The Nasdaq 100 has posted its strongest rally since the 1999 dot-com bubble, with BTIG analysts warning that technical indicators and weakening seasonal trends suggest increased market volatility ahead.

#YonhapInfomax

#Nasdaq100 #BTIG #DotComBubble #MarketVolatility #RecordHighs

#Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=73099

#DotcomBubble

🚀🤪 "Web3 #onboarding was the next big thing," they said, as they handed out seedphrase keychains like they were party favors from the '90s dotcom bubble. Fast forward to 2025, and surprise! 🎉 Turns out no one wants to collect digital ghost towns; they just want dollars that text like teenagers. Keep counting those #wallets, folks! 🦗💸

https://tomhadley.link/blog/web3-onboarding-flop #Web3 #DotcomBubble #DigitalAssets #HackerNews #ngated

Um… If memory serves, you did pretty well if you got into the market in 1997.

You just needed to get out a few years later…

Ah yes, another 'I survived the dot-com bubble and all I got was this lousy article' tale. 🎈💥 Who knew that raising 60 million might come with a side of existential crisis? 🤯 But fear not, dear reader, for Brian's here to save #capitalism one #burnout at a time! 🚀

https://upgradingcapitalism.substack.com/p/searching-for-black-swans #dotcombubble #existentialcrisis #article #HackerNews #ngated

🎈 Oh, look! Another nostalgic trip down memory lane by #gramps from the Silicon Underground reminiscing about the good ol' days of the dotcom bubble, when tech stocks were as inflated as a clown's balloon animal. 🎈 No groundbreaking insights here, just a reminder that some people are still stuck in 2000 while the rest of us moved on. 🤷♂️

https://dfarq.homeip.net/when-the-dotcom-bubble-burst/ #nostalgia #techbubble #memorylane #dotcombubble #HackerNews #ngated

When the Dotcom Bubble Burst

https://dfarq.homeip.net/when-the-dotcom-bubble-burst/

#HackerNews #DotcomBubble #DotcomBust #TechHistory #InternetCrisis #EconomicCrash

@ClubTeleMatique May it pop worse than the #dotcombubble

39 years ago, Microsoft held its very successful IPO. Microsoft didn't need the money, but were essentially forced into it. It made Bill Gates filthy rich and put Microsoft on the map. The search for the next Microsoft led to the dotcom bubble. #MicrosoftIPO #BillGates #TechHistory #DotcomBubble #RetroComputing #SiliconValley #StartupCulture #1980sTech #TechMilestones https://dfarq.homeip.net/microsofts-1986-ipo/

US job market shows similarities to late 1990s dot-com era, raising concerns about AI-driven tech bubble and potential economic impacts

#YonhapInfomax #DotComBubble #USJobMarket #ArtificialIntelligence #TechStocks #EconomicConcerns #Economics #FinancialMarkets #Banking #Securities #Bonds #StockMarket

https://en.infomaxai.com/news/articleView.html?idxno=53564

By Fred Vogelstein and Om Malik @Onmyom:

"""

the technology revolutions that followed five years after 1996 and 2007 reshaped [..] business and society at large.

Without the leverage of the free open source software on generic x86 servers, you don’t get [..] Google, Amazon, and Meta.

Without cheap hard drives to go into iPods, and cheap broadband to download music, you don’t get Apple's resurgence.

"""

https://crazystupidtech.com/archive/what-to-expect-from-us-in-2025/

Found some old CDnow.com stickers. The Internet's number one music store!

At the peak of the dotcom bubble, the company was worth over $1 billion. In 2000, it was acquired by BMG for 1/10th that amount. At some point shortly after that it was acquired by Amazon and turned into a DNS redirect to amazon.com's CD department.

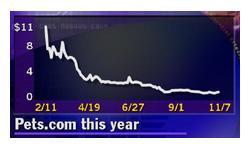

El 7 de noviembre de 2000 el sitio web Pets.com cierra operaciones debido al colapso de la burbuja .com. la compañía había acrecentado su reconocimiento de marca a través de campañas de marketing pero debido a la mala planeación financiera y de negocios se fue a la quiebra.

Asi como ésta empresa miles se fueron a la bancarrota alcanzando el pico más alto en el año 2000. Solo las más organizadas sobreviviron.

#retrocomputingmx #dotcombubble

If I ever seen an economic megahype bubble about to burst:

"AI's growing money problem"

https://youtube.com/watch?v=tF_Aqy43-TM

I'm also old enough to have personally been through the #dotcombubble ~25ya, to know there will be a second coming for #AI too.

