AI is too risky to insure, say people whose job is insuring risk

#LloydsofLondon

📢Viking #VikingCruises Libra liquid hydrogen PEM fuel cell-powered cruise ship keel laying in Italy.

27x225kW @PowerCell_Group #PEM #H2 #fuelcells totaling 6MW are being packaged by Isotta Fraschini Motori #IFautomobili #IFM.⬇️

Swedish Powercell #fuelcell is #LloydsofLondon type approved.

Putin’s seizure of 147 leased civil aircraft leads to a multi billion legal victory for firms against insurance companies

President Putin Pic credit: President’s office RussiaCase came as a result of action taken after Russia launched Ukrainian war

An extraordinary ground breaking judgment last week which has received little publicity outside the insurance and legal world has cost the insurance industry, including Lloyds of London, billions of pounds in claims as a direct result of the current Ukraine war.

At the time Russia invaded Ukraine in 2022 Russian civil aviation firms, mainly Aeroflot and S7, a private Siberian airline, were leasing 147 aircraft and 16 spare engines from companies across the world. As soon as this happened the companies wanted their planes back as they came under sanctions against Russia issued by the EU, US, and the UK.

But the move was thwarted by PresIdent Putin who passed a law banning the export of all the planes and the spare engines from leaving Russia and they are still there today.

The decision led to an extraordinary legal case coming before the Commercial Court in London when six of the companies came together to claim against their insurers to get their money back in a joint action that could cost the insurers over £3.4 billion.

Mr Justice Butcher; Pic Credit: Judiciary websiteThe case which has been quietly rumbling on for five months was a lawyers’ bonanza with more than 50 barristers employed on both sides-. It was heard by Mr Justice Butcher who has issued a 230 page ground breaking judgment covering 100 years of case law.

The six leasing companies were Aercap Ireland: Dubai Aerospace Enterprise, Falcon 2019-1;KDAC Aircraft Trading; Merx Aviation Servicing and Gasl Ireland Leasing A-I. Aercap Ireland, based in Dublin, is the world’s largest aircraft leasing company.

The insurance companies involved included Lloyds,AIG Europe; Chubb European Group and the underwriting group Kiln Syndicate 510. KDAC settled with Chubb before the end of the case. To add to complications under Russian law they had also to have insurance from Russian companies.

S7 – the Siberian Airline which leased many of the jetsThe dispute centred round whether the aircraft were covered by ” all risks” policies or ” war risks” polices. The judge ruled that they were covered by “war risks” policies because of the action of Putin in banning them leaving Russia. This will mean the companies will not get all the money they claimed but it will still run to billions of pounds The judge also rejected an argument from the insurers that sanctions against Russia prevented them paying out any money.

The ruling is also significant as it would spark off other claims against insurers and there were 400 leased aircraft in Russia at the time. The insurers have until the end of this week to appeal.

Make a one-time donation

Your contribution is appreciated.

Donate

Make a monthly donation

Your contribution is appreciated.

Donate monthly

Make a yearly donation

Your contribution is appreciated.

Donate yearly

Please donate to Westminster Confidential

£10.00

#aircraftLeasing #insurance #lloydsOfLondon #presidentPutin #ukraineWar

Financial Times: Insurers launch cover for losses caused by AI chatbot errors. “Insurers at Lloyd’s of London have launched a product to cover companies for losses caused by malfunctioning artificial intelligence tools, as the sector aims to profit from concerns about the risk of costly hallucinations and errors by chatbots.”

Shabna Begum welcomed Lloyd’s beginning to do some of the work to acknowledge that their wealth, power and influence are derived from slavery. However “Lloyd’s needs to address issues, including its 21.5% pay gap for black employees, not just through more ‘inclusion and diversity’ but through active anti-racist policies that address inequalities in income and pay now.”

