Tariffs, Supply Chain Instability, and the Future of Cross-Border Commerce

Author(s): Scott Douglas Jacobsen

Publication (Outlet/Website): The Good Men Project

Publication Date (yyyy/mm/dd): 2025/07/04

Bede Ramcharan is the founder, president, and CEO of Indetatech, a certified Service-Disabled Veteran-Owned Small Business (SDVOSB) founded in February 2020. A retired U.S. Army veteran, he holds a master’s degree in healthcare administration from the Army-Baylor University Graduate Program. Under his leadership, Indetatech delivers supply chain, logistics, staffing, and facility management solutions across six U.S. states and three international markets. Honoured as the 2015 Minority Veteran Entrepreneur of the Year by NaVOBA, Ramcharan also serves on advisory boards for NaVOBA and the U.S. Global Leadership Coalition, advocating for veteran entrepreneurship and responsible global commerce.

Scott Douglas Jacobsen: Today, we’re here with Bede Ramcharan, founder, president, and CEO of Indetatech, a certified Service-Disabled Veteran-Owned Small Business (SDVOSB) established in February 2020. A retired U.S. Army veteran, he holds a master’s degree in healthcare administration from the Army-Baylor University Graduate Program in Health and Business Administration. Ramcharan leads Indetatech in delivering global supply chain, logistics, staffing, and facility management solutions. The company operates in more than six U.S. states and exports to three international markets.

He was honoured as the 2015 Minority Veteran Entrepreneur of the Year by the National Veteran-Owned Business Association (NaVOBA). Ramcharan also serves on advisory boards, including NaVOBA and the U.S. Global Leadership Coalition, where he contributes to both veteran empowerment and business advocacy. Thank you for joining me today. I appreciate you taking the time. Are the new U.S. customs rules continuing to affect cross-border commerce?

Bede Ramcharan: Well, the first thing is—we don’t know. There’s much inconsistency. What’s enacted today could change tomorrow morning. The tariff rates are frequently revised, and enforcement patterns vary, which creates unpredictability.

This unpredictability has led to instability in supply chains. Some businesses are stockpiling inventory, while others are delaying purchases. In anticipation of future costs, suppliers may raise prices. All this leads to confusion for the end consumer.

If tariffs were consistent and predictable, we could develop strategies around them. However, current policy volatility makes it challenging to plan. It sometimes feels like we’re responding to whims. Today’s tariff rate might be gone tomorrow—or even increased. That uncertainty ripples across the economy.

Jacobsen: What is the de minimis threshold, and why is it significant?

Ramcharan: The de minimis threshold is the maximum declared value of goods that can be imported into the United States without incurring duties or formal entry procedures. Currently, that threshold is $800 under Section 321 of the U.S. Tariff Act.

This is significant because it enables faster, duty-free shipping for low-value items—primarily e-commerce orders from platforms like Amazon, Shein, or Temu. It benefits consumers and small businesses by lowering the cost and complexity of imports.

However, there’s increasing scrutiny of this policy. Lawmakers and trade advocates have expressed concerns that foreign companies—especially those shipping from China—are exploiting this threshold to avoid tariffs and undercut domestic competitors. There have been proposals to lower the threshold or increase customs inspections, which could slow delivery times and raise costs.

If the $800 limit is lowered or stricter enforcement is applied, we could see delays at customs. U.S. Customs and Border Protection would need more staffing and resources to inspect a higher volume of parcels. This could lead consumers to rethink spontaneous online purchases—especially if delivery timelines stretch from two days to two or three weeks.

I’ve experienced that already when ordering items. You place the order, and then the delivery date changes. What was originally a one-week delivery becomes two weeks, then three. At that point, you’re forced to decide if it is still worth it. That’s where the most significant impact is going to be—on the individual consumer.

Large companies that import in bulk, well above the $800 de minimis threshold, are bringing in entire containers or even half a ship’s worth of goods. They’re operating at a different scale. However, for the individual ordering online and receiving shipments directly, that threshold matters significantly. The most significant impact, in that case, is delayed delivery time.

Jacobsen: What about the broader implications for international shipping logistics? That is, admittedly, a broad question—but more specifically, could you speak to congestion at the ports, delays in the supply chain, and the cumulative effects on processing times?

Ramcharan: Yes. We’ve already experienced the effects of supply chain disruptions during the COVID-19 pandemic, but these disruptions primarily stemmed from a lack of manufacturing and shortages of goods. This time, the issue is different. The products are available, but the bottleneck is now at the ports due to increased scrutiny and enforcement.

