How 2000 Aussie punters helped me raise $85,000 to put billboards across the country exposing gas companies' tax dodging - including one massive billboard right outside #Woodside HQ where every executive can see that Aussie teachers pay more tax than their entire industry.

#gas #gascartel #taxdodging #auspol #punterspolitics

#TaxDodging

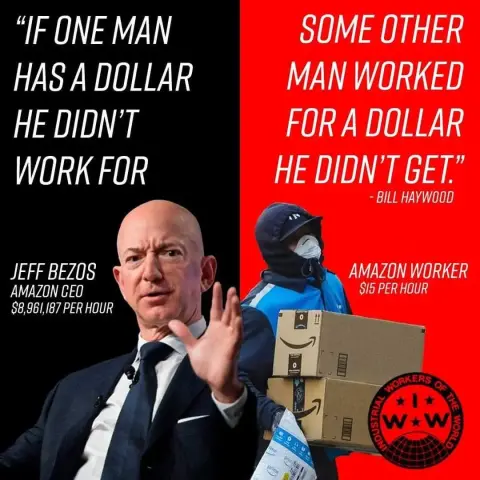

And they should only be paid for the time they are actually working, not a second more!

- After all, if it's okay to not pay school teachers during summer vacation, then those #billionaire #bootlickers can also survive that!

Also every kind of income should be taxed like #WageWork and #BuyBorrowDie needs to be criminalized as illegal #TaxDodging and #SocialSecurityFraud!

- Plus make it illegal to attain any #donations, #contributions or #gifts whatsoever and prosecute any attempts as #corruption!

#USpol #Inequality #MinimumWage #Medicare #Medicaid #SocialSecurity #Taxes #FairShare #Accountability #Consequences #Justice #Equality

So much for Rachel Reeves' ruthless dash for growth.

News Corporation has misled the Australian Parliament. In a Senate submission, they claimed Foxtel pays “millions of dollars” in income tax, GST, and payroll tax—unlike their international competitors. However, Foxtel was actually paying zero income tax at the time. Lying to the Senate can result in imprisonment, but ‘contempt of Parliament’ laws are rarely enforced.

#NewsCorp #Foxtel #TaxDodging #Accountability #AusPol #MediaManipulation #CorporateGreed #Parliament #Transparency

https://michaelwest.com.au/rupert-murdochs-foxtel-misleads-parliament/

From 2017: #BernieSanders: We must end #GlobalOligarchy

"Greed is their religion."

By Bernie Sanders, November 13, 2017

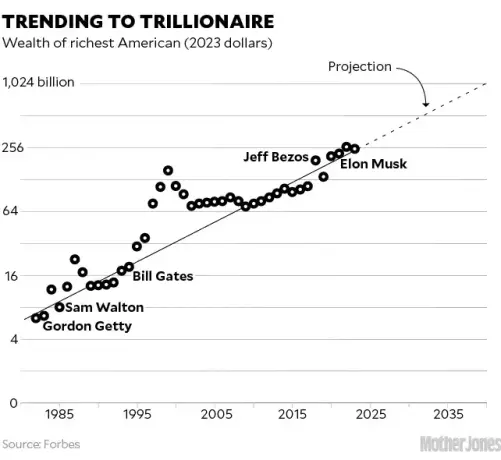

"One of the major, untold stories of our time is the rapid movement toward global #oligarchy, in which just a handful of# billionaires now own and control a significant part of the world economy [and the US government in January 2025].

"Here in the United States, the top one-tenth of 1% owns almost as much wealth as the bottom 90%. Incredibly, according to a recent report from the Institute for Policy Studies, three of the richest people in America – #BillGates, #JeffBezos and #WarrenBuffett – now own more wealth than bottom 160 million people in our country.

"But this is clearly not just an American issue. It is a global issue. While millions of people throughout the world live in dire poverty, without clean drinking water, adequate health care, decent housing, or education for their kids, the six wealthiest people in the world as ranked by Forbes Magazine own more wealth, according to Oxfam, than the bottom half of the world’s population, 3.6 billion people.

"This massive level of wealth and income inequality, and the political power associated with that wealth, is an issue that cannot continue be ignored. We must fight back.

"Thanks to the so-called #ParadisePapers, a trove of millions of documents analyzed by the International Consortium of Investigative Journalists (#ICIJ) and its collaborating news outlets, we now have a better understanding of how the largest corporations and wealthiest people in the world avoid paying their taxes and hide ownership of assets. Needless to say, these billionaires are all strong supporters of our military, our veterans, our infrastructure, our schools and other government services. They would just prefer that you pay for those activities, not them.

