Budget 2025: EV pay-per-mile tax sparks backlash from motoring experts

Drivers face a new pay‑per‑mile tax on electric cars — a move critics say could stall Britain’s net zero journey and add fresh costs to motorists already struggling with rising bills.

From April 2028, battery electric vehicles will be charged 3p per mile, while plug‑in hybrids will pay 1.5p per mile. The Treasury argues the measure is needed to replace lost fuel duty revenue as more drivers switch to electric.

The charge will be levied in addition to existing road taxes, including Vehicle Excise Duty (VED), which EVs will begin paying from 2025.

“Mixed messages” for motorists

John Wilmot, CEO of car lease comparison site LeaseLoco, said the new tax risks eliminating one of the biggest incentives for going electric — cheaper running costs.

“One of the massive benefits to driving an electric vehicle was that it was far cheaper to run than a petrol or diesel car, but a pay‑per‑mile tax risks eliminating that advantage, which could make drivers think twice about switching any time soon,” he said.

Wilmot warned that the change sends “mixed messages” to drivers, who are already facing rising insurance premiums, increased home charging costs and limited charging infrastructure.

“Understandably, drivers want clarity before committing to making the switch to electric — and it’s hard to have confidence when the rules and the costs keep changing.”

LeaseLoco said it has seen growing interest in electric options among lease customers, but cautioned that the new tax could cause many to hesitate.

FairFuelUK: “Thin end of the wedge”

FairFuelUK, the long‑running campaign group representing motorists and hauliers, welcomed the Chancellor’s decision to freeze fuel duty for a 15th consecutive year. Founder Howard Cox said this was a victory after years of lobbying, but warned that the new EV mileage levy could be the start of a wider shift to taxing all road users by distance.

“Rachel Reeves’s 3p pay‑per‑mile on EVs is, I fear, the thin end of the wedge to make all vehicles, whatever their type of fuel, pay tax as they drive,” said Cox.

He argued that fuel duty and VAT already deliver billions to the Exchequer, and that layering a mileage tax on top risks unfairly penalising drivers.

“Whilst fuel duty and VAT continue to deliver billions to the exchequer, both types of taxation cannot work alongside each other. It’s time government listens to and consults drivers on a long‑term road user tax plan that’s fair to the UK’s 37 million drivers and the economy.”

Cox also thanked MP Lewis Cocking for leading the campaign inside Parliament, noting that thousands of FairFuelUK supporters had contacted MPs to demand the freeze.

Industry concerns mount

The Office for Budget Responsibility forecasts the new levy will raise £1.1 billion in 2028–29, rising to £1.9 billion by 2030–31.

Yet across the motoring industry, concern is mounting that the policy could backfire. The Society of Motor Manufacturers and Traders warned the measure comes at the “wrong moment” in the UK’s EV transition, while the RAC said it risks undermining incentives for adoption just as electric cars are beginning to enter the mainstream. Octopus Electric Vehicles went further, predicting the tax could cut sales by more than 400,000 units in the coming years.

Leasing firms have also sounded the alarm. Select Car Leasing described the levy as a “significant shift” in government policy that will force drivers to reassess running costs. Consumer surveys echo that sentiment: research by What Car? found more than half of in‑market car buyers said the tax would deter them from choosing an EV.

Together, these warnings paint a picture of an industry worried that the government’s new approach could stall momentum at a critical point in the UK’s net zero journey.

A turning point for drivers

The warnings from both consumer finance experts and driver lobby groups underline how contentious the new mileage levy has become. LeaseLoco cautions that the tax risks stripping away the financial incentive to go electric, while FairFuelUK fears it could be the first step towards taxing all road users by distance.

Industry bodies add weight to those concerns, with manufacturers, leasing firms and motoring organisations all warning that the policy risks slowing adoption at a critical moment. Surveys suggest ordinary drivers are already questioning whether the benefits of going electric outweigh the costs.

Together, these voices paint a picture of a sector caught between ambition and reality: a government determined to secure revenue as fuel duty declines, and drivers who want clarity, consistency and confidence before committing to the switch.

With net zero targets looming, the debate over how Britain pays for its roads is no longer theoretical. For millions of motorists, the Budget’s pay‑per‑mile tax could mark a turning point in the journey to cleaner transport.

Related stories from Swansea Bay News

Autumn Budget 2025: Westminster leak, Welsh impact

Rachel Reeves’s Budget was overshadowed by an OBR leak and fierce Commons clashes — here’s what it means for Wales.

Autumn Budget 2025: Welsh parties clash over Reeves’s plans

Labour hails child poverty measures, Plaid warns Wales is shortchanged, Conservatives call it a “circus,” Reform and Lib Dems add criticism.

Autumn Budget 2025: What more than 100 possible tax changes could mean for South West Wales

From income tax rises to energy bill shifts, we break down how Budget reforms could affect households and businesses locally.

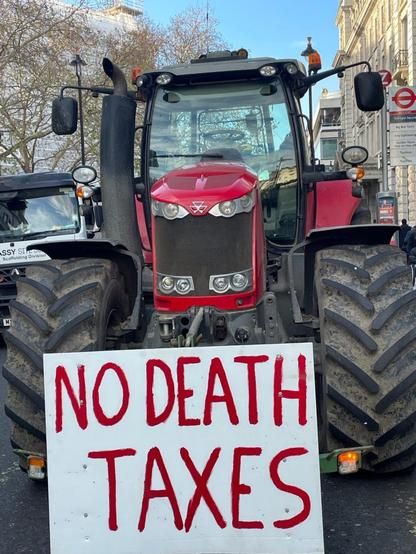

Tractors roll into Westminster as farmers protest Budget’s “family farm tax”

Farmers drove tractors into Westminster to protest inheritance tax reforms, warning of lasting damage to Welsh family farms.

#autumnBudget2025 #budget #electricVehicles #ev #fairfueluk #motoring #netZero #payPerMileTaxUk #payPerMile #politics #rachelReevesBudget #rachelReevesMp #ukBudget2025