@Domino #Russia is welcome to have their #FrozenAssets in #Europe returned after they pay roughly 1 trillion in reparations to #Ukraine. After that, whatever they want to do with their assets, if they have any left, is their business.

#frozenAssets

Europe’s High-Stakes Gamble: Unlocking Frozen Russian Assets for Ukraine

EU’s Plan to Leverage Frozen Russian Assets for €140B Ukraine Loan: Economic Risks & Retaliation Fears

In the shadowed corridors of Brussels, where the weight of history and the urgency of the present collide, European leaders are charting a course that could redefine the boundaries of economic warfare. It’s October 2025, and with Ukraine’s defenses stretched thin and Western economies groaning under the strain of prolonged support, the European Union is inching toward a audacious financial maneuver: harnessing the power of approximately $300 billion in frozen Russian central bank assets to fuel a lifeline for Kyiv. This isn’t a simple transaction; it’s a delicate dance on the edge of international law, one that promises relief for Ukraine but whispers warnings of broader instability. As Germany, France, and the United Kingdom—core pillars of the G7—push forward, the question hangs heavy: what happens when the line between sanction and seizure blurs? And in the worst-case scenario, how might this gamble unravel Europe’s creditworthiness and provoke a vengeful response from Moscow?

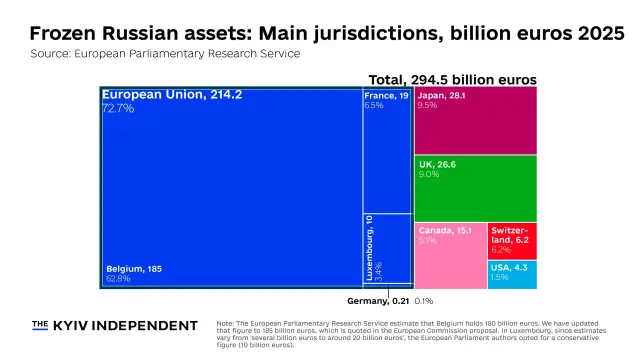

The roots of this saga trace back to February 2022, when Russia’s full-scale invasion of Ukraine triggered a swift and unprecedented global response. Western nations, led by the United States and the European Union, froze roughly $300 billion in assets belonging to Russia’s Central Bank—funds intended to stabilize the ruble and underpin the economy. These weren’t the yachts or villas of oligarchs but sovereign reserves, parked in trusted institutions like Euroclear in Belgium and Clearstream in Luxembourg. Of the total, about €210 billion sits within the EU, with €185 billion managed by Euroclear alone, much of it now matured from bonds into cash equivalents earning interest in low-risk deposits. For years, these assets have languished, a silent trophy of sanctions, their interest skimmed off to trickle into Ukraine’s coffers—some $7 billion in 2024 alone, funneled through mechanisms like the European Peace Facility.

By mid-2024, the G7 had escalated: at their summit in Italy, leaders pledged a $50 billion loan to Ukraine, backed by the “extraordinary revenues” from these frozen holdings—profits deemed fair game under international norms because they weren’t the principal assets themselves. The U.S. and EU each chipped in about $20 billion, with Canada, the U.K., and Japan covering the rest. Disbursements began swiftly, with the U.K. and France unveiling their portions in early 2025. This was a clever workaround, avoiding outright confiscation while ensuring Russia indirectly footed some of the bill for its aggression. But as Ukraine’s reconstruction needs balloon—estimated at $524 billion by international assessors—the $50 billion proved a mere down payment.

Enter the EU’s latest gambit, unveiled in the sweltering days of late summer 2025. With Ukraine’s 2026-2027 financing gap pegged at around €130 billion by Finnish and Swedish estimates, the European Commission proposed a “Reparations Loan” of up to €140 billion, collateralized by the frozen assets but structured to sidestep direct theft. Here’s how it works: Euroclear would redirect its cash holdings—now €176 billion in liquid form—into zero-coupon bonds issued by the Commission itself. These bonds would secure the loan to Ukraine, disbursed in tranches aligned with Kyiv’s verified needs. Repayment? Only if and when Russia coughs up war reparations in a future peace deal. Until then, Russia retains a legal claim on its original funds, now mirrored by equivalent EU bonds. EU member states would backstop the guarantees collectively, proportional to their economic heft, minimizing individual exposure. It’s a financial sleight of hand, endorsed tentatively by leaders at a Brussels summit just days ago, with the Commission tasked to finalize details by year’s end.

