President Trump promised no taxes on tips, but workers are still waiting #DonaldTrump #TaxFoundation #Democrats #Minimumwage #MadKingDonald #DementiaDon #Unhinged #FailuretoLead #Unqualified #Incompetence

https://share.newsbreak.com/cvwbkx1z

#TaxFoundation

Oops! A #Rich-People-Friendly #ThinkTank Confirms Our #Richest Pay Under 1 Percent of Their #Wealth Annually in #Tax

A new #TaxFoundation analysis also inadvertently shines a light on the uselessness of ‘adjusted gross #income’ as an indicator of actual #billionaire #economic income.

It's easy to see why #Trump wants to raise #tarrifs and reduce #incometax; it would be a transition to the #flattax that billionaires have always wanted. The #TaxFoundation wrote a pretty good analysis of how the previous and new tariffs did/will harm the economy:

https://taxfoundation.org/research/all/federal/trump-tariffs-biden-tariffs/

The #TaxFoundation’s #TaxEDU curriculum, backed by the #Koch network and major corporations, is promoting pro-business tax policies in public schools. Critics argue that this curriculum misleads students about tax burdens and economic impacts, favoring corporate interests and undermining efforts to make the wealthy pay their fair share. The initiative is part of a broader strategy to shape future taxpayers' views and influence tax policy in favor of the rich.

https://jacobin.com/2024/07/tax-foundation-public-schools-indoctrination

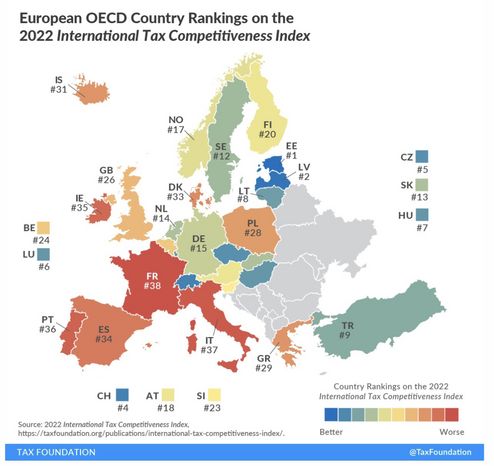

European OECD Country Rankings on the 2022 International Tax Competitiveness Index

Source: TaxFoundation

#taxfoundation #international #taxes #Europe #UE