Everything has to be checked—inspected for proper tariff classification and valuation—and taxed accordingly. That additional layer of customs enforcement is going to significantly slow things down. I recently read an article stating that the first ships impacted by the new tariffs are expected to reach U.S. ports by either the end of this week or early next week.

Jacobsen: Understood. That would mark the first physical test of these new rules.

Ramcharan: Exactly. We will assess the volume of those incoming vessels and determine how long the processing will take. There’s much speculation—armchair quarterbacking, if you will—about how this will play out. But the truth is, no one knows yet. We have not dealt with something of this scope before—not quite like this.

Even I’m cautious. You could predict something in the morning, and it might already be outdated by the afternoon. We’ll have to wait and see how significant the backlog and bottlenecks become at the ports.

On top of that, there were reports of a possible labour strike at one of the ports, which would further complicate the situation. When you start adding all these variables together—tariff enforcement, port congestion, labour issues—it creates a complex scenario. It’s a big black hole in terms of predictability right now.

The biggest concern on everyone’s mind is pricing. Am I going to pay more for this item? Interestingly, it was Walmart that stated they would not pass the increased tariff costs on to consumers. That’s significant, but whether others follow suit remains to be seen.

Some companies have stated that they will not pass on the tariff cost. Others have said they’ll display both prices—the original and the tariff-adjusted price—side by side. That way, consumers can see that it’s not the company arbitrarily raising the cost; rather, it’s the tariff that’s driving the increase.

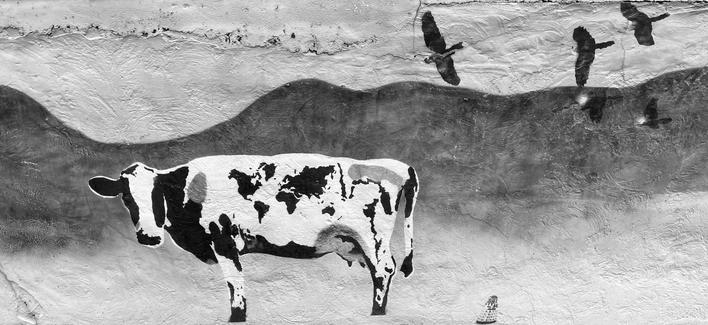

And I keep coming back to pricing because that is what will drive consumer behaviour. People will either choose not to buy or look for an alternative source. The intended effect of tariffs, of course, is to encourage consumers to buy more American-made products. But at the end of the day, there are very few products that are genuinely independent of the global economy.

Take automobiles and clothing—many of those may be assembled or finished in the United States, but the components or even just the packaging could be sourced overseas. So, even if the product is technically “Made in the USA,” disruptions can still occur if the packaging supply chain is affected.

In the MRO (Maintenance, Repair, and Operations) world, where I operate within logistics, we’ve pre-positioned several months’ worth of inventory. That buffer means we’re unlikely to see immediate price increases. The inventory already present on U.S. soil will be used first.

However, once those inventories begin to run low, we can expect to see two consequences: price increases and delays in delivery. Our customers care about two key indicators—price and lead time. Those two metrics determine how we market our goods and how we move them through the supply chain.

Jacobsen: From what I gather, this means increased processing times and higher prices for consumers. Is that generally correct?

Ramcharan: Yes. Everyone will raise prices.

Let’s say I’m Vendor A selling an item for $1, and tariffs now force my competitor to sell the same item for $2. I may raise my price to $1.50, even though I could still sell at $1. Why? Because the market will bear it. That’s the incentive structure. And how many companies are going to pass on the opportunity to raise prices?

Prices are going to rise no matter what. Historically, we’ve seen that once prices rise, they rarely return to their previous levels—even when conditions stabilize. We adjust to a new price norm. Unless there’s an oversupply and a need to clear out inventory, there’s little pressure to reduce prices. As a market, we’re conditioned to accept those higher price points.

The one major exception people track going up and down is gasoline. We expect fluctuation there, and so we’re psychologically prepared for it. But for most goods—groceries, cars, housing—prices go up and tend to stay there.

There was a time when we had a housing glut, and prices dropped. But now? Materials are the next pressure point. We import much lumber from Canada. That affects housing prices. Once prices rise due to increased raw material costs, they rarely return to their previous levels by much. The higher pricing becomes the new normal for as long as the market can sustain it.