Germany, France, and the U.K. stand at the forefront, their economies battered by energy shocks and inflation yet resolute in their commitment to Ukraine. Berlin’s incoming chancellor, Friedrich Merz, has signaled cautious support, framing it as a moral imperative without touching property rights. Paris, under Emmanuel Macron, views it as legally permissible if structured right, though French officials privately fret over precedents that could boomerang on European assets abroad. London, ever the Atlanticist, has already loaned its share of the initial $50 billion and eyes this expansion as a way to amplify Britain’s post-Brexit influence. Together, these nations—representing the EU’s economic engine and the G7’s European flank—see the plan as a bridge to sustain Ukraine without further straining domestic budgets. After all, Europe’s collective aid fatigue is palpable: Germany’s €230 billion in new debt for Ukraine-related spending has already nudged up bond yields, while France grapples with fiscal deficits exceeding 5% of GDP.

Yet, for all its ingenuity, this scheme carries profound risks, particularly for Europe’s credit standing and the allure of its markets to global investors. Sovereign immunity has long been a cornerstone of international finance—a promise that a nation’s reserves, parked in foreign vaults, are sacrosanct. By leveraging these assets as collateral, even indirectly, the EU risks eroding that trust. Imagine the chill descending on central banks in Beijing or Riyadh: if the eurozone can repurpose Russian reserves today, what stops a future adversary from eyeing European holdings tomorrow? The European Central Bank’s Christine Lagarde has voiced these concerns, warning that such moves could dent the euro’s status as a 20% global reserve currency, stable for now but vulnerable to shifts if major holders like China diversify away. Borrowing costs could tick up as investors demand higher premiums for perceived political risk, echoing the 2011 debt crisis when yields spiked amid Greek turmoil.

For countries with deep ties to the European community—think Japan, with trillions in EU bonds, or Gulf sovereign wealth funds pouring billions into green projects—the implications are stark. A perceived breach of norms might trigger capital flight, not overnight but steadily, as portfolio managers recalibrate. Analysts at Brookings note that while short-term alternatives to G7 currencies are scarce, prolonged uncertainty could inflate eurozone yields by 20-50 basis points, adding billions to annual debt servicing. The EU’s Transmission Protection Instrument might cushion bond market volatility, but it can’t rebuild shattered confidence. Critics, including some in the European Parliament’s more hawkish corners, argue the moral case outweighs these perils—Russia’s aggression demands accountability, and Ukraine’s €524 billion tab shouldn’t fall on Western taxpayers alone. Yet, as one Belgian official quipped, this isn’t just finance; it’s “an act of war” in monetary guise, with taxpayers potentially on the hook if guarantees activate unexpectedly.

The United States, meanwhile, is dragging its feet, a wrinkle that underscores transatlantic fissures. At IMF meetings last week, Washington rebuffed Europe’s overtures to join the expanded G7 framework, citing threats to market stability. The Trump administration, with figures like Marco Rubio at Treasury, has toyed with seizure ideas but balks at anything that might undermine the dollar’s primacy—ironically, the very reserve status Europe now guards jealously. Bipartisan senators push for collateralized loans, but for now, the U.S. portion of assets— a modest $5 billion—remains sidelined, forcing the EU to proceed potentially without full G7 buy-in. Canada and the U.K. are on board, but Japan’s silence speaks volumes about Asian wariness.

