2 Desjardins: While #energyprices provided a significant drag, #inflationary pressures looked to be easing across a host of other categories too. #CPI #usecon

#USecon

1 Desjardins: #US #price growth was relatively benign to start the year. Headline #consumerprices rose just 0.171% in January, undershooting expectations for a 0.3% increase. That pushed headline #inflation three ticks lower to 2.4%. 🧵 #CPI #usecon

“Oh, and while both Donald #Trump and Scott #Bessent have recently asserted that #constructionjobs are booming, #employment growth in #construction, which was high under Biden, has in fact fallen precipitously:” open.substack.com/pub/paulkrug... #usecon #PaulKrugman

3 CIBC: Today’s report was also accompanied by the annual #benchmark #revisions up to March 2025, the only sore point in the report, which showed expectations were almost right on the money with 862K negative revisions. #usecon #jobsdata #USEconomy #NFP

2 CIBC: The main driver was a surge in #healthcare and #construction #hiring in the month. Net revisions over the prior two months were -17K, putting the three-month average payroll gain at 73K in January. 🧵 #usecon #jobsdata #NFP #jobs #employment

2 BMO: … as #investors look for evidence of #labormarket stabilization in the new year. #Treasury #yields are on the decline as #investors digest the news and price in a slightly higher probability of three quarter-point #ratecuts from the #Fed by year-end. #markets #usecon

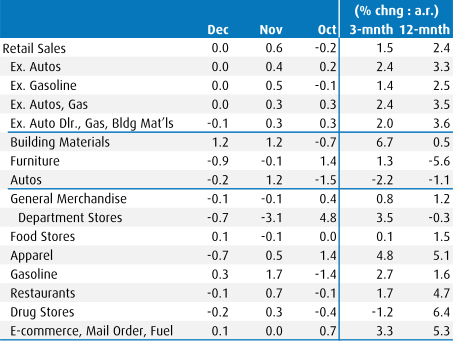

1 BMO: The unexpected decline in #US control real #retailsales in Dec will likely prompt a markdown in #Q4 real #consumerspending growth forecasts, putting a dampener on the resilient #consumer narrative and increasing the importance of this week’s #January #Employmentreport, … 🧵 #usecon

US Consumer Confidence Falls Sharply in January https://www.conference-board.org/topics/consumer-confidence/ #usecon #econ #cdnecon

“For the record, #trade between the #U.S. and #Canada is roughly balanced, and cutting off this trade would be severely damaging to both #economies:” #cdnecon #usecon #tariffs open.substack.com/pub/paulkrug...

'With each crisis over the past 15 years, the Federal Reserve has expanded the scope and scale of its interventions. This gradual mission creep has blurred the line between routine liquidity support and support for insolvent institutions, undermining the very purpose of central-bank independence.' https://www.project-syndicate.org/commentary/fed-mission-creep-undermines-its-legitimacy-by-amit-seru-2025-12 #usecon #econ #debt

Most Americans don’t agree. The problem is that economic stats often describe the system as a whole, not the lived experience of many of the country’s 340 million people. And about 74 percent think the economy is at best fair and mostly poor.

#economics #tariffs #USecon #trade #recession #inequality #GDP #markets #macroeconomics

https://www.washingtonpost.com/opinions/2025/12/23/economy-tariff-inflation-jobs/

Apollo Global Management Chief Economist #TorstenSlok: “Despite the turbulence surrounding #LiberationDay in April, #foreign #investors ended up buying more #US #assets in 2025 than in 2024. #markets #Usecon

2 CIBC: With #ACA #subsidies expiring at year-end, #Americans may be hurrying to take advantage of #elective #procedures that might either not be covered or come at far greater cost next year. #Services spending could look robust again in Q4 for the same reason. #usecon #GDP

1 CIBC: #US #CPI #inflation was softer than expected in November, supporting the case for further #Fed cuts in the New Year. Headline inflation was 2.7% year-over-year, which was well below the 3.1% expected by the consensus. Core inflation was similarly weaker than anticipated 🧵 #USEconomy #usecon

🤔 Fresh Concerns About AI Spending Are Rattling Wall Street (🎁 link) https://www.wsj.com/finance/stocks/ai-fed-interest-rate-stock-market-749e18e2?st=hNHaJN&reflink=desktopwebshare_permalink #aihype #ai #usecon #llm

🤔 Record spending on Black Friday and Cyber Monday was partly due to historic use of buy-now-pay-later options https://www.marketwatch.com/story/we-fear-people-will-end-up-in-financial-trouble-americans-will-spend-a-record-20-billion-via-buy-now-pay-later-during-the-holidays-576d7f35?st=vmiqRc&reflink=desktopwebshare_permalink #debt #consumerism #blackfriday #cybermonday #economics #usecon #econ