"According to the ICIJ’s investigative reporting, the Americans listed as having offshore accounts in the Paradise Papers, (which have not been independently reviewed by CNN), are a who’s who of billionaires, some of whom are the very same officials who have led the effort to promote the Republican tax plan, which would provide even more tax-avoiding opportunities to the very rich.

"Even before these revelations, we knew that #TaxDodging by the #wealthy and large #corporations, not just in the US but globally, was taking place on a massive scale. In 2012, the Tax Justice Network, a British advocacy group, estimated that at least $21 trillion was stashed in offshore tax havens around the world. In other words, while governments enact austerity budgets, which lower the standard of living of working people, the super-rich avoid their taxes.

"According to Berkeley economist Gabriel Zucman, individuals in the US are avoiding $36 billion through offshore tax schemes and US corporations are avoiding more than $130 billion through these schemes. The situation has become so absurd that one five-story office building in the #Caymans is now the 'home' of nearly 20,000 corporations – and that is just one of many tax havens operating across the globe.

"The essence of oligarchy is that the #BillionaireClass is never satisfied with what they have. They want more, more and more – no matter what impact their efforts have on working people, the elderly, children, the sick and the poor. Greed is their religion. While the oligarchs are avoiding their taxes, Trump and his Republican colleagues, ostensibly in order to save federal dollars, have been trying to throw tens of millions of Americans off of their health insurance, and make massive cuts in education, nutrition assistance and affordable housing.

"As a candidate for president, Trump promised that he would stand up for the working class of this country. Needless to say, that was a lie. Almost half of the benefits in the Trump/Republican tax plan would go to the top 1%, according to the Center for Budget and Policy Priorities. Additionally, they want to lower the corporate tax rate from 35% to 20%, even though in 2012 one out of every five large, profitable corporations in the US paid no federal income taxes at all and between 2008 and 2015, 18 corporations had a tax rate lower than 0%.

"Republicans also want to make it easier for companies to shelter their profits overseas and pay zero taxes. The 'territorial tax system' they are proposing, which means companies would be taxed only on income earned within our country’s borders, would exempt the offshore profits of American corporations from US taxes and allow for a one-time 12% tax on their offshore cash profits when brought back into the United States.

Get our free weekly newsletter

"Meanwhile, while the wealthy and large corporations are receiving huge tax breaks, nearly half of middle-class families would actually see their taxes go up by the end of the decade by eliminating deductions for medical expenses, student loan interest rates, state and local income and sales taxes, and the cost of health insurance for the self-employed.

"The Paradise Papers make it clearer than ever that we need, in the United States and throughout the world, a tax system which is fair, progressive and transparent.

"Now is the time, in the United States and internationally, for people to come together to take on the greed of the oligarchs. We can and must create a global economy that works for all, not just a handful of billionaires."

https://www.cnn.com/2017/11/13/opinions/oligarchy-paradise-papers-bernie-sanders-opinion/index.html

#USPol #GlobalPol #Corporatocracy #Oligarchy #Oligarchs #Trump #CorporateFascism #HungerGames #StillSanders

[Disclaimer: I haven't fact-checked whether Graham Norton really said this. But the source is not what this post is about, so 🤷.]

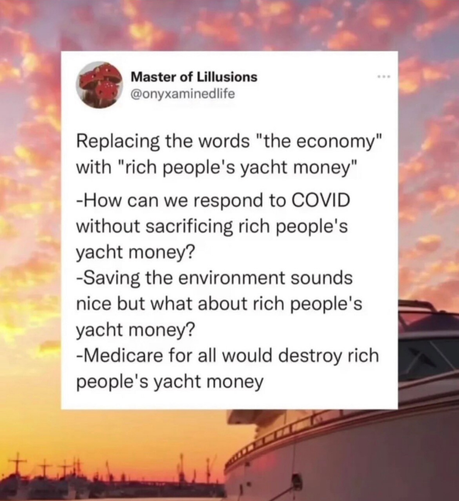

The secret to tax-dodging?

Be rich.

https://www.counterpunch.org/2024/08/06/the-secret-to-tax-dodging-in-america-be-rich/

Super-rich being advised how to avoid Labour tax clampdown, undercover investigation suggests.

No sh*t, Sherlock. Life’s inevitabilities:

Death, taxes & loopholes.

One of many reasons why England is a mess. Boarding schools for the so called rich people...