No discussion of this plan is complete without peering into the Kremlin’s reaction—and the shadows of worst-case reprisals. Moscow has branded the scheme “theft,” plain and simple, with Foreign Ministry spokeswoman Maria Zakharova vowing a “painful response” that could escalate from economic jabs to outright confrontation. Russia’s Deputy Finance Minister Alexei Moiseev struck a more measured tone last week, affirming no immediate plans to seize European assets in Russia—estimated at $50 billion from departed firms like Renault and Unilever. But the proviso is clear: cross the line into confiscation, and all bets are off. A presidential decree from October 2025 already streamlines the sale of “unfriendly” assets, a tool Moscow could wield to nationalize banks, factories, or intellectual property from EU entities.

In the direst scenarios, which we must contemplate as the user urges, Russia’s toolkit brims with asymmetric weapons. First, retaliation in kind: swift seizures of the €300 billion in Western holdings within its borders, from Airbus plants to Deutsche Bank branches, crippling supply chains and stranding billions in illiquid assets. Legal salvos could follow, with Russia hauling the EU before the International Court of Justice, tying up funds in protracted litigation and amplifying reputational damage. Economically, Moscow might dump euro holdings to roil markets, though its own reserves are depleted, limiting the punch. More insidiously, hybrid measures: cyberattacks on Euroclear’s systems, disinformation campaigns eroding investor faith, or even leveraging alliances with China and India to isolate the euro in BRICS forums.

The human cost underscores the stakes. For Ukraine, this €140 billion could mean fortified frontlines, rebuilt grids, and a path to sovereignty—funds that buy time against attrition. But for Europe, it’s a Faustian bargain. Germany’s Mittelstand exporters, already reeling from lost Russian markets, could face boycotts or tariffs in retaliation. France’s luxury giants, with footprints in Moscow, might see their brands torched in proxy conflicts. And the U.K., post-Brexit, risks further alienation if its zeal invites asymmetric hits on City of London finance.

Proponents counter that the plan’s collateral structure—preserving Russia’s claim—mitigates escalation, buying moral high ground without full expropriation. The European Parliament, in resolutions from March and September 2025, has championed this path, urging legislative tweaks to enshrine it. Yet, as ECB models project, even a 10% dip in foreign investment inflows could shave 0.5% off EU GDP growth over five years, a slow bleed amid demographic headwinds.

As winter looms, the EU’s foreign ministers convene again, the air thick with compromise. Hungary’s veto threats linger, but qualified majorities could sidestep them, rolling sanctions every six months. For now, the assets remain frozen, a geopolitical powder keg. This isn’t just about money; it’s about the rules that bind nations, the trust that oils global trade, and the resolve to hold aggressors accountable. Europe stands at a precipice, balancing Ukraine’s survival against its own stability. The coming months will reveal if this gamble pays dividends—or detonates.

References

- Reuters. “Explainer: How will the West use Russia’s frozen assets?” October 2, 2025. https://www.reuters.com/business/finance/how-will-west-use-russias-frozen-assets-2025-10-02/

- Brookings Institution. “What is the status of Russia’s frozen sovereign assets?” 2025. https://www.brookings.edu/articles/what-is-the-status-of-russias-frozen-sovereign-assets/

- European Parliament Research Service. “Confiscation of immobilised Russian sovereign assets.” EPRS Briefing, 2025. https://www.europarl.europa.eu/RegData/etudes/BRIE/2025/775908/EPRS_BRI(2025)775908_EN.pdf

- Reuters. “Russia says no EU asset seizure if Russian assets are spared confiscation.” October 22, 2025. https://www.reuters.com/business/russia-says-it-has-no-plans-confiscate-eu-assets-now-is-monitoring-eus-own-2025-10-22/

- Bloomberg. “US Is Stalling on G-7 Plan to Expand Use of Russian Assets.” October 20, 2025. https://www.bloomberg.com/news/articles/2025-10-20/us-is-stalling-on-g-7-plan-to-expand-use-of-russian-assets

- BBC. “EU aims to endorse contentious deal to hand Russian assets to Ukraine.” October 23, 2025. https://www.bbc.com/news/articles/cwykd4l3dy1o

- Forbes. “Using $300 Billion Russian Frozen Assets To Pay For Ukraine War Losses.” October 23, 2025. https://www.forbes.com/sites/andyjsemotiuk/2025/10/23/using-300-billion-russian-frozen-assets-to-pay-for-ukraine-war-losses/

