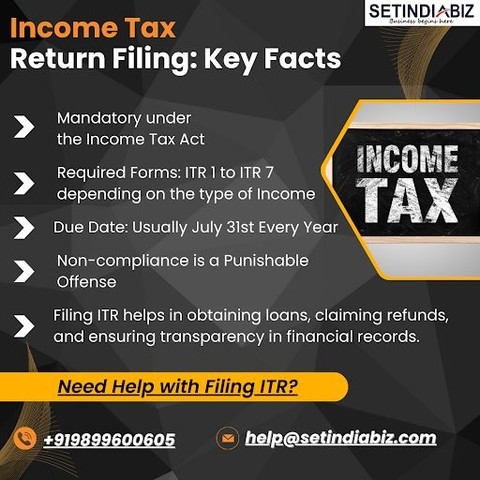

🚨 ITR Due Date Alert 🚨

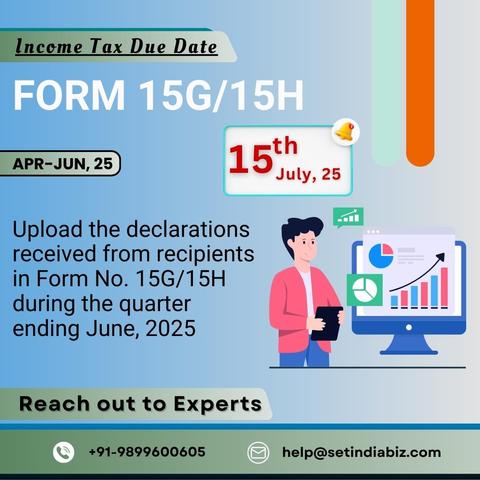

Filing Form 15G/15H Due Date is nearing faster.

File ASAP to ensure compliance.

Stay informed.

Get Expert Help @ https://zurl.co/sn2Am

Join WhatsApp: https://zurl.co/w31G3

#form15g #form15h #duedate #duedatealert #itrfiling #setindiabiz