So, yes—conversions are happening in pricing. You also have vendors behaving, in a strange way, almost anti-competitively—raising prices not purely out of necessity but because the market conditions allow for it. The entire system is out of alignment. It is not easy to phrase precisely, but that’s the reality.

As I mentioned earlier, COVID-19 provided us with a test run on large-scale supply chain disruptions. For about a year after COVID, when global trade resumed and supply chains started flowing again, prices were still elevated. Everyone said, “Well, it’s because of the earlier disruptions.” But even after conditions stabilized, prices didn’t return to pre-COVID levels.

Jacobsen: Would it be fair to say that the world has never been more globalized than it is today?

Ramcharan: Absolutely. As a country, the United States has experienced periods of isolationism in the past. But today is different—our economy is deeply enmeshed in the global system.

Consumers can now pick up a smartphone, place an order, and never even think about where the item is coming from. In the past, you had to look at catalogues or consider supply sources. Now, online commerce is so seamless that the global nature of our purchases is invisible—until disruption hits.

People are starting to understand that globalization is not just about goods and services. It’s also about pharmaceuticals, which many did not realize are heavily imported. Or food—we often talk about supporting local farmers, and they do tremendous work, but many Americans are unaware of how much of our daily food intake is imported. It may arrive fresh, but it was not grown or produced here.

From an American perspective, we are becoming increasingly aware of the interconnectedness of everything. Most people had no idea—unless they were already working in logistics or procurement—that this was the case.

Those of us who made it through COVID-19 in terms of business continuity became acutely aware—highly sensitized—of the origin of every product. You might want to buy something locally, but if it’s not made here, you’re dependent on a global supply chain to get it. And now, we have to pay close attention to those origins.

You must assess political stability in your sourcing regions. If there is unrest or conflict, it could disrupt production and your access to the goods. You have to monitor environmental risks, too—like natural disasters. I recall a major typhoon that occurred years ago in Asia—perhaps in 2008—where one of the affected areas was a key producer of Intel chips. That single event had a cascading effect on electronics manufacturing worldwide.

And because of that typhoon, shipping was shut down for weeks. Ports were closed, and semiconductor chips were not shipped. As a result, computer and laptop prices spiked, and many people could not understand why. The reason was a global chip shortage caused by a single weather event on the other side of the world.

We are probably living in the most interconnected, globalized era humanity has ever experienced—and I’m speaking globally now. And it’s only going to intensify. It’s not just about products anymore; it’s also about people.

In the U.S., if we erode or disrupt the workforce involved in production, logistics, and distribution—the people who touch these goods—we are going to experience disruptions at that level, too. I do not think many people fully appreciated that before. It is not just the product that matters; it is the people throughout the supply chain. If you disrupt either side—goods or labour—you disrupt the entire system.

Jacobsen: These sessions always feel like the trial version of a more extended conversation—it keeps things sharp. With a four-hour talk, you would need breaks for coffee and the restroom, but in these tighter formats, you stay more focused.

I’ve spoken to many business leaders and economists. One theme that consistently emerges, regardless of political or geographic affiliation, is that stability is beneficial for business. Consumers know it. Vendors know it. So, thinking long-term—especially with developments involving companies like DHL and changes in customs regulations—if things eventually settle into a more “normalized” state, how long does it typically take for global trade and cross-border e-commerce to regularize again?

Ramcharan: That’s a tricky question. We can reach a new normal—but we cannot go back to the old one. Things will never be precisely the way they were before COVID. That was a pivotal moment—a stake in the ground. Since then, we’ve adjusted. Now, we are adapting again to what I would call a “new new normal.”

The more stability we have—particularly at the policy level—the faster we can return to a more predictable supply chain. If global governments were able to engage consistently and pragmatically, that would go a long way. Ultimately, it is those governments that set trade policy and negotiate international agreements.

Right now, however, that stability is lacking.

How long will it take to resolve this? Honestly, I do not know—and I am trying to leave politics out of this—but it depends on how long it takes to establish that stability.

Money talks.

Two things will happen. First, when large corporations—whose performance is measured by earnings per share and stock price—begin to take serious financial hits, they will feel the pressure. Even though many of these companies are already highly profitable, if profits dip further, they will have the incentive to act. They can and will apply pressure at the proper governmental levels to say, ‘We need a solution.‘

Consumers have a breaking point as well. They can do one of two things: they can say, “We’re not going to buy from you anymore.” We saw this play out in the Target-Costco scenario. Target lost ground while Costco gained, despite both sourcing many of their products from the same suppliers.