- Al Jazeera. “EU poised to agree on using frozen Russian assets to help Ukraine.” October 23, 2025. https://www.aljazeera.com/news/2025/10/23/eu-poised-to-agree-on-using-frozen-russian-assets-to-help-ukraine

Share your thoughts in the comments, and explore more insights on our Journal and Magazine. Please consider becoming a subscriber, thank you: https://dunapress.org/subscriptions – Follow J&M Duna Press on social media. Join the Oslo Meet by connecting experiences and uniting solutions: https://oslomeet.org

#EUSanctions #EUSanctions #frozenAssets #RussiaUkraineWar #RussianAssets #UkraineAid

Nhiều nước EU, bao gồm Slovakia và Bỉ, phản đối việc sử dụng tài sản bị đóng băng của Nga để tài trợ cho chi tiêu quốc phòng Ukraine. Cuộc tranh cãi này phản ánh sự chia rẽ trong EU về cách xử lý tài sản Nga bị đóng băng.

#EU #Russia #Ukraine #Slovakia #Belgium #frozenassets #Geopolitics #ChâuÂu #Nga #Ukraine #Slovakia #Bỉ #tàisảnđóngbăng #địachínhtrị

Belgium’s Defiant Stand: Battling Brussels Over Frozen Russian Assets

Belgium clashes with Brussels over using frozen Russian assets for a Ukraine loan—risking €140B in debt if Russia sues. De Wever vows it "will never happen." A tale of national risk vs. EU solidarity. Who blinks first? #BelgiumEU #FrozenAssets #UkraineAid

At the Brussels summit, Belgium stopped the EU’s plan to turn €183 billion in frozen Russian assets into aid for Ukraine—demanding legal guarantees first.

It’s a reminder that even in wartime, Europe’s unity can freeze faster than its funds.

🔗 https://euromaidanpress.com/2025/10/23/belgium-blocks-russian-assets-ukraine/

The EU's ambitious plan for frozen Russian assets, explained

https://kyivindependent.com/the-eus-ambitious-plan-for-frozen-russian-assets-explained/

#ruSSia #EU #frozenAssets #seizeRuSSianAssetsNow

#Ukraine #UkraineWar #StandWithUkraine

Prime Minister Sir Keir Starmer reveals a bold coalition: UK, France, Germany will fully use frozen Russian assets to back Ukraine’s defense, escalating pressure on Putin. Coordinated with the US, this move signals stronger sanctions and potential loans to Ukraine amid ongoing attacks. Discover the full strategy at BBC News. #JamesChater #Ukraine #Russia #Sanctions #FrozenAssets #KeirStarmer #EU #France #Germany #Zelensky #UK #BBCNews https://www.bbc.com/news/articles/c62np269qv9o?at_medium=RSS&at_campaign=rss

This isn’t just strategy, it’s justice. And if you agree… drop a 💙 to show you stand with Ukraine and believe in holding aggressors accountable.

#StandWithUkraine #FrozenAssets #EconomicSanctions #BlueCrew #PeaceThroughPressure

#Ukraine

Tuesday, September 23, 2025

Ukraine hits Russian drone hub, ammunition depot, S-400 air defense system in series of strikes -- For first time, Ukraine hits 2 Russian anti-submarine amphibious aircraft in occupied Crimea -- Slovakia, Hungary excluded from initial EU drone wall talks -- Ahead of elections, Moldova’s president warns of Kremlin interference ... and morehttps://activitypub.writeworks.uk/2025/09/tuesday-september-23-2025/

Sunday, September 21, 2025

Putin feels free to increase attacks on Ukraine without fear of consequences from Trump, Bloomberg reports -- Oil pumping stations in Volgograd and Samara stop work after Ukrainian drone attack -- Ukraine braces for renewed blackouts amid new wave of Russian attacks on energy -- [vlog/video] Ukrainian history vs. Russian propaganda ... and morehttps://activitypub.writeworks.uk/2025/09/sunday-september-21-2025/

