💰 Not sure how much to save for the future? It’s more than “whatever’s left.” Use the 25x rule (expenses × 25), automate your savings, and start early to let compounding do the work. Define your goals, reverse-engineer the math, and build your freedom fund. 🧠Read the full article to find out more

✨#SaveSmart #MoneyGoals #FinancialFreedom #LongTermWealth

#MoneyGoals

💼 Got goals? Let’s fund them.

📩 team@the-loan.space

🌐 www.the-loan.space

🚀 Start today. Your future won’t wait.

📲 #TheLoanSpace #FinanceYourDreams #FastLoan #BusinessFunding #HomeLoan #StartupFunding #MoneyGoals #FinancialFreedom #EasyLoan #DreamBig #GetFunded

Need a loan? We make it easy.

Get fast funding for your business, home, or personal goals with THE-LOAN.SPACE.

✅ Quick simulations

✅ Best rates

✅ Full support until approval

📩 team@the-loan.space

🌐 www.the-loan.space

🚀 Your loan, your future, simplified.

📲 #TheLoanSpace #FastLoan #BusinessLoan #HomeLoan #FinanceYourDreams #LoanApproval #FinancialFreedom #InvestInYourself #MoneyGoals #StartupFunding #LoanMadeEasy

✨ Need funding fast?

🚀 THE-LOAN.SPACE helps you get the loan you need, stress-free.

✅ Personal, Business & Mortgage Loans

✅ Fast simulations, best rates

✅ Full support until approval

📩 team@the-loan.space

🌐 www.the-loan.space

✨ Finance your dreams today.

📲 #TheLoanSpace #Finance #Loan #BusinessFunding #Mortgage #StartupFunding #FinancialFreedom #FastLoan #BestRates #InvestInYourFuture #MoneyGoals #FinanceMadeEasy

From monthly trackers to savings plans, our Budget Planner tools are built to help you stay focused. Our Budget Planner collection helps you track expenses, set savings goals, and manage bills with ease. With planners, filler paper, and budget-themed stickers, budgeting just became part of your routine. Shop now at https://thehappyplanner.com/collections/budget

#BudgetPlanner #FinancialPlanning #MoneyGoals #MoneyManagement #HappyPlanner

It’s #NationalSunglassesDay 🕶—and we’re throwing some shade at bad money habits.

Let’s bring some clarity to your financial future:

☀️ Save before you spend

📈 Invest early—even just $50/month

🏖 Automate your money moves

🧴 SPF = Smart Personal Finance 😉

Good vision isn't just for your eyes—it’s for your goals too.

#Investillect #ClarityInFinances #NationalSunglassesDay #Investillect #MoneyMindset #FinanceTips #InvestSmart #FinancialClarity #MoneyGoals #SummerSavings #PassiveIncome #SmartMoneyMove

📊 Want to take control of your budget—without spreadsheets or stress?

The 50/30/20 rule is your new go-to:

🔹 50% = Needs (bills, food, housing)

🔹 30% = Wants (fun, travel, extras)

🔹 20% = Savings + Debt Payoff

This isn’t about restriction—it’s about clarity.

Spend with intention. Save with purpose.

💾 Save this + tag someone ready to get their money right.

#BudgetingMadeSimple #503020Rule #MoneyHabits #FinancialWellness #SmartSpending #WealthBuilder #BudgetTips #PersonalFinance #MoneyGoals #2025

These money goals are probably holding you back... #money #moneygoals #finance

Posted into FLIPBOARD USER GROUP @flipboard-user-group-JanetteSpeyer

These goals aren't the best for your finances... #moneygoals #money #finances

Posted into FLIPBOARD USER GROUP @flipboard-user-group-JanetteSpeyer

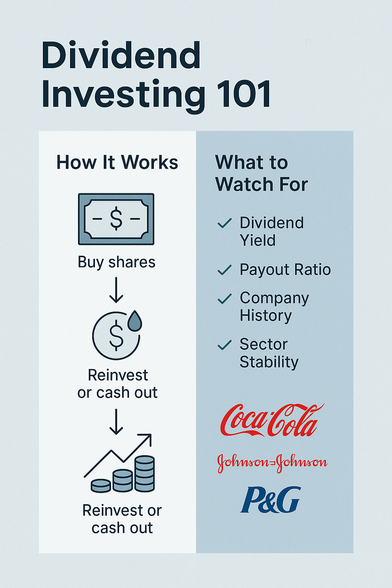

💸 Earn passive income just by holding stocks? That’s dividend investing.

