RBA cuts interest rate to 3.85%—first reduction since 2020! With inflation below 3%, property experts project housing prices to rise 4-6% in 2025. Could this trigger the property market turnaround we've been waiting for? #AusEconomy #RBA #HousingMarket https://bit.ly/43ojuUy

#auseconomy

🚨 3 MILLION Aussies could get a pay rise! Albanese Gov just backed real wage increase for cleaners, retail workers & childcare staff. Inflation now at 2.4%, within RBA target. How will this affect YOU? #AusEconomy #WageGrowth #FairWorkAU https://www.readmencari.com/p/wage-boost-albanese-government-backs

BREAKING: Australia adds 89,000 jobs in April with women securing 73% of new positions. Unemployment steady at 4.1% while participation among parents hits record 88.3%. Is the future of work female? Full analysis: #AusEconomy #JobsData https://www.readmencari.com/p/australias-employment-boom-women

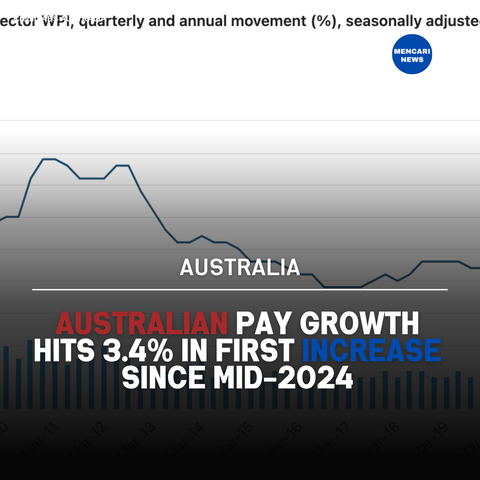

📈 BREAKING: Australian wages grow 3.4% in year to March, first acceleration since mid-2024. Public sector leads at 3.6% while enterprise agreements drive over half of all growth. What does this mean for your paycheck? #AusEconomy #WageGrowth https://www.readmencari.com/p/australian-pay-growth-hits-34-in

💸 BREAKING: Inflation down from 6% to 2.4%, jobs growing, real wages up. "We're turning the corner," says PM Albanese. 20% off HECS debt + cheaper childcare on offer. Is your wallet feeling the difference? #CostOfLiving #AusEconomy

New survey reveals financial struggles for many Australians: 1 in 5 have less than $100 in savings, while 10.3% have no savings but are debt-free. 15.8% are in debt or seeing it grow, and 26.5% say their savings are declining or they’re saving less than usual. Only 4.2% saved more in the past year, with 16.6% managing to save consistently. #FinancialWellness #SavingsStruggles #ausecon #auseconomy #auspol

Australian mortgage holders are facing a financial squeeze, with monthly home loan repayments hitting $14.5 billion in June 2024, according to Reserve Bank data. Shockingly, 66% of this was just interest, a $5.5 billion rise since March 2022. Many are desperately waiting for rate cuts to ease the burden. #HomeLoans #InterestRates #RBA #Auspol #auseconomy #massimmigration

More people are seeking help as Australia's economy slows down, #RBA governor acknowledges "Some may ultimately make the difficult decision to sell their homes"

#ausecon #auspol #LuckyCountry #BetterNotBigger #auseconomy

https://www.abc.net.au/news/2024-09-05/rba-michele-bullock-more-australians-seeking-help-cost-of-living/104313588

Why Australia's Economy is Doing Surprisingly Badly - #auspol #dutchdisease #auseconomy https://www.youtube.com/watch?v=o5mE_ZVp34U

Canada and Australia rolled the dice on housing—and lost.

IFM Investors’ Chief Economist shared this chart highlighting the stark divergence in household debt between Australia, Canada, and the United States. It’s a telling comparison that speaks volumes about economic strategy. #housing #ausecon #auseconomy

https://www.macrobusiness.com.au/2024/08/canada-and-australia-bet-on-housing-and-lost/

Tsunami of financial distress: a sad indictment of society. Banks' lenient lending during record-low interest rates has led to today's #mortgagecrisis. They knew it was unsustainable once rates rose. #FinancialCrisis #MortgageCrisis #BankingReform #ausecon #auseconomy #auspol #bankingroyalcommission

Australia's #housingcrisis is a complex issue . Several factors and policies over decades have contributed to the current state of the housing market, including:

1. Supply and Demand: A growing population, increased immigration numbers, particularly in major cities, has driven up demand for housing. Limited supply, due to zoning laws and other regulations, has exacerbated the issue.

2. Negative Gearing and Capital Gains Tax Concessions: Policies that allow property investors to deduct losses on rental properties from their taxable income (negative gearing) and concessions on #capitalgains tax have been criticized for inflating property prices. These policies have been in place for many years and have been supported by both major political parties at different times.