Why the EU wrestles with what to do with #Russia’s #frozenassets https://www.euractiv.com/section/politics/news/why-the-eu-wrestles-with-what-to-do-with-russias-frozen-assets/?utm_source=dlvr.it&utm_medium=mastodon

Why the EU wrestles with what to do with #Russia’s #frozenassets: The EU has frozen approximately €210 billion in Russian central bank assets since Moscow invaded #Ukraine in 2022. https://www.euractiv.com/section/politics/news/why-the-eu-wrestles-with-what-to-do-with-russias-frozen-assets/?utm_source=mastodon&utm_medium=dlvr.it

Putin's Under More Pressure - Will he Crack?

Interview: Tom Keatinge is the founding Director of the Centre for Finance & Security (#CFS) at #RUSI.

https://www.youtube.com/watch?v=WhjTatbg3g8

#frozenAssets

#ruSSia #kleptocrat #fascist #billionaire #looter #torture #rape #terror #maffia

Saturday, July 12, 2025

Ukraine deploying interceptor drones to defend Kyiv amid surge in Russian attacks — Russia targets life: Russian attacks kill 9, injure 42 over past day, damaging maternity hospital in Kharkiv — Ukraine behind new pipeline explosion in Siberia that supplies Russian military-industrial complex — These were not negotiations; Ukraine’s deputy foreign minister on Istanbul talks with Russia in exclusive interview … and more

https://activitypub.writeworks.uk/2025/07/saturday-july-12-2025/

Ovatko Lindsey Grahamin kiemurtelut ajamassa Trumpia Venäjä-pakotteisiin?

”Russia Act -lakiehdotuksen mukaan lakiehdotus asettaisi Vladimir Putinille ”luunmurtopakotteita” ja 500 prosentin tullitariffin tavaroille, joita tuodaan maista, jotka ostavat venäläistä öljyä ja muita tavaroita, ja sen kohteina voisivat olla Kiina ja Intia”

#Venäjä #Terroristivaltio #Sanktiot #Pakotteet #Öljy #Kaasu #Pensa #Oligarkki #Slaavikyykky #FrozenAssets #CoupdÉtat

https://www.theguardian.com/us-news/2025/jun/03/lindsey-graham-trump-russia-ukraine?CMP=Share_iOSApp_Other

#OlenaHrazhdan - The #Economics of War and Resilience in Ukraine and Using the Frozen Russian Assets.

https://www.youtube.com/watch?v=njH8r3NpQ8A

#ruSSia #kleptofascist #billionaire #looter #rape #torture #terror #maffiaState

Finland to Supply Heavy Ammunition to Ukraine Financed from Frozen Russian Assets

#Ukraine #Finland #Denmark #Russia #EU #DefenseSupport #155mm #FrozenAssets #MilitaryAid

Finland to Supply Heavy Ammunition to Ukraine Financed from Frozen Russian Assets

#Ukraine #Finland #Denmark #Russia #EU #DefenseSupport #155mm #FrozenAssets #MilitaryAid

🇪🇺 EU | 🇷🇺 RUSSIA

🔴 EU to Compensate Investors Using Frozen Russian Assets

🔸 Euroclear to redistribute €3B from frozen Russian assets to Western investors.

🔸 Seen as retaliation for Russia's asset seizures from EU investors.

🔸 €200B+ in Russian central bank reserves remain untouched.

🔸 Euroclear holds \~€180B of the frozen funds.

"russia, the economy is over"

Simple math wins over Z-patriotism. Who would have thought.

Mark Biernat updated his estimated point of time of russia economically crumbling down from 2026 to mid-2025.

https://www.youtube.com/watch?v=7Xot1MazKek

#russia #russianEconomy #Economy #Ukraine #War #FrozenAssets #Sanctions #WarEconomy

![[Illustrative purposes] Ukraine's drone designed to intercept and destroy Iranian-designed Shahed drones used by Russia was shown in Kyiv on April 9, 2025. (President Volodymyr Zelensky / Telegram)](https://files.mastodon.social/cache/media_attachments/files/114/840/444/869/099/598/small/55057ba5ee060a68.webp)