⚫️ Ask HN: Could AI be a dot com sized bubble?

at @ycombinator HackerNews

#DotComBubble #DotCom

"By 1999, losing money was the mark of a successful dot-com."

#BrianMcCullough, 2018

🤔 Doom Chart.

#Cisco damals zur #DotComBubble

#Nvidia heute...

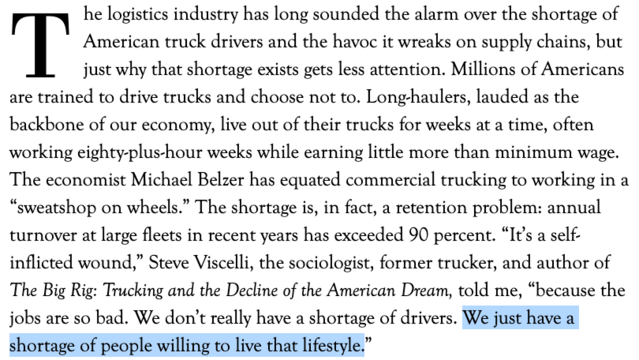

https://harpers.org/archive/2024/02/lost-highway-emily-gogolak

So true.

I've done this job. There's much about #OverTheRoad trucking that I enjoyed a great deal. Plenty I didn't, too.

The timing was bad. I got into trucking because the #DotComBubble took my job & all my prospects. But I still had teen kids at home. Very hard to be away 95% of the time & expect them to thrive & behave.

"The Silicon Valley Loop: How The Dot-Com Crash Created Palo Alto’s Clueless Investor Class.", Intelligencer (https://nymag.com/intelligencer/2023/02/the-silicon-valley-loop-malcolm-harriss-palo-alto.html).

#SiliconValley #VentureCapital #VC #Startups #Bubble #IrrationalExuberance #YCombinator #Funding #DotComBubble #Yahoo #Internet

📈👀

Der kapitalgewichtete #SP500 übertrifft die gleichgewichtete Version um fast 11% im Jahresverlauf ... bisher der größte Performanceunterschied seit 1998 (#DotcomBubble) und der zweitgrößte in den Aufzeichnungen.

Do you remember the good ol' days of the Dot-Com Bubble? And the Dot-Com-Crash that followed?

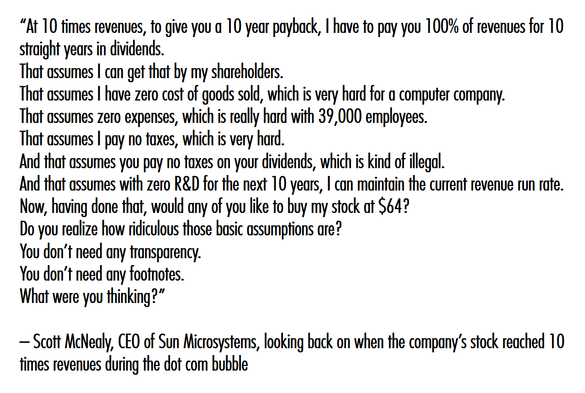

Back then, Sun Microsystems was one of the darlings of Silicon Valley. The company is credited with inventing Java, and many of the Internet's servers at the time ran on Sun hardware. Investors jumped in the bandwagon, which pumped the share price. People were buying the shares because they expected the share price to keep going up. This can look good — for a while.

A problem with speculative stocks is that the price ceases to bear a healthy relation to the company's potential future earnings. There's no way for the company to deliver enough profit to make the price you paid worth it. The fundamentals don't stack-up, and a crash is inevitable. With the benefit of hindsight, Scott McNealy, CEO of Sun Microsystems, was critical of speculative trading when the company’s stock price reached a whopping 10 times revenues.

You may think that was all just "tulip mania".

You may think sharemarket investors have learned from the dot-com bubble era.

You may think governments and banks would have changed the rules to prevent things getting so out-of-whack again.

You may think the "snake-oil salesman" tactics by Silicon Valley Tech-Bros couldn't create a disaster like that again these days...

Tesla's share price is being pumped by a fast-talking madman. Tesla's Price-to-Sales Ratio is currently about 9, and looks to be heading up to over 10 again, where it was from mid June to mid-July.

Nvidia's share price is being pumped by AI hype. Nvidia's Price-to-Sales Ratio is currently about 35, and looks to be heading up to over 40 again, where it was from mid June to mid-July.

#Tech #Bubble #TulipMania #DotComBubble #DotComCrash #DotComBoom #DotBomb #Tesla #NVidia #AI #AIHype