Database

https://www.slavevoyages.org/voyage/database

#capitalism #Colonialism #insurance #slavery #LloydsOfLondon

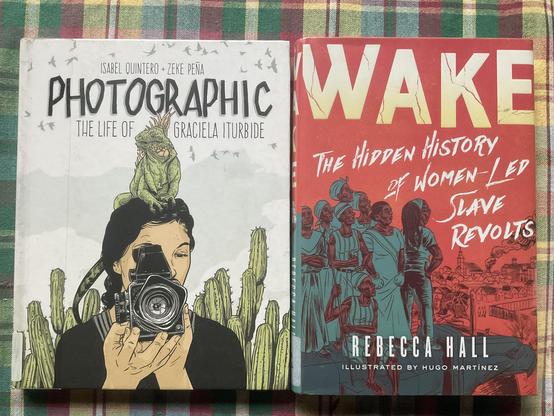

“The more women onboard a slave ship, the more likely a revolt” - Rebecca Hall

#BooksOfMastodon #graphicnovels

#Photography #GracielaIturbide #slaveRevolts #middlePassage #LloydsOfLondon #Capitalism #WestAfrica #Dahomey #Ahosi #Whydah / #Ouida #Benin

The collapse of the Francis Scott Key Bridge in Baltimore is set to make history with unprecedented marine insurance claims. How can this catastrophe reshape the industry's future strategies?

Read: https://supplychain360.io/francis-scott-key-bridge-collapse-marine-insurance-loss/

Lloyd's of London in the rain.

Lloyd’s of London finds hypothetical cyberattack could cost world economy $3.5 trillion

Insurance giant Lloyd’s of London has warned that the global economy could lose $3.5 trillion as a result of a major cyberattack targeting payment systems.

The hypothetical scenario is not considered likely. The researchers suggested it had roughly a 3.3% chance of happening

#LloydsOfLondon #cyberattack #economy #finance #banking #fintech #security #cybersecurity #hacking

https://therecord.media/lloyds-finds-cyberattack-would-cost-trillions

To the CEOs and senior management at #AIG, #LibertyMutual, #LloydsOfLondon, #SwissRe, and #ZurichRe

... it's important

that insurers remember that climate change is a real and, apparently accelerating thing; that we cannot afford to open up any more fossil fuel wells or mines because what we already have open still represents too much carbon dioxide and methane to bequeath to an already over-hot atmosphere;

that offering insurance to these projects is in effect allowing them to go ahead;

that when it comes to people being charged for crimes against humanity, enablers of such crimes also bear criminal responsibility.

Big European insurers ‘underwrite 30% of US coal despite net zero pledges’ https://www.theguardian.com/environment/2023/sep/28/big-european-insurers-us-coal-lloyds-of-london-zurich-swiss-re #Europe #DirtyCoal #Coal #NetZero #LloydsOfLondon #Swiss #Zurich #Shame #ClimateChangeCriminals

#MothersRiseUp sending a clear message outside the #LloydsOfLondon offices: #StopEACOP #StopRosebank

NO NEW FOSSIL FUELS, FOR THE SAKE OF THE KIDS! #EndFossilFuels

Hey #LloydsOfLondon! "Whenever you fund the game: Coal, oil, gas, and shame. Right then, there, I feel that burning pain. Well ya' treating me bad. Why can't you see? This ain’t the way it's supposed to be!"

#MothersRiseUp 💚✊ #StopEACOP #ClimateCrisis

@InsureOurFuture #EndFossilFuels

To this day, when a ship is lost, it is recorded by hand, in ink, in the Casualty Book at the underwriting floor of Lloyd's of London. This story is of a visit to find the entry for Shackleton's Endurance.

https://www.bbc.com/news/science-environment-64818864

#History #LloydsOfLondon #Ships #Endurance #Insurance #Marine

#TrueIrishHearts (14) #AloneInNewYork (14) #TheEagleAndTheHawk (33) #MidnightClub (33) #TheStoryOfTempleDrake (33) #CradleSong (33)

#HellAndHighWater (33) #DeathTakesAHoliday (34) #DoubleDoor (34) #TheWitchingHour (34) #NowAndForever (34) #Car99 (35)

#TheLivesOfABengalLancer (35) #AnnapolisFarewell (35) #PalmSprings (36)

#LloydsOfLondon (36) #IdGiveMyLife (36) #BulldogDrummondEscapes (37)

#GoneButNotForgotten

#GuyStanding (1873-1937)

#KnightsOfFilm #FilmMastodon 📽️ 🎬

Santa momma 🧑🏽🎄 is on her way to Lloyds Of London!

Unfortunately, Chair of Lloyd's Bruce Carnegie-Brown & CEO John Neal have made the NAUGHTY LIST 👎🏽 of fossil fuel insurers …again!

Lloyd’s, give our kids what they need this Xmas: a fighting chance of a healthy planet. 🌍

#MothersRiseUp #InsureOurFuture #LloydsOfLondon @InsureOurFuture #EndFossilFuels