#Corporate #debt repayment capacity concerns #BOT

🧐"e #centralbank’s 2024 #Thailand Financial Stability Assessment, highly #leveraged large corporations (HLLCs) hv accumulated high debt levels cf w their peers.. tot borrow'g by HLLCs amted Bht6.1tril, w #bankloans contributing Bht2.9tril or 22% of tot corp loans o/s. Borrowing fr corp bonds Bht3.2tril, or 62% of tot corp bonds o/s.. D/E ratio increased (to) 1.23% in 2024. Vs ave D/E ratio for gen listed large corps 0.47%"

https://www.bangkokpost.com/business/general/3010590/corporate-debt-repayment-capacity-concerns-bank-of-thailand

#leveraged

Perhaps the most notorious byproduct of Wall Street’s private equity boom is the #leveraged #buyout,

a revolutionary and controversial investment method that Stephen #Schwarzman and #Peterson helped pioneer at #Blackstone.

For the most part, leveraged buyouts follow a predictable pattern:

A private equity firm buys a company, implements managerial changes designed to increase efficiency and then sells the company at a handsome profit.

But these transactions have drawn scrutiny from Wall Street watchdog groups,

because in most cases, the private equity firm funds its buyout using a large amount of 💥money borrowed by the company being purchased.

Thus, when it resells the company a few years later, 🔥the firm often profits greatly beyond its initial investment, 🔥while the company is left to pay off the debt created by the original buyout.

“It’s all about trying to buy and sell within three to four years,” said Josh Kosman, a financial reporter for the New York Post,

who is the author of “The Buyout of America: How Private Equity is Destroying Jobs and Killing the American Economy.”

“You try to jack up the profits quickly often by cuts in different areas, and then you try to get out and resell it or bring it public.”

According to Kosman, private equity buyouts often lead to layoffs or other cost-cutting measures that actively harm workers.

“Companies who need to pay money back end up not spending enough on research and development, fire more people than their peers, and often they fall behind their peers,” Kosman said.

A case study of Blackstone’s method is the firm’s 2006 investment in the travel reservations business Travelport,

says Celia Weaver, research and policy director at New York Communities for Change, a social and economic justice nonprofit.

Blackstone spent $4.1 billion on the acquisition, and over the next year, Travelport laid off nearly 850 employees, about 10 percent of its total workforce.

A story in The Wall Street Journal documented the human cost of those cuts: lost health insurance, unemployment, workers forced to sell their homes or postpone plans to start a family.

“Travelport took on a lot of debt, which is common in private equity,” Weaver said.

“They will overleverage any asset because their model is to only be in the deal for a short period of time.”

Private equity investment is “inherently predatory,” Weaver said.

But defenders of private equity argue that investment by firms like Blackstone enables struggling companies to regain their footing,

leading to long-term job growth.

School of Management professor Andrew Metrick ’89 GRD ’89 described private equity investors as “radical surgeons”:

The treatment is necessary, even if sometimes a body part must be amputated, or the patient dies.

“I’m relatively certain that if you add up the ledger for contributing to society from Stephen Schwarzman, it’s heavily in the positive standpoint,” Metrick said.

“But you know, he’s broken a lot more eggs to make these omelets than most people do.”

Since the 1980s, Blackstone has evolved significantly, moving beyond traditional buyouts and expanding its reach outside the United States.

After the foreclosure crisis in the late 2000s, the firm became a major player in the real estate business, buying houses through a subsidiary group called #Invitation #Homes.

Indeed, in 2015, Blackstone became the largest owner of real estate in the world.

Claire Parker, a spokeswoman for Invitation Homes, said the company spends an average of $25,000 renovating houses, which is required to meet a 250-point checklist before move-in.

“Invitation Homes brings value to the 120,000 residents we serve by providing access to high quality,

well-maintained homes in close proximity to the neighborhoods and schools they value,” Parker said.

But according to Weaver, Invitation Homes has a track record of poor management.

In 2014, a family sued the company for failing to make repairs to a three-bedroom rental house infested with mold and cockroaches.

