@SceNtriC

Umweltbank ETF — very broad, with ~2000 stocks across the world, but a bit too much China real estate IMHO

Ökoworld Growing Markets 2.0 — more expensive, but much higher sustainability and diversification, with a strong exclusion of controversial sectors and a focus on emerging markets, super admixture and super low correlation with MSCI World

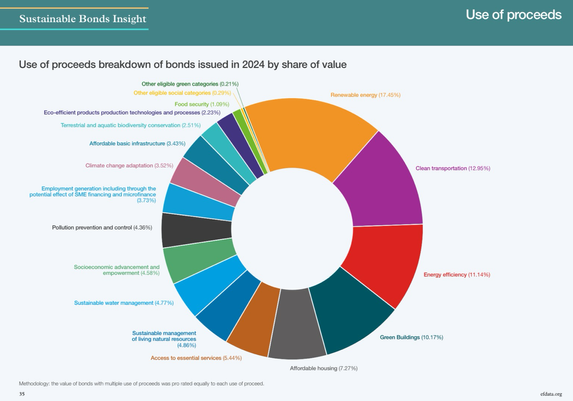

GLS Klimafonds & Ökobasis One World Protect — include also #greenBonds which I like

Ark/Rize Environmental Impact 100 — small thematic ETF

Ark/Rize Sustainable Future of Food — small thematic ETF

Ethius Global Impact — rather big cap, high correlation with MSCI World

Triodos Pioneer Impact Fund — rather small cap

B.A.U.M. Fair Future Fonds — rather small cap europe

Of course, fees are typically a bit higher than for mass-market ETFs. But these funds show it's possible to invest globally while supporting a more ethical future

[7/x]