"This Tech Boss Wants To Profit From Your Opinions"

#NovaraMedia

Dec 5, 2025

#Gambling #LateStageCapitalism

#Kalshi #cnn #Polymarket #Betting #PredictionMarkets #Predictions

https://www.youtube.com/watch?v=TH6DHPmKkDs

#PredictionMarkets

Metavesco accelerates OTCfi Pulse platform, skipping beta to build fully licensed on-chain prediction market for OTC equities, signaling major innovation in financial technology #FinTech #PredictionMarkets

Hmmmm - prediction markets are now "data". Prediction Markets are on tear.

CNN strikes up an exclusive partnership with Kalshi and will access Kalshi's data through an API that auto-updates in real time. The data feed will be featured on CNN's air with a real-time data ticker and will include Kalshi content related to politics, news, culture and weather. https://www.axios.com/2025/12/02/cnn-kalshi-prediction-market-data #CNN #Kalshi #News #PredictionMarkets #Data #Prediction #Politics #Culture #Weather

Robinhood has entered the prediction markets sector through the acquisition of LedgerX, sending its shares up 10% as analysts highlight the strategic importance of this move for the company’s growth and market share.

#YonhapInfomax #Robinhood #PredictionMarkets #LedgerX #SIG #SharePriceSurge #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=92800

📈 The surge in #PredictionMarkets revenue at Robinhood highlights a shift towards alternative investment vehicles. This trend warrants closer examination for its impact on speculative behavior and risk exposure within the broader Robinhood user base. (2/8)

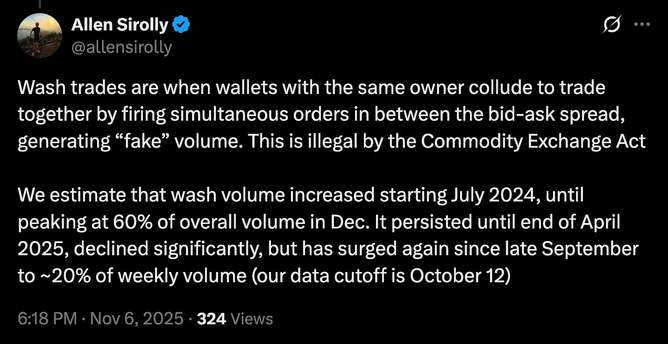

some Columbia professors just published a study of how prevalent wash trading and manipulation are on #predictionmarkets like #Polymarket and #Kalshi where you can bet on things like elections and wildfires is (spoiler: it’s so prevalent it was actually the majority of all betting activity around the time of the 2024 #election, a time when the prediction market numbers were reported by the media as if they were as good as polling data)

> "We estimate that wash [trading] volume [on Polymarket] increased starting July 2024, until peaking at 60% of overall volume in December"

i would wager this is almost certainly an undercount but overall a very impressive stab at getting a real number on this kind of thing.

* thread summary of findings: https://x.com/allensirolly/status/1986573995051774044

* paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=5714122

#crypto #USDC #cryptocurrency #uspol #elections #PredictionMarket

Google Finance expands AI capabilities with Deep Search and prediction markets: Google Finance adds Deep Search, prediction markets from Kalshi and Polymarket, live earnings tracking, and launches in India with English and Hindi support. https://ppc.land/google-finance-expands-ai-capabilities-with-deep-search-and-prediction-markets/ #GoogleFinance #AICapabilities #DeepSearch #PredictionMarkets #LiveEarningsTracking

Robinhood Markets Inc. delivered a surprise Q3 earnings beat, with revenue more than doubling year-on-year to $1.27 billion and net income surging, driven by rapid product expansion and strong growth in its Prediction Markets business.

#YonhapInfomax #RobinhoodMarkets #Q3Earnings #RevenueGrowth #PredictionMarkets #TransactionBasedRevenue #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=89542

Curious about Prediction Markets? Here is a good foundation/primer on these markets including risks from the BowTiedBull team.

https://defieducation.substack.com/p/primer-on-prediction-markets #PredictionMarkets #Kalshi #PolyMarket #Crypto #Gambling #DeFi #SubStack #PredicttheFuture

congratulations americans, you will soon be able to bet on the outcome of the 2026 elections at a business operated by an infernal conglomeration of the trump family and an organized crime adjacent crypto exchange (Crypto[.]com) whose assets were seized by the Bank of #Lithuania for #moneylaundering for #Putin a few years ago.

what could go wrong?

* Fortune: https://fortune.com/crypto/2025/10/28/trump-media-prediction-markets-crypto/

* Crypto Dot Con?: https://cryptadamus.substack.com/p/are-cryptocom-and-binances-european

#election #predictionmarkets #uspol #trump #CryptoCom #crypto #cryptocurrency #eupol #russia #ukraineWar #ukraine #Kalshi #polymarket

Prediction markets are rapidly transforming from curiosities into serious financial infrastructure — yet regulators still can’t decide whether they’re innovation or gambling — bank analysts recently referred to Kalshi and Polymarket's sports contracts as "untaxed gambling."