“There’s a huge gap between what private equity expects and what the market will deliver, if your goal is stable, long-term housing,” Weaver said.

“No matter what, Blackstone is going to make its profit.”

https://yaledailynews.com/blog/2017/04/07/profit-at-any-cost/

#DonaldTrump is now a "leveraged" man.

To make sure he doesn't become a leveraged President, #VoteBidenHarris in November

#DonaldTrumpIsARussianAsset #Leveraged #LeveragedByPutin

#Chubb #StopFascism #StopAuthoritarianism

#VoteBlue

#leveraged funds' record short UST bets surge again, chart @ReutersJamie @ReutersBiz https://www.reuters.com/markets/us/leveraged-funds-record-short-treasuries-bets-surge-again-mcgeever-2023-10-23/

Less-than-truckload shipping operator Yellow has folded after attempts to make their workforce take a poison pill so that the company could keep staggering on into ruin failed. The #Teamsters have asserted that #Yellow was catastrophically #mismanaged. Other sources say that Yellow's problem was that it was so heavily #leveraged that it couldn't get out from under the debt it had been loaded up with. There's probably truth in both.

FAR TOO MUCH of the modern #business #management world is based on the premise that it's absolutely fine to burn the entire neighborhood down, as long as you stole all the valuables first. Buy up a company to strip its assets and load it up with all of your debt, then walk away. In #MBA world, this is FINE. The lives you destroy don't matter because they're not real people.

I assert once again that the #Harvard School of Business (and its clones throughout the rest of the Ivy League) and its theory of bottom-line management are among the most long-term destructive things to have ever happened to not merely US business, but to the entire US, both #economically and #socially.

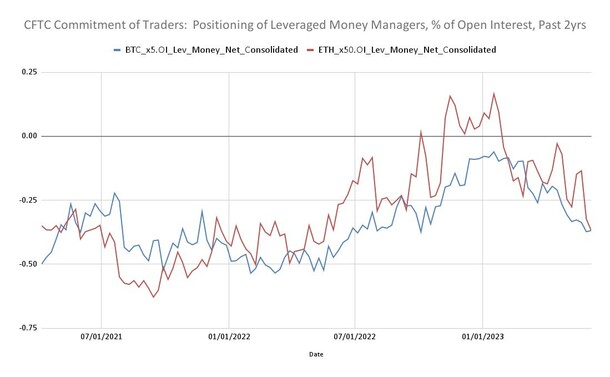

From digging into the positioning data, we can see that both #bitcoin (#BTC) and #Ethereum (#ETH) futures net positioning for #leveraged money managers are net short and are at or near one-year lows, which confirms the relatively bearish expectations for both tokens and, by proxy, the greater #crypto #market. https://social.wubits.io/share/648a0f0b1cd29465d6049c2d?rid=63dffbc796acc11510f0903b&utm_source=link

#leveraged and inverse #ETFs are like walking into a casino – providers argue they are useful, but critics say they are being used for short-term gambling, chart @FT bit.ly/3ChHlZ4

As #bank #lending standards began to tighten last year, a growing share of both #leveraged buyout #LBO financing and highly leveraged #loans have come from direct lenders and other non-banks, chart David Lebovitz @JPMorganAM

Leveraged - Imagine getting paid before you order paid traffic, know you will get a guaranteed ROI. Now imagine building your email list at the same time for free, while others pay you for the traffic. Freaking Awesome!

#leveraged #paidtraffic #arbitrage #traffic

https://www.marketingsharks.com/leveraged-review-bonus-otos-how-to-make-money-from-paid-traffic/

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- #endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔

- $32bn #valuation led by 30-year-old MIT graduate #SBF from a flat in #Bahamas

- #bankrupt in days

- $8bn missing customer deposits (shifted to #Alameda…accident)

- no #CorporateGovernance

- loyalty over #competence

- #toxic #workplace

- celebrity endorsement

- too #leveraged

- key #stakeholders: #prosecutors, #regulators, #investors (#lawsuit), #creditors

#Klarna also getting nervous #BNPL (I know, not the same)

#Regulation needed…or let them #fail…?🤔