#eton #clique #taxdodging #corruption #brexit #mobbusiness

https://edition.cnn.com/2024/06/20/business/uk-private-school-fees-labour/index.html

Football......jus to put it in perspective regarding venture capital in the UK

Westham 446,60 Million Net Worth (place 7 in the Premier League)

Freiburg 189,20 Millionen Net Worth (place 8 in Bundesliga)

#capitalism #football #fcfreiburg #taxdodging #brexit #venturecapital #clowns

World’s biggest #scam – #billionaires, #multinationals #taxdodging – can’t be fixed by #talkfests for one simple reason: the #USA will never agree to a plan where their billionaires and multinationals pay more #tax in other countries like #Australia

2015: #Sanders Statement on #TaxDodging Companies

April 9, 2015

BURLINGTON, Vt., April 9 – "Sen. Bernie Sanders (I-Vt.), the Senate Budget Committee ranking member, today issued the following statement on new data showing the extent to which some American companies are avoiding taxes:

"'I applaud Citizens for Tax Justice for releasing new data today revealing the unfairness of our tax system and the fact that a number of the biggest and most well-known corporations in America continue to pay little or nothing in taxes.

"'At a time when we have massive #wealth and income #inequality, and when #corporate profits are soaring, it is an outrage that many large, profitable corporations not only paid nothing in federal income taxes last year, but actually received a rebate from the IRS last year.

"'Instead of balancing the budget on the backs of the #elderly, the #children, the sick and the #poor, as the Republicans in Congress have proposed, we need a tax system that demands that large, profitable corporations and the wealthy start paying their fair share in taxes. I look forward to working with my colleagues in the coming months to make certain that happens.'

Top Ten Corporate Tax Dodgers from Citizens for Tax Justice’s Report

1. Not only did media giant #TimeWarner pay nothing in federal income taxes last year, it received a rebate of $26 million from the IRS even though it made $4.3 billion in U.S. profits.

2. #CBS made $1.8 billion in U.S. profits last year, but instead of paying federal income taxes it received a rebate from the IRS of $235 million.

3. #Xerox made $629 million in U.S. profits in 2014, but received a tax rebate of $16 million from the IRS.

4. #Prudential Financial made $3.5 billion in U.S. profits last year, but instead of paying federal income taxes, it received a tax rebate of $106 million from the IRS.

5. The toy maker #Mattel made $268 million in profits last year, but received a tax rebate of $46 million from the IRS.

6. #Priceline.com not only paid nothing in federal income taxes last year, it received a tax rebate of $9 million, even though it made $73 million in profits last year

7. #PacificGasAndElectric not only paid nothing in federal income taxes last year, it received a tax rebate of $84 million from the IRS even though it made $1.8 billion last year.

8. Wireless technology maker #Qualcomm made $3.2 billion in U.S. profits last year, but instead of paying federal income taxes, it received a refund from the I.R.S. of $98 million.

9. #GeneralElectric made over $5.8 billion in profits in the U.S. last year, but paid just 0.9 percent of that amount — less than one percent — in federal income taxes.

10. #Jetblue Airways made $615 million in U.S. profits last year, but paid just 0.4 percent of that amount — less than half of one percent — in federal income taxes.

Source:

https://www.sanders.senate.gov/press-releases/sanders-statement-on-tax-dodging-companies/

#Oligarchy

#OilAndGasIndustry

#Oiligarchy

#Corporatocracy

#Corporatism

Tweets That Really aged Like Milk, Part 743 ...

So no UK broadcast news coverage of #NadhimZahawi and his #TaxDodging antics. Why?!

Forgot the #Sexist,#Rapist, #Taxdodging, #Immoral, #Incompetent, #Bullying, #Ugly, #Selfish, #ManSloth #Cockwomble... have I missed anything???

#Trump

Amazon’s Hidden Worldwide Subsidies

http://www.uni-europa.org/news/amazons-hidden-subsidies

https://www.uni-europa.org/wp-content/uploads/sites/3/2022/02/amazon_subsidies_report.pdf

"Amazon, notorious tax-dodger, extracted at least $4.7 billion in subsidies from taxpayers globally. The total amount of tax breaks received by Amazon “could be significantly higher”. Amazon, the $1.4 trillion tech juggernaut and notorious tax-dodger, is not only vying for more consumers’ dollars, it also aggressively seeks taxpayers’ money."

#Amazon confirms it pays #UK #business rates of only £63.4m | #Technology | The Guardian

https://www.theguardian.com/technology/2019/jan/09/amazon-confirms-uk-business-rates

Why do people care more about #benefit #scroungers than #billions lost to the #rich? | Robert de Vries and Aaron Reeves | #Opinion | The Guardian