Kalshi has began offering contracts tied to major sporting events like the Super Bowl, and last month expanded its sports-related offerings with pre-made and custom parlays.

Beyond sports, platforms are expanding into economic and technological events. Users can now trade contracts on outcomes like the U.S. Federal Reserve's interest rate decisions or the success of AI startups.

CFTC regulates these markets as derivatives offering event contracts, yet, a number of states are challenging arguing that prediction markets are unlicensed gambling with some states issuing cease-and-desist orders. https://www.investopedia.com/prediction-market-kalshi-valuation-has-more-than-doubled-to-usd5b-in-just-3-months-here-is-why-11828197 #PredictionMarkets #Gambling #Kalshi #PolyMarket #CFTC #USGov #SportsGambling #Regulation

🎲 New Prediction Bet

Market: Fed rate hike in 2025?

Betting €1.13 on "No"

Probability: 98.8%

Potential profit: €0.01

Very high confidence but low return

Good liquidity: $591,769.908

Longer time horizon

🎲 New Prediction Bet

Market: Fed rate hike in 2025?

Betting €1.13 on "No"

Probability: 98.8%

Potential profit: €0.01

Very high confidence but low return

Good liquidity: $591,769.908

Longer time horizon

🎲 New Prediction Bet

Market: Fed rate hike in 2025?

Betting €1.13 on "No"

Probability: 98.8%

Potential profit: €0.01

Very high confidence but low return

Good liquidity: $591,768.788

Longer time horizon

🎲 New Prediction Bet

Market: Fed rate hike in 2025?

Betting €1.13 on "No"

Probability: 98.8%

Potential profit: €0.01

Very high confidence but low return

Good liquidity: $591,768.788

Longer time horizon

Intercontinental Exchange to Invest $2 Billion in Prediction Market Platform Polymarket

Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, is set to invest up to $2 billion in Polymarket, a crypto-based prediction market platform. This investment values Polymarket at approximately $8 billion and marks a strategic partnership that aims to leverage ICE's infrastru... [More info]

Who is your Bookie?

In-game or live betting are now the dominant drivers of revenue growth for the sports gambling industry - now accounting for more than half the money wagered on FanDuel and DraftKings. But it’s not all rosy for the well known sport betting platforms who have seen their stock prices under pressure the past few months. https://www.thestreet.com/markets/gambling-apps-meet-their-match-as-cheaper-regulated-prediction-markets-foray-into-sports-cultural-events

Prediction markets are coming up fast on the outside with Polymarket and Kalshi rapidly gaining popularity. Robinhood has partnered with Kalshi to provide trading on pro and college football, other sports, politics, and economic events as alternative to traditional betting by treating trades as commodities rather than wagers – thus avoiding gambling laws. https://www.coindesk.com/business/2025/08/19/robinhood-partners-with-kalshi-to-launch-pro-and-college-football-prediction-markets #SportsBetting #Betting #Gambling #DraftKings #FanDual #PolyMarket #Kalshi #Robinhood #NFL #NCAAFootball #PredictionMarkets #Commodities #InGameBetting

"When billionaire Bill Ackman suggested on Twitter that Eric Adams could “place a large [Polymarket] bet on Andrew Cuomo and then announce [his] withdrawal” from the New York City mayoral race, he described something that feels profoundly illegal. A politician profiting from non-public knowledge of their own withdrawal from an election surely crosses some line — insider trading? Market manipulation? Election interference? Illegal gambling? Ackman ended his tweet: “There is no insider trading on Polymarket” — not because it doesn’t happen, but because it won’t be charged. He’s right: the Securities and Exchange Commission’s insider trading rules don’t apply here. But that leaves the question: what rules, if any, do?

As Ackman says, prediction markets fall outside the SEC’s jurisdiction, living in a different regulatory world than stock markets where executives get prosecuted for trading on non-public earnings or tipping off friends about upcoming mergers. Unlike crypto’s ongoing turf wars between regulators, prediction markets have a clear home: the Commodity Futures Trading Commission, which oversees futures, swaps, and other derivatives trading. A farmer worried about a poor wheat harvest can buy futures contracts that rise in value if wheat prices increase, helping to offset the money lost from selling less grain. An airline can buy oil-based futures contracts to offset the risk of jet fuel costs rising, effectively letting them budget fuel at today’s prices even if market rates climb before delivery. Some derivatives markets more closely resemble prediction markets, dealing in events rather than commodities — for instance, ski resorts can hedge against poor snowfall by trading weather-based contracts.

While farmers hedging wheat prices serves a clear economic purpose, prediction markets operate in murkier territory."

https://www.citationneeded.news/prediction-markets-oversight/

#USA #PredictionMarkets #MarketManipulation #Elections #Polymarket #Kalshi

One thing is certain: these markets are going to rapidly proliferate as new companies enter the space — from exchanges like Crypto.com and Robinhood to gambling platforms like FanDuel. And they’re likely to push for even more types of contracts.

Regulators need to grapple with these questions before the industry grows too big to effectively control. The cryptocurrency industry has shown how difficult it becomes to implement meaningful oversight once a poorly regulated industry accumulates enough money and political influence to push back.