3. #ForeignInvestment: Increased foreign investment in Australian property, particularly from Chinese buyers, has also been cited as a factor driving up prices. Policies regulating foreign investment have evolved over time but have often been seen as insufficient.

4. Monetary Policy: Low interest rates set by the Reserve Bank of Australia (#RBA ) have made borrowing cheaper, contributing to higher property prices.

5. Government Incentives: Various government incentives, such as first-home buyer grants and other subsidies, while intended to help buyers enter the market, can also contribute to price inflation by increasing demand.

6. Urban Planning: Inefficient urban planning and infrastructure development have limited the availability of affordable housing, particularly in well-connected areas.

If one were to identify a turning point, some analysts point to the late 1990s and early 2000s, during the tenure of Prime Minister #JohnHoward, when policies like the relaxation of capital gains tax in 1999 and the support for #negativegearing were solidified. These policies are often cited as significant contributors to the property investment boom.

However, it is important to recognise that both major political parties in Australia (Liberal and Labor) have had opportunities to address these issues over the years and have made various policy decisions that have contributed to the current situation.

#rentalcrisis #auseconomy

A photo showing near hundreds of people queueing up for a food bank in an inner-city suburb reflects "the sad new reality of our country", Aussies say, with charity organisers warning the number of those seeking help has "grown exponentially" in recent months #auspol #BetterNotBigger #auseconomy #greed

There are claims that international education is a $48 billion export industry funding public programs like the NDIS and Medicare. In reality, it's a people-importing migration industry that generates far less export income. Without generous work rights and pathways to permanent residency, the industry would collapse. The Australian Bureau of Statistics inflates the $48 billion figure by including all student spending, much of which is earned within Australia.

#ausecon #auseconomy #auspol

Why Living in #Australia is Becoming Impossible

Australia boasts the 13th largest economy in the world, beautiful beaches, access to world-class education, universal #healthcare, and much more. However, skyrocketing #housing prices and rental rates have made Australia one of the most unaffordable places to live. What are the key causes of this affordability crisis? Factors include high immigration, bureaucratic red tape, tax incentives, declining investment, and more.

By examining these issues, we can uncover the real reasons behind Australia's housing market problems and suggest potential solutions.

#auspol #ausecon #auseconomy #housingcrisis #negativegearing

A farmer from New South Wales recently visited Japan and discovered that Australian #meat was being sold in Tokyo for less than it costs in major Australian supermarkets. Analysts argue that direct comparisons can be "misleading" without accounting for factors such as global import competition, differences in meat cuts, and exchange rate fluctuations. Although #Coles and #Woolworths have denied allegations of price gouging, the #ACCC is set to release an interim report on its inquiry into supermarkets by August.

#ausecon #auseconomy #auspol

https://www.abc.net.au/news/2024-05-28/australian-beef-cheaper-tokyo-supermarket-than-coles-woolworths/103897144

Rising rent? Mega mortgage? Cozzielivs? 'Hardship' help hard to get, as banks fail to help those who need it.

A recent #ASIC report reveals that lenders' hardship processes are so challenging that many struggling customers give up. Mortgage hardship notices surged by 54% in the last three months of 2023 compared to the same period in 2022.

ASIC criticises banks for not complying with legal obligations to assist customers, as rising interest rates, soaring rents, and living costs push more borrowers into financial trouble.

ASIC plans further legal action against non-compliant lenders. #FinancialHardship #ASIC #BankingReform #ausecon #auseconomy #banks

https://www.abc.net.au/news/2024-05-20/hardship-help-hard-to-get-as-banks-fail-to-help-those-in-need/103860130

Amidst soaring cost of living expenses, Australians are adapting their #coffee habits, favouring cheaper alternatives like instant coffee over frequent cafe visits. As a result, cafes grapple with dwindling customers and increased costs, signalling potential coffee price hikes. #CostOfLivingPressures #CoffeeShifts #auseconomy #ausecon https://www.abc.net.au/news/2024-05-14/cost-of-living-coffee-costs-cafes-instant-sales-rising/103824058

#Australian economy comes in for crushed landing. The not-so-secret sauce of the crushed landing is, of course, the #massimmigration-led, labour market expansion growth model that so pleases fat rent-seekers and corrupt politicians but pulverises the living standards of the per capita Australian. #auspol #ausecon #auseconomy #BetterNotBigger #sustainability

https://www.macrobusiness.com.au/2024/04/australian-economy-comes-in-for-crushed-landing/

Almost half of all Australian have less than $1000 in savings in their bank account, while one in five have none at all, shocking new data has revealed. #auseconomy #inequality ##BetterNotBigger #greed #homelessness #auspol