✅ How it works:

Buy dividend stocks

Get paid (usually quarterly)

Reinvest or spend

📌 Don’t chase high yields—check payout ratio, cuts, track record, and stability.

Start small. Stay consistent. Grow rich. 👑

#DividendInvesting #PassiveIncome #InvestSmart #MoneyGoals

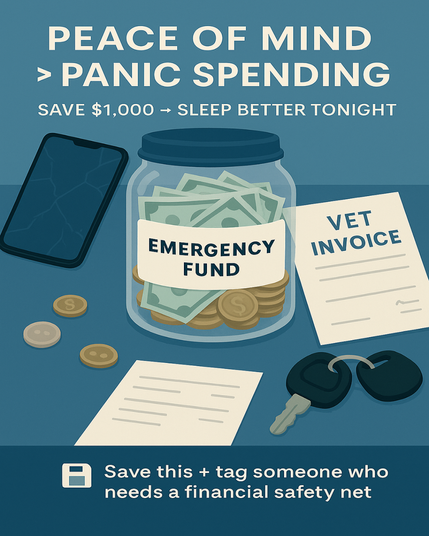

💼 In 2025, having an emergency fund isn’t boring—it’s smart.

Life happens. And when it does, your “rainy day” fund turns chaos into calm.

Start with $500. Build to $1,000. Aim for 3–6 months of expenses.

It’s not about fear—it’s about freedom.

💾 Save this + tag someone who needs a financial safety net.

#EmergencyFund #SmartMoney #MoneyTips #FinancialFreedom #SaveSmart #MoneyGoals #WealthWellness #2025Finance #RainyDayReady #Investillect

Good Things Come to Those Who Budget: A Student’s Guide to Financial Success

By CA Manish Mishra, Founder, GenZCFO

#AsianTalks #StudentFinance #BudgetSmart #MoneyMatters #GenZCFO #CollegeBudgeting #FinancialFreedom #SmartSpending #SaveMoreSpendLess #StudentLifeHacks #MoneyManagement #BudgetTips #FinanceForStudents #ZeroBasedBudgeting #PersonalFinance #FinancialLiteracy #MicroSavingGoals #StudentSavings #MoneyGoals #SmartMoneyMoves #InvestInYourself

Time to set updated financial goals... #moneygoals #money #goal #finance

Posted into FLIPBOARD USER GROUP @flipboard-user-group-JanetteSpeyer

Delayed gratification. It's like a muscle you need to train! 💪

Want that new thing? Save up for it.

Resist the takeaway? Cook at home!

It's about choosing long-term rewards over instant ones.

Anyone else finding their 'patience muscles' getting stronger?

#savings #patience #delayedgratification #moneygoals #discipline

Line 37: I want these M's to come quicker / But I'ma monk on the issue"

Desire for wealth (M’s), but maintaining patience and discipline ("monk").

#MoneyGoals #PatienceBars #HustleMentality #RapDecoded #WooSaah #buddism #LordKrishna

Tired of low savings rates holding back your goals? A money market account could be the answer! With rates reaching 4.75% APY this January, there’s no reason to let your cash sit idle. Time to put your savings to work! Don’t forget to explore FDIC-insured options, too.

https://thecollegeinvestor.com/21940/best-money-market-accounts/

Don't overlook these smart money goals! #moneygoals #personalfinance #goals

Posted into FLIPBOARD USER GROUP @flipboard-user-group-JanetteSpeyer

𝐅𝐢𝐧𝐚𝐧𝐜𝐞 𝐓𝐢𝐩: Challenge yourself! 💪 Embrace a 𝐍𝐨-𝐒𝐩𝐞𝐧𝐝 𝐌𝐨𝐧𝐭𝐡 and watch your savings grow. 🌱 Skip unnecessary expenses, and see how much you can save! Are you ready to take the challenge? 🛑💸

#NoSpendChallenge #SaveMoney #SmartFinances #MoneyGoals #FinancialFreedom #CashinMortgages

Happy New Week.

As we ease out of 2024, it's time to prepare for the January Challenges.

The 21 Day Financial Fast starts on Wednesday. Get a Physical Copy of the book here https://amzn.to/41OQLcD or you a free trial of Audible here https://amzn.to/3BD2DDZ

3. 12 Month Investing Challenge focus for January is Bonds. Book a class here bit.ly/stellasbondclass

What challenge are you participating in?

💓

Stella

#Bemoneysmart #StellaSataMoneyChallenges #moneymatters #moneygoals