Consumers today are showing a willingness to make sacrifices—even in terms of pricing—to make their voices heard. That is a significant shift. Historically, people voted with their wallets—that was the phrase: “I vote with my pocketbook.”Now, we’re seeing a more values-based consumer behaviour, where pricing is not always the deciding factor.

This is a new paradigm in the economy. I was reading an article this morning that noted—for the first time in a long time—public confidence in labour unions has surged. In the last six to eight months, support for labour unions has nearly doubled that of big business.

People are paying attention to the human element. CEOs at large corporations may earn millions in salary and bonuses, while frontline workers at the other end of the production line are sometimes not even paid a living wage. That imbalance is becoming harder for consumers to ignore.

No, we are not going to eliminate that gap, but there’s a growing push to elevate the lower half of the labour force—to get people to a place where they can sustain themselves. This shift in sentiment toward organized labour influences consumer behaviour. It changes how and why people buy.

Today, you can offer a cheaper product, but that alone does not guarantee market share. Consumers expect more. They want ethical practices, transparency, and social responsibility. It is no longer just about price.

So again, this is all part of a broader transformation we are witnessing. We are studying, responding to, and adapting to it in real-time.

Jacobsen: Last question—how is your business doing, both domestically and internationally?

Ramcharan: Sure. Our international activity has slowed significantly, and this slowdown began during the COVID pandemic. We built some new relationships abroad, sourced products, and adapted, but the focus gradually shifted.

Now, we are concentrating more on what is right here in our backyard. While we still conduct business across the United States, I have prioritized customers who are within a three- to four-hour radius of our location.

That’s my current growth strategy—deepening relationships with existing customers. Before, the mindset was always about acquiring new business. However, during the COVID-19 pandemic, some of our clients remained loyal despite challenging circumstances, and that loyalty is now a priority for us.

So, instead of casting a wide net, we’ve pulled in slightly. We are focusing on servicing, supporting, and growing the base we already have—because I know what those customers need, and we’ve built trust.

We’ve already established our supply chains. I do not want to establish entirely new supply chains for new customers at this time. First, it’s not feasible in the current environment. Second, I do not want to take that risk only to fall short of expectations and have a customer say, “I thought you were better than that.”

So, yes, it is a gamble, but I’ve chosen to pull in and consolidate until things stabilize, and we can get a clearer picture of what’s happening in the market.

Jacobsen: Bede, thank you so much for your time today.

Ramcharan: Did I answer your questions? I want to ensure that I’ve covered everything.

Jacobsen: You did. Absolutely. I appreciate your expertise, and it was a pleasure to meet you.

Ramcharan: Thank you. Likewise, I’m looking forward to doing some reading this weekend—I plan to go back and review more of your work. You had some exciting titles. I read one or two, then scrolled through your résumé and saw several other articles online that caught my eye. I thought, “I’ve got to go back and read that one.” So yes, it’s my pleasure—and I’m glad to add you to my network.

Jacobsen: Excellent. Likewise.

Last updated May 3, 2025. These terms govern all In Sight Publishing content—past, present, and future—and supersede any prior notices. In Sight Publishing by Scott Douglas Jacobsen is licensed under a Creative Commons BY‑NC‑ND 4.0; © In Sight Publishing by Scott Douglas Jacobsen 2012–Present. All trademarks, performances, databases & branding are owned by their rights holders; no use without permission. Unauthorized copying, modification, framing or public communication is prohibited. External links are not endorsed. Cookies & tracking require consent, and data processing complies with PIPEDA & GDPR; no data from children < 13 (COPPA). Content meets WCAG 2.1 AA under the Accessible Canada Act & is preserved in open archival formats with backups. Excerpts & links require full credit & hyperlink; limited quoting under fair-dealing & fair-use. All content is informational; no liability for errors or omissions: Feedback welcome, and verified errors corrected promptly. For permissions or DMCA notices, email: scott.jacobsen2025@gmail.com. Site use is governed by BC laws; content is “as‑is,” liability limited, users indemnify us; moral, performers’ & database sui generis rights reserved.

#ConsumerPricing #globalTrade #supplyChains #TariffPolicy #VeteranEntrepreneurship