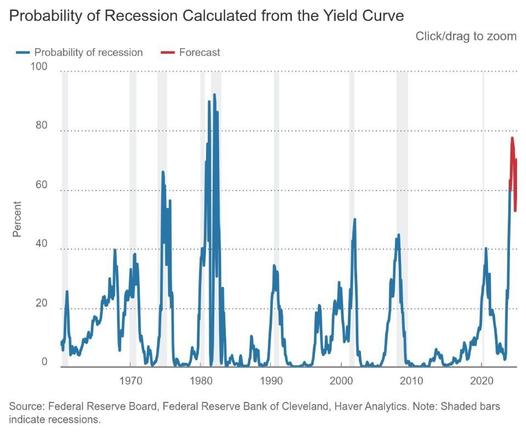

In finance, an inverted yield curve is when interest rates on short-term debt instruments rise above the interest rates of longer-term debt instruments of similar creditworthiness. In other words, this is an unusual situation in which, all else being equal, shorter-term investments return more money than longer-term investments.

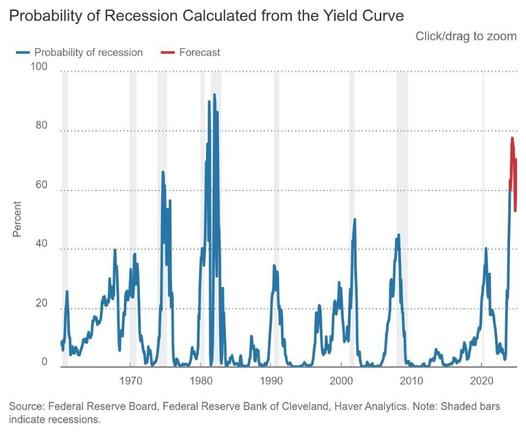

Historically, inverted yield curves on US treasuries have been reliable indicators of impending recessions or economic downturns, and more prolonged inversions generally correlate with more severe crashes, as this video by the Game of Trades investment channel demonstrates: https://www.youtube.com/watch?v=ELF_EivMCMI

(The last 30 seconds of this video are just ads for the channel's trading advice services.)

Our current situation in 2024 is that the yield curve has been inverted for 540 days, which is comparable to the durations of the inversions preceding the 1974 crash and the 2008 global financial meltdown (low 500s each) and second only to the 1929 market crash that kicked off the Great Depression (700).

The stock market is currently still going up, but keep in mind that the stock market went up for a long time after the 2008-era inversion as well: a record 657 days. If the market were to keep rallying for that length of time today, then the crash would begin this August.

2008 showed us that the average person will be angry and more ready to question capitalism itself when events like this happen. As Marxists, we must prepare to do widespread agitation, education, and organizing in its wake, spreading real knowledge about how to understand, resist, and fight back against capital.

#yieldcurve #ustreasury #federalreserve #invertedyieldcurve #recession #crash #financialcrash #financialmarket #economy #economics #news #politics #gfc #globalfinancialcrisis #2008 #greatdepression #depression #yieldinversion #capitalism #socialism #communism #socialist #communist #marxism #marxist #revolution #rev2030 #revolution2030 #tatertube